[홍춘욱의 경제와 투자] US economic situation breaking the recession formula… Watch out for the number of new unemployment benefit applicants

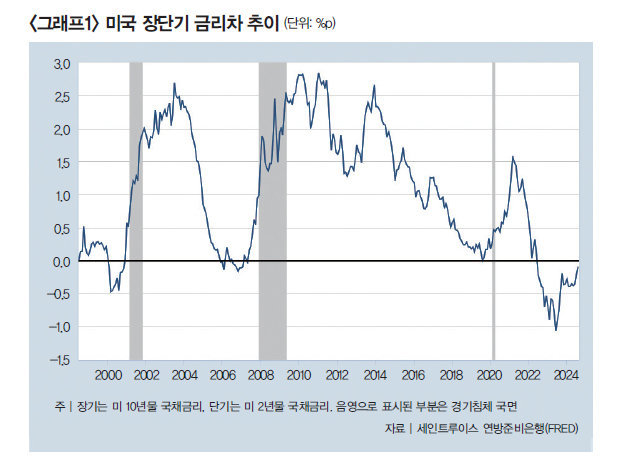

Recently, some have claimed that the global economy will face a strong recession (economic downturn) by citing the deterioration of key leading indicators, including the U.S. short-term and long-term interest rate differential. However, as shown in Graph 1, even though the short-term and long-term interest rate differential has been negative for more than two years (the 2-year government bond yield is higher than the 10-year government bond yield), the economies of advanced countries, including the U.S., are recording stable performance.

U.S. Mortgage Lending at All-Time Low

Even the International Monetary Fund (IMF) revised upward its 2025 global economic growth rate forecast from 3.2% to 3.3% in its regular economic outlook report on July 16. Let’s take a look at the reasons for the continued stable growth despite the prolonged inversion of the short-term and long-term interest rates.

The biggest reason for the economic downturn whenever short-term and long-term interest rates reversed was the decrease in lending. Currency is divided into base money and derivative money. Base money is related to the direct money supply of the central bank. On the other hand, derivative money refers to money released through bank loans. For example, when Bank A lends to Company B and this leads to an increase in employment at Company C, the money created is derivative money. Therefore, bank loans, which represent the flow of derivative money, are the most important factor affecting economic fluctuations.

So why did US bank lending increase despite the growing signs of a recession? Bank lenders were very conservative in lending money, but the most direct reason for the lack of lending was the strong fundamentals. Household and corporate debts decreased significantly after the 2008 global financial crisis, and the money released after the COVID-19 pandemic in 2020 is still circulating in the market, so the delinquency rate remains at an all-time low. The delinquency rate for US real estate-backed loans, which soared to 11.48% in the first quarter of 2010, right after the global financial crisis, is currently at 1.73% as of the second quarter of this year.

From the bank’s perspective, the fact that the delinquency rate has decreased despite raising interest rates and conducting strict loan screening is the best operating environment. This is because interest income can be expanded without much risk. If the phenomenon of short-term and long-term interest rates inverting has occurred but bank loan recovery is not occurring, there is no need to worry about a serious recession right now.

The number of new unemployment benefit applicants emerges as a key indicator

As the ability to predict short-term and long-term interest rate differentials declines, efforts to find reliable leading economic indicators will inevitably continue. In this case, the author approaches it based on two principles. The first principle is not to look at just one indicator. This is because by selecting various economic indicators, you can avoid making wrong judgments even if one or two indicators lose their predictive power. The second principle is to pay attention to consumers. Since a recession is when households suddenly reduce their consumption and focus on saving, it is necessary to pay attention to trends in retail sales or personal consumption expenditures (PCE).

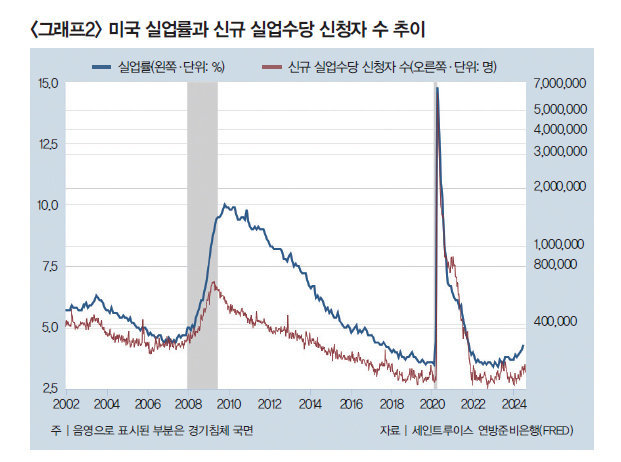

And the indicator that reflects both of these principles is the number of new unemployment claims. Since the first thing that laid-off workers do is apply for unemployment benefits, it helps us quickly understand labor market trends. Furthermore, households that receive layoff notices are likely to reduce their consumption, so it is also very helpful in measuring changes in overall demand in the economy.

‘Graph 2’ shows the relationship between the number of new unemployment benefit applicants and the unemployment rate in the United States. It can be seen that the number of new unemployment benefit applicants is currently hovering at the lowest level in history. Of course, we cannot rule out the risk of large-scale layoffs in the future. Therefore, while observing the change in the number of new unemployment benefit applicants, we should also pay attention to trends in bank lending and delinquency rates.

*If you search for ‘Magazine Donga’ and ‘Twovengers’ on YouTube and portals respectively and follow them, you can find a variety of investment information, including videos in addition to articles.

[이 기사는 주간동아 1455호에 실렸습니다]

Hong Chun-wook, Economist and CEO of Prism Investment Consulting

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-07 09:07:31