2024-06-05 05:54:37

“As housing costs rise, the center class topic to inheritance tax will increase.

“Inheritance quantity between 500 million and 1 billion requires tax adjustment.”

Makes an attempt to increase the center class by tax minimize points

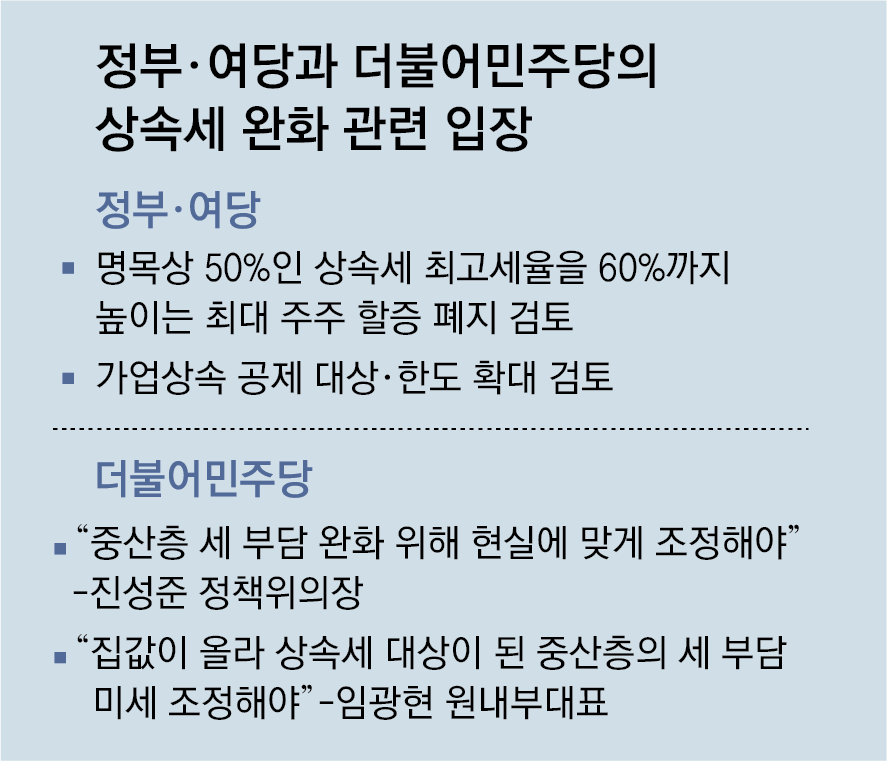

The Democratic Celebration of Korea introduced on the 4th that it’s going to actively take into account revising the inheritance tax regulation to ease the tax burden on the center class. Some within the occasion argued for the necessity to ease the great actual property tax (complete actual property tax), and in addition introduced a coverage to revise the Inheritance Tax Act, leaping into the ‘tax minimize’ situation, which had been thought-about an agenda for the conservative camp. Within the political world, an evaluation was made that “the Democratic Celebration is trying to increase its attain amongst moderates, focusing on the subsequent presidential election.”

Lim Kwang-hyeon, vice-president of the Democratic Celebration, mentioned on the occasion’s ground plan assembly on today, “Because of the enhance within the publicly introduced value of residence complexes, the variety of individuals topic to taxation within the 500 million to 1 billion received vary of inherited property worth as of 2022 has elevated by 49.5% (in comparison with 2020), and the inheritance tax for this vary has been determined. “The tax quantity has surged by 68.8%,” he identified, “however the measurement of the overall inheritance tax lump sum deduction has remained the identical for 28 years, at 500 million received.” He mentioned, “In a state of affairs the place the variety of middle-class inheritance tax topics is predicted to proceed to extend attributable to rising housing costs, and so on., we’ll evaluation an modification to the inheritance tax regulation that may moderately regulate the tax burden on these households.” Lim, former deputy director of the Nationwide Tax Service, entered the twenty second Nationwide Meeting as a proportional consultant.

