[아파트 이상거래]397 cases detected through on-site inspection and planned investigation by the Ministry of Land, Infrastructure and Transport

Please do not sell our 00 pyeong apartment for less than 0 billion won. Let’s protest as a group against Real Estate Agent A, who registered properties for sale for less than 0 billion won (specific areas and complex SNS open chat rooms)

The Ministry of Land, Infrastructure and Transport announced on the 3rd that it detected 397 suspected illegal real estate transactions through on-site inspections and planning investigations of housing transactions in the metropolitan area.

There were five major cases of suspected illegal transactions detected by the Ministry of Land, Infrastructure and Transport. First, an apartment complex in Seoul was suspected of ‘house price collusion’ by using notices or online communities to order houses not to be put on sale below a certain price in order to unfairly influence the market price. Accordingly, the Ministry of Land, Infrastructure and Transport requested additional investigation from local governments.

Another case was a violation of the labeling and advertising regulations for brokerage objects. A real estate agent displayed an apartment located in Seoul on a specific real estate portal, registered the advertisement for sale, and then deleted the advertisement once the contract was concluded. Afterwards, the registration was repeated a total of seven times on the same day, and violations of the Licensed Real Estate Act regulations were confirmed and became the subject of notification to the local government.

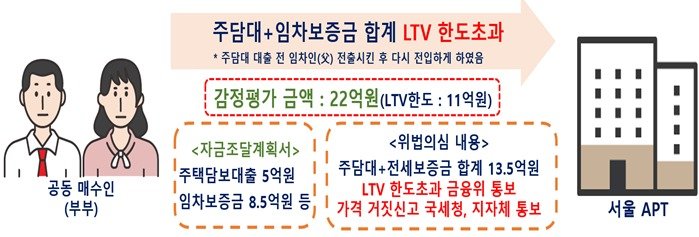

There were also cases of exceeding the LTV limit and reporting false prices in overheated speculative districts. A couple who were co-buyers received an appraised value of 2.2 billion won (LTV limit of 1.1 billion won) for an apartment in Seoul for the purpose of a housing mortgage loan.

The buyers were concerned that they would not be able to get a home mortgage loan of 500 million won if they had a senior rental deposit of 850 million won, so they had the father, who was living in the apartment before the loan, move out of the address and then take out a loan and move back in, which is suspected of being a violation of loan regulations. It became the subject of notification by the Financial Services Commission. In addition, the buyer reported the house price falsely, becoming the subject of notification to the local government and the National Tax Service for violation of the Transaction Reporting Act and suspicion of tax evasion.

There were also cases of suspected falsification of financing plans. The buyer wrote a self-help statement saying that he would finance the entire transaction price of 2.15 billion won with deposits from financial institutions while purchasing an apartment in an unregulated area of Seoul. However, during the actual transaction investigation, we were asked several times to submit explanatory materials to prove actual financing, but did not submit them, so we were classified as subject to notification to the local government and the National Tax Service for violation of the Transaction Reporting Act and suspicion of tax evasion.

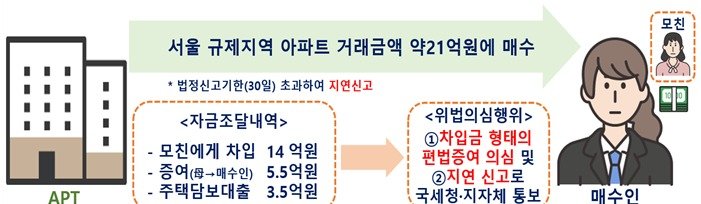

Another case was suspicion of delayed reporting and illegal donations. The buyer purchased an apartment in the regulated area of Seoul for approximately KRW 2.1 billion and financed it using a loan from his mother (KRW 1.4 billion), funds received as a gift (KRW 550 million), and a home mortgage loan (KRW 350 million). procured.

This was classified as a subject to notification by the National Tax Service as a suspected case of expedient purchase of an expensive apartment with money and loans received from others without any funds of one’s own. In addition, the report was delayed beyond the statutory reporting period of 30 days, making it subject to notification to the local government.

(Seoul = News 1)

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-10-03 20:05:45