Columns

Karen Ward

Do the French and British elections jeopardize the recovery in Europe?

Karen Ward

© PR

In France, right-wing extremists won the first round of parliamentary elections. There were fears in advance that a new euro crisis could occur. Karen Ward explains why she doesn’t see this risk

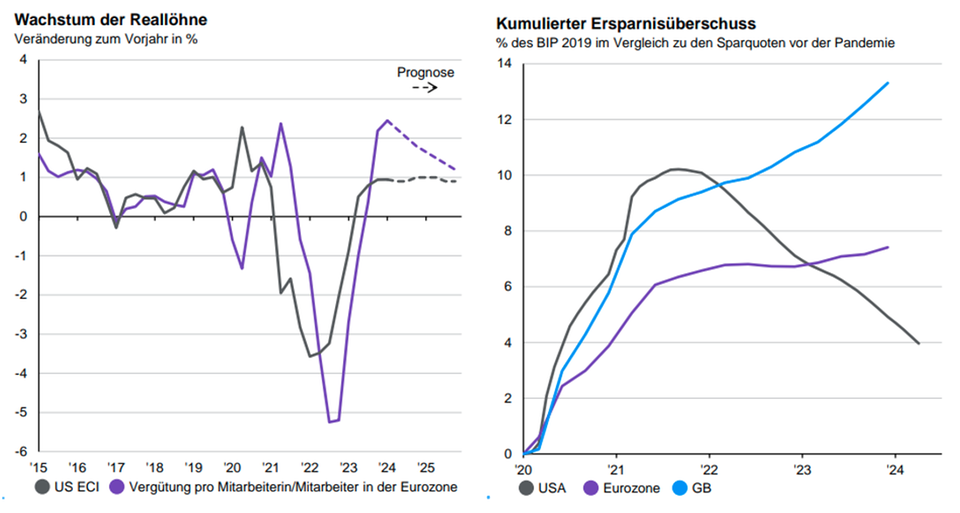

At the beginning of the year, we strongly believed that there would be some convergence between the growth rates of the US and European economies. As the sugar rush of generous tax giveaways wore off and pandemic savings were depleted, we expected US growth to slow. In Europe, however, we expected economic activity to pick up as the cost of living shock subsided and consumers were therefore confident about spending some of their pandemic savings.

A recovery in the global economic cycle should also benefit Europe’s manufacturing sector, which has been on the upswing for two years. The question now is whether the elections in Great Britain and France will have a negative impact on this development?

Wages and savings in Europe

Source: (Links) BLS, CBO, European Central Bank, European Commission, LSEG Datastream, JP Morgan Asset Management. The US data is the employment cost index with forecasts from the CBO. US data is the Employment Cost Index (ECI), with forecasts from the CBO. Eurozone data is compensation per employee, with forecasts from the European Commission. Eurozone data are smoothed over 2020 and 2021 to remove pandemic-related biases. (Right) BEA, Eurostat, LSEG Datastream, ONS JP Morgan Asset Management. The savings surplus was calculated compared to the savings rates in the fourth quarter of 2019. Markets Guide – Europe. Data as of June 24, 2024

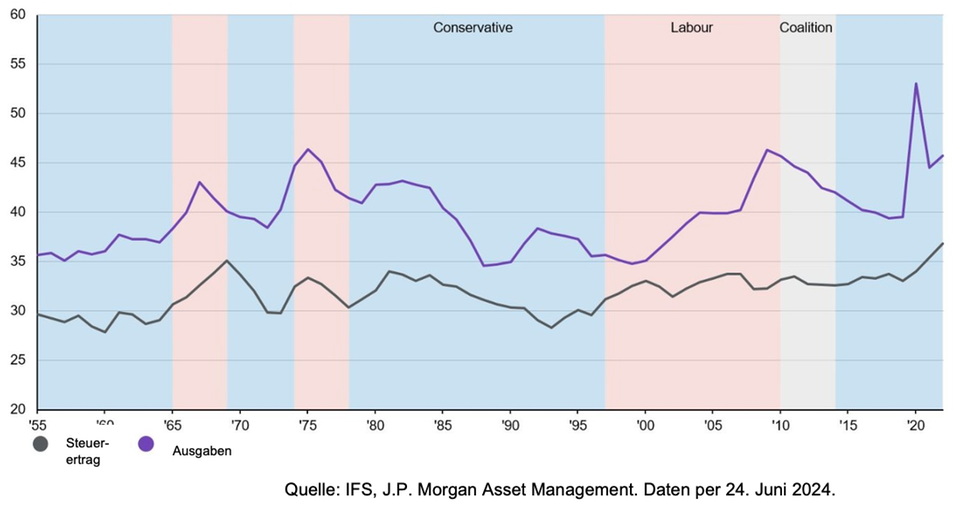

In Britain, opinion polls show a change of government and a large Labor majority after the July 4 vote. The fiscal impact of such a result is not yet clear. Historically, Labor governments have spent more money than Conservative governments. For a number of structural reasons – not least the cost of supporting an aging population – UK government spending as a percentage of GDP is already very high, as is tax revenue.

