Pandemic Boomtowns See Sharpest Rise in Home Price Cuts as Market Rebalances

National data reveals a significant shift in the housing market, with cities that experienced rapid growth during the COVID-19 pandemic now leading the nation in price reductions on home listings.

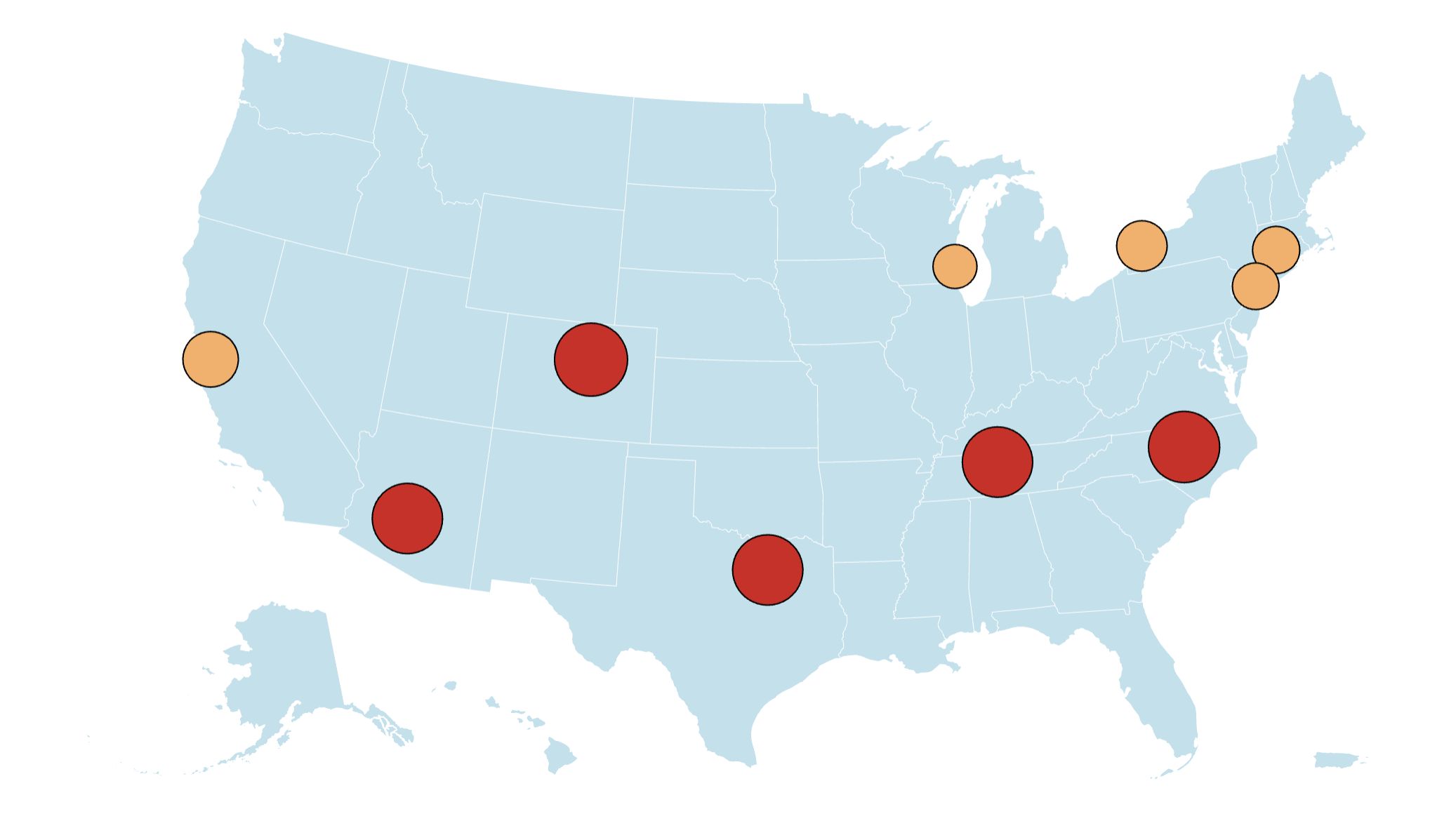

The housing markets in several U.S. cities are undergoing a correction as a surge in inventory meets a slowdown in sales. A new report from real estate marketplace Zillow indicates that Denver, Colorado, recorded the highest percentage of for-sale homes with price cuts in June, with 38.3% of listings seeing reductions. Raleigh, North Carolina, followed closely behind at 36.4%, while Dallas, Texas; Nashville, Tennessee; and Phoenix, Arizona, all registered a 35.5% rate.

A Nationwide Trend of Price Reductions

Across the country, sellers are increasingly compelled to lower their asking prices to attract buyers. This trend is fueled by a combination of factors, including sellers re-entering the market after waiting for more favorable mortgage rates and a growing number of properties remaining unsold. While a substantial gap persists between housing supply and demand, affordability remains a major obstacle for many Americans.

The average 30-year fixed-rate mortgage currently hovers around 7%, and experts anticipate it will remain elevated in the near future. Despite a deceleration in growth since the peak of the pandemic homebuying frenzy, home prices remain high, compounded by rising costs for home insurance, property taxes, and homeowners association (HOA) fees.

According to Zillow data, 26.6% of listings nationally experienced price cuts in June, an increase from 25.8% in May and 24.4% a year prior. This represents the highest June rate recorded since 2018. Sellers are now forced to adjust their expectations and offer concessions to compete in a more challenging market, or risk removing their properties from listings altogether.

Pandemic Boomtowns Are Rebalancing Faster

The pronounced increase in price cuts within cities like Denver, Raleigh, Dallas, Nashville, and Phoenix is attributed to a more significant market correction. These locations experienced unprecedented growth during the pandemic, attracting remote workers seeking more affordable living and a higher quality of life. However, the return to office mandates and increased mortgage rates have rapidly cooled these previously overheated markets.

Conversely, some cities remain largely unaffected by these dynamics, maintaining a severe inventory shortage that supports higher prices. Milwaukee, Wisconsin, reported the lowest share of price cuts at 13.9% in June, followed by New York City, New York (15.6%), Hartford, Connecticut (16%), Buffalo, New York (18.3%), and San Jose, California (22.1%). Notably, Buffalo experienced the largest month-over-month increase in price cuts, rising 3.9% from May.

Zillow anticipates that price cuts will continue to become more common across the country as the market adjusts.

.

The shift signals a broader rebalancing of the U.S. housing market, moving away from the extraordinary conditions of the pandemic era and toward a more sustainable, albeit challenging, landscape for both buyers and sellers.