2024-07-05 02:35:00

- Donald Trump supports BTC as a strategic reserve asset.

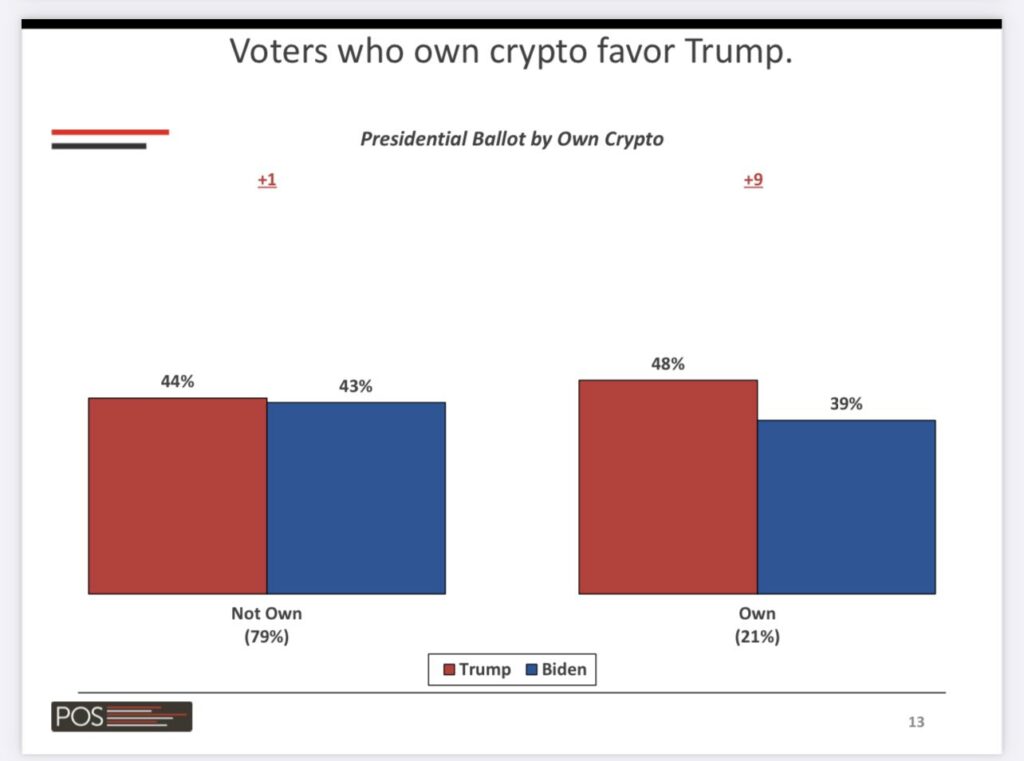

- Trump’s pro-cryptocurrency stance has fueled a voting bloc of cryptocurrency executives and owners.

In a radical turn of events, former President Donald Trump has changed his stance on the once-hated cryptocurrencies. His speech aims to fight and defeat the current President Joe Biden by gathering the votes of young cryptocurrency enthusiasts and wealthy stakeholders.

However, Trump has not been a fan of cryptocurrencies for a long time, and when he became president in 2019, he expressed his disdain for them.

In 2019, Donald Trump

Said BTC and other cryptocurrencies are not money and are highly volatile. He said through a series of tweets:

“I am not supporting Bitcoin or other cryptocurrencies, which are not money and whose value is very volatile and based on nothing. “Unregulated cryptoassets can facilitate illegal behavior, including drug trafficking and other illegal activities.”

He also said:

“In the United States we have a true single currency, stronger than ever, reliable and trustworthy. It is the dominant currency in the world for a long time and always will be. It’s called a US dollar!”

However, Donald Trump has now changed his position after meeting crypto miners and receiving $100 million in funding for his 2024 campaign. He encouraged cryptocurrency users to vote for him as he will counter Biden’s hatred of Bitcoin.

Politicians support BTC/USD

Recently, Trump came out in favor of BTC as a strategic reserve asset. With Trump’s voice in the debate, some politicians have shown their support for BTC.

Former presidential candidate Ramaswamy is said to have advised Trump to consider backing the US dollar with various commodities, including BTC, to maintain the value of the dollar.

In addition, Senator Cynthia recommended that the Federal Reserve add BTC to its currency holdings. Led by Trump, these Republican politicians see BTC as a store of value and beneficial to the economy.

The success story of El Salvador and MicroStrategy

Several companies have adopted BTC as a reserve asset and, for corporations like MicroStrategy, it’s a success story.

In 2020, MicroStrategy announced that it had started accumulating BTC as treasury reserve assets. After a decade of poor results, MicroStrategy’s share price has risen more than 900%.

Currently, he is the largest corporate holder of BTC, holding over 226k BTC. El Salvador has used BTC as a reserve asset since 2021.

After the election of the current president, Bukele, the country announced its intention to accumulate BTC as a reserve asset. Since buying BTC in 2021, the tokens have accumulated more than 50% of gains, and the president plans to maintain this position for the long term.

What Trump’s re-election would mean for cryptocurrencies

In particular, if Donald Trump could be re-elected, he would be the first pro-BTC president in the United States. In essence, his election would play a critical role in establishing greater regulatory clarity.

The crypto community wants clear, consistent and fair regulation that also protects investors, and a pro-cryptocurrency regime would help provide such clarity.

With clear regulations, it would be easy to discuss and understand the impact of digital currencies on the US and the global economy.

Finally, Trump’s re-election would mean legitimacy for cryptocurrencies, which would encourage other governments and states to engage in cryptocurrency-friendly regulations.

Legitimacy means greater adoption, better use and better returns for investors, while encouraging the decentralization of global currencies.

This is an automatic translation of our English version.

#Trumps #Crypto #Pivot #Bitcoin #Strategic #Reserve #Elections