Tax returns and spending policies of government parties in Great Britain (in % of GDP)

Source: IFS, JP Morgan Asset Management. Data as of June 24, 2024

In its election manifesto, Labor committed to reducing debt as a percentage of GDP over the five-year term. This means that a Labor government will hardly be able to adopt more generous spending policies without significant tax increases. However, as increases in income tax, national insurance and VAT are also excluded, Labour’s spending ambitions are likely to be slightly lower.

If elected, the future Chancellor of the Exchequer will also live in the shadow of the Liz Truss mini-budget crisis. This means that spending commitments are unlikely to be unfunded in the short term.

It is possible that the new British government will create more confidence among the population if it is seen as more stable than the previous government. This is because the Prime Minister and high-ranking cabinet members have changed several times in recent years. In this case, the UK elections could further strengthen the already rising confidence.

France – Macron in a quandary

Across the Channel, France’s National Assembly elections will close shortly after the UK election on 7 July. There are many signs that President Macron must form a coalition with the far-right Rassemblement National or the far-left La France Insoumise and appoint the leader of that party as prime minister.

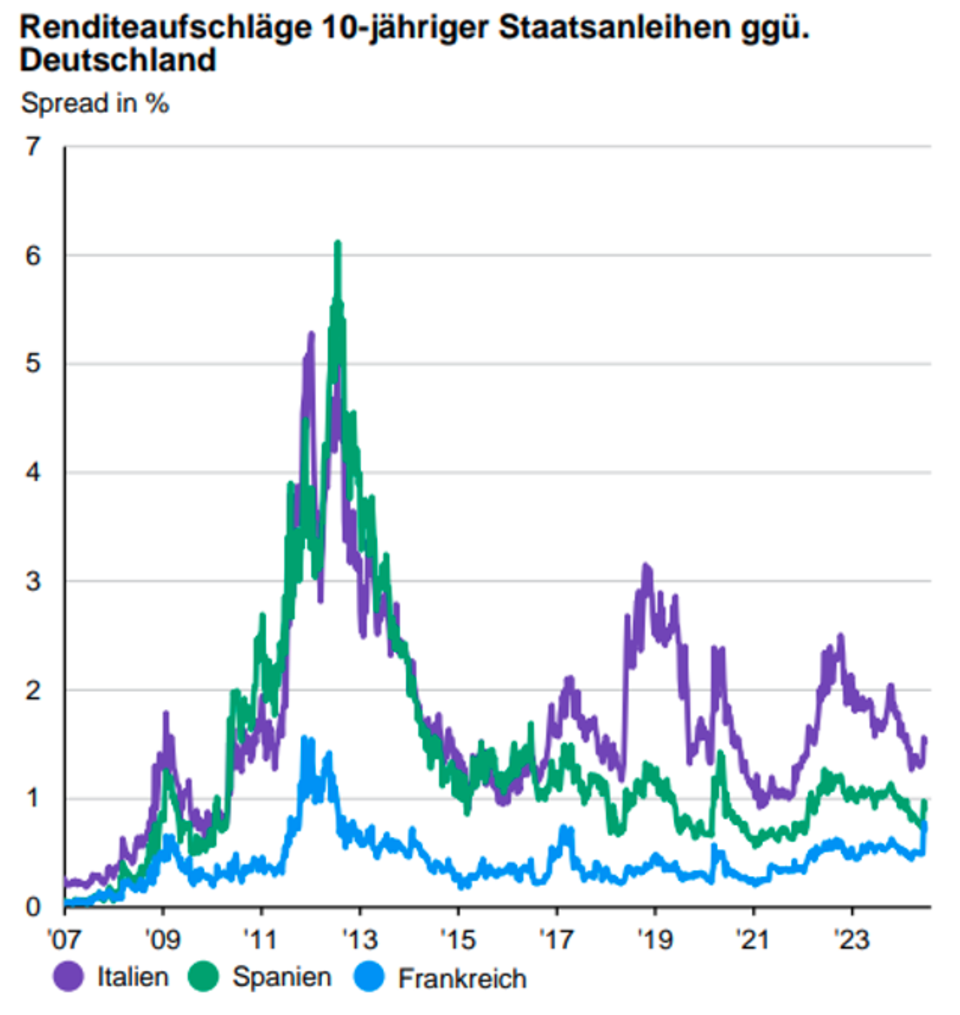

This prospect has caused great volatility in European markets since the election was announced. However, it is important to understand that none of these more populist parties want France to leave the European Union or the euro. The parties that received support in the recent European elections have a common denominator: immigration policy and the reversal of austerity policies, which focus on a balanced budget and reduction of the national debt. This time there is more of a fiscal risk than a collapse risk. So we do not assume that other countries such as Italy and Spain will be infected.

It is not clear whether a victory for the far left or the far right would result in a much more aggressive budget agenda in France. It is relatively easy for a populist opposition party that does not expect to actually govern to make big promises. However, the reality in office is very different and these commitments must be financed by international bond investors. Since the elections were called, the ambitions of the Rassemblement National have already been reduced. For example, the pension reform should be adjusted and not abolished.

Italian Prime Minister Giorgia Meloni, who also belongs to a party considered populist, has given a measure of stability to the Italian government. Ahead of the European elections and recent political worries in France, Italian bonds were trading at a very narrow spread over German federal bonds.

Overall, I suspect the market is unnecessarily worried right now. I do not accept that the two elections will jeopardize the recovery in Europe.

#Subject