Democratic Celebration Coverage Committee Chairman Jin Seong-jun additionally mentioned in a telephone name on the identical day, “Easing the inheritance tax burden is one thing that may be thought-about,” including, “There’s a tax burden on the center class, and the requirements themselves are outdated, so there’s a want to regulate them to go well with actuality.”

野 “Ease the burden by rising the inheritance tax lump sum deduction from 500 million received” 野 “Full reorganization”

Democratic Celebration “Reduces inheritance tax burden”

Center-class tax minimize card aimed on the subsequent presidential election… “Leisure of complete actual property tax has no political profit”

The federal government considers altering ‘heritage tax→heritage acquisition tax’… Promotion of abolition of premium taxation for main shareholders

The Democratic Celebration of Korea’s suggestion of a ‘tax discount coverage’ to ease the tax burden on the center class, together with inheritance tax reform, is interpreted as a technique aimed on the subsequent presidential election. A key official from the pro-Myung (pro-Lee Jae-myung) faction of the Democratic Celebration mentioned, “The decisive reason behind the defeat within the final presidential election was the true property situation,” and “Ultimately, it’s not straightforward to win average votes by tax will increase.” The aim is to safe average votes by ‘right-clicking’ to a sure extent and show its capabilities as a ruling occasion.

●與 “Elementary reform of inheritance tax” 野 “Tax discount for the ultra-rich”

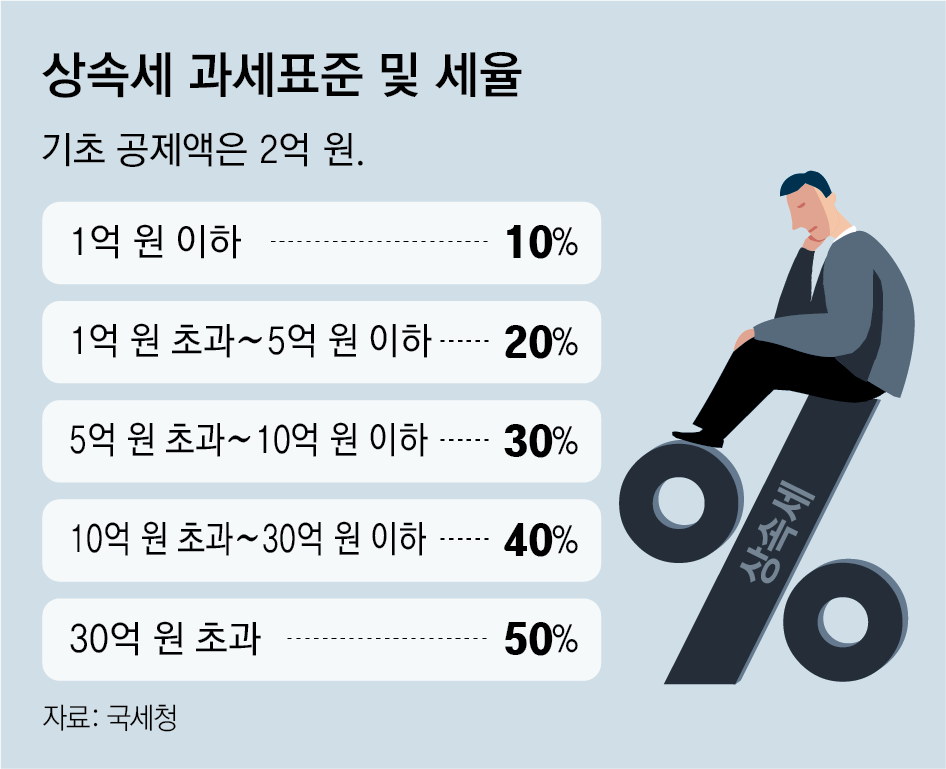

The core of the inheritance tax reduction plan introduced by the Democratic Celebration’s ground management on the 4th is decreasing the tax burden on the center class. The present inheritance tax fee is 10% for tax bases of 100 million received or much less, 20% for over 100 million received to 500 million received, 30% for over 500 million received to 1 billion received, and 40% for over 1 billion received to three billion received. If it exceeds 3 billion received, it’s 50%. Nonetheless, when calculating inheritance tax, a lump sum of 500 million received is mostly deducted from the taxable worth, however the intention is to extend this quantity to scale back the precise tax burden.

In a telephone name that day, Deputy Ground Chief Lim Kwang-hyun mentioned, “As actual property costs have risen considerably, even when an individual who owns a home value 500 million to 1 billion received dies, his or her youngsters should pay inheritance tax.” He added, “It’s cheap to fine-tune the lump sum deduction.” did.

The Individuals Energy Celebration additionally plans to debate methods to essentially reform the inheritance tax on the twenty second common session of the Nationwide Meeting. Specifically, we’re contemplating altering the inheritance tax system from the present ‘heritage tax’ to ‘heritage acquisition tax’. Presently, if two youngsters inherit a property value 5 billion received, the complete 5 billion received should be taxed after which divided between the 2, which is a big burden. Alternatively, the inheritance acquisition tax is a technique of paying tax on the two.5 billion received every particular person inherits, which reduces the burden. As well as, we’re additionally pursuing a plan to abolish the premium taxation for main shareholders. Presently, if shares are inherited from a serious shareholder, a 20% main shareholder surcharge is utilized. The best inheritance tax fee for company succession in Korea is 50%, but when surcharge is utilized, the tax fee is successfully as much as 60%, which is why trade circles level out that company succession is just about unimaginable.

The Individuals Energy Celebration criticized the Democratic Celebration’s fine-tuning plan, saying, “We have to have a look at the general inheritance tax not solely from the center class, however from a broader scope.” Relating to the Individuals Energy Celebration’s abolition of surcharge taxation for main shareholders, the Democratic Celebration countered that it was “a tax minimize for the ultra-rich for firms that inherit a whole bunch of billions of received.”

●Chin Myeong, complete actual property tax “has no political profit”

Not too long ago, inside the Democratic Celebration management, there was continued speak about numerous tax cuts, together with the great actual property tax and monetary funding revenue tax, along with the inheritance tax. Ground chief Park Chan-dae, who was the primary to say the necessity to ease complete actual property tax inside the occasion, additionally mentioned at a press convention on the 2nd, “Within the case of complete actual property tax, gold funding tax, and inheritance tax, it’s essential to test whether or not the present system is acceptable.” “It’s proper to maneuver in that course,” he mentioned. Consultant Lee Jae-myung can be identified to emphasise his pragmatic method to discussions on tax reform. In accordance with this management coverage, the Democratic Celebration is claimed to quickly set up a analysis group to evaluation the general tax system, together with inheritance tax, complete actual property tax, and gold funding tax. A key pro-Myung faction official mentioned, “Though the precise impact of accelerating tax income just isn’t giant, there’s a want to guide discussions on reforming ideological tax insurance policies to increase the center class.”

Nonetheless, the bickering continues even inside the occasion. Coverage Committee Chairman Jin Seong-jun mentioned in a telephone name, “Stress-free the great actual property tax just isn’t a difficulty that particular person lawmakers can pursue primarily based on their private beliefs,” and added, “It will be good to method it cautiously.” A key pro-Myung faction official additionally mentioned, “I imagine that the great actual property tax is now not a matter of nationwide concern as a result of it has already been eased a number of instances,” and added, “We imagine that there might be no political profit in mentioning it additional.”

Relating to the gold funding tax situation, Coverage Committee Chairman Jin made his opposition clear at a press convention on the identical day, saying, “The place will the inadequate tax income come from?” and “The precept is that it is going to be carried out once more when the grace interval ends (subsequent yr).”

Reporter Dabin Yoon [email protected]

2024-06-05 05:54:37