The sharks continue to circle around Shufersal, in an attempt to take advantage of the lack of a core of control, in favor of creating a position that will allow them to influence the largest retailer in Israel.

Read more in Calcalist:

4 View the gallery

Michal Cohen in charge of the competition. Due to the ownership structure in Shufersal, the purchase of 20% of the shares of the food retailer makes the buyer the actual controlling shareholder

(Photo: Abigail Pepperno-Beer)

On the face of it, this is a problematic move, which gives the supplier exceptional accessibility to the most significant factor in the food market. A 5% holding will allow the Williger brothers to propose to the shareholders’ meeting, which is expected to convene next month, a director on their behalf for Shufersal. If elected, their representative will sit on board meetings and be part of the company’s decision makers.

But even before they reach the required maintenance rate, the very exposure of the move already gives the two a disturbing effect. “Once the cheese owner knows that Zvika holds a share of the company’s shares and is influential, he no longer treats him as a doubter,” claims a senior market official.

“This should not be immediately translated into appointing a director or leading a move to increase Shufersal’s Moyle Food shopping. It is meant first and foremost to serve the story of the Williger brothers, who want everyone to understand that they are not just unbranded cheese suppliers trying to bite into local brands, but part of the company’s owners. It improves their status and gives them a lot of power in front of elements in society. “

The things concerning the “story” that the Williger brothers are working to promote in parallel with the company’s day-to-day operations are reaffirmed, bearing in mind that this is not the first time that the Williger brothers’ intention to become stakeholders in Shufersal has made headlines. As early as 2012, Willy Food took part in what was called IDB’s ‘IPO’ and purchased shares in the then controlling shareholder of Shufersal with an investment of NIS 9.5 million, as part of a group of investors formed by Dankner. About two years ago, the brothers’ name came up when they tried to acquire the holdings of Eduardo Elstein, then the owner of IDB, in the Shufersal retail chain he owned through Discount Investments.

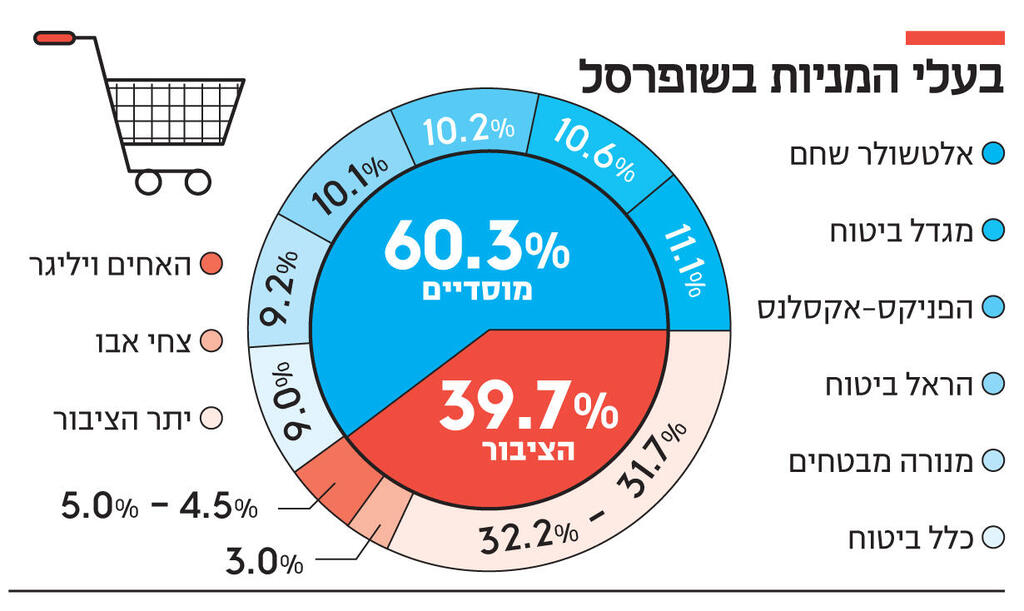

