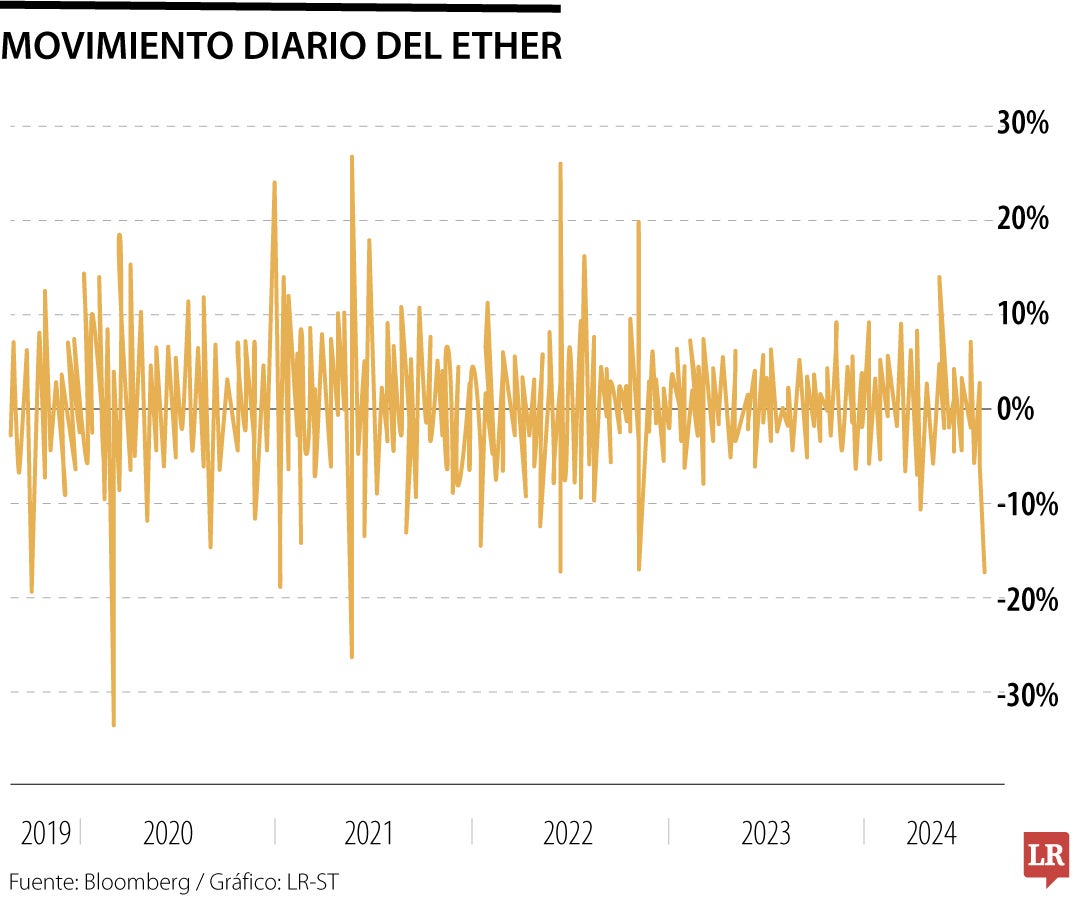

In a week, the largest cryptocurrency has gone from nearing its records to experiencing one of the biggest drops in recent times. Just on this July 5th, bitcoin’s price has fallen by 13%. Ethereum, even more severely affected, loses 20% in 24 hours.

Cryptocurrencies not only fail to escape the downward wave affecting financial markets. Digital assets stand out among the most affected. Evidence of this can be seen in the plummets recorded in today’s session by its two main representatives.

In the last 24 hours, bitcoin’s price has at times surpassed a 13% drop. In the case of ethereum, the correction reaches 20%. Investors assign penalties greater than 20% to alternative cryptocurrencies (altcoins) like polkadot, chainlink, or uniswap.

The most bullish crypto segment of the year, that of ‘meme coins’, also stands out today in the decline chapter, with drops nearing or exceeding 20% in the prices of dogecoin, shiba inu, pepe, and dogwifhat.

IG analysts remind us that “bitcoin and cryptocurrencies in general are risk assets, and they are located at the extreme end of the risk spectrum.” The alerts triggered in the broader financial markets prompt a flight to safety and accelerate the profit-taking in the most revalued assets, such as cryptocurrencies.

The greater aversion to risk is fully hitting the crypto market. “The latest batch of bad macroeconomic data, which raises the prospect of a recession in the US, combined with the Fed’s persistent aggressive stance, does not really lead investors to remain long in higher-risk assets,” explains Pierre Veyret, analyst at ActivTrades, in his report today.

The avalanche of sales on Wall Street following the US employment data released last Friday, geopolitical tensions and even the “fluctuations in market predictions regarding the US presidential elections” have worsened the bearish pressures on cryptocurrencies, according to analysts at Avenue Digital Investments.

“Investors are seeking safety,” they add from ActivTrades, and this trend includes the decision to cash in on the profits obtained from the cryptocurrency rally.

Last Monday, bitcoin approached $70,000, just a step away from its historical records of $73,800. Today it falls to $52,000, the result of a 25% correction in one week. In this same period, the decline reaches 30% in the case of ethereum. Just on today’s session, it loses 20%, trading around $2,300.

The second largest cryptocurrency additionally suffers from the lackluster debut of the new spot ethereum ETFs. Demand figures are light-years away from those recorded during January in the first trading days of the spot bitcoin ETFs. This lower investor appetite accentuates the temptation to take profits in the crypto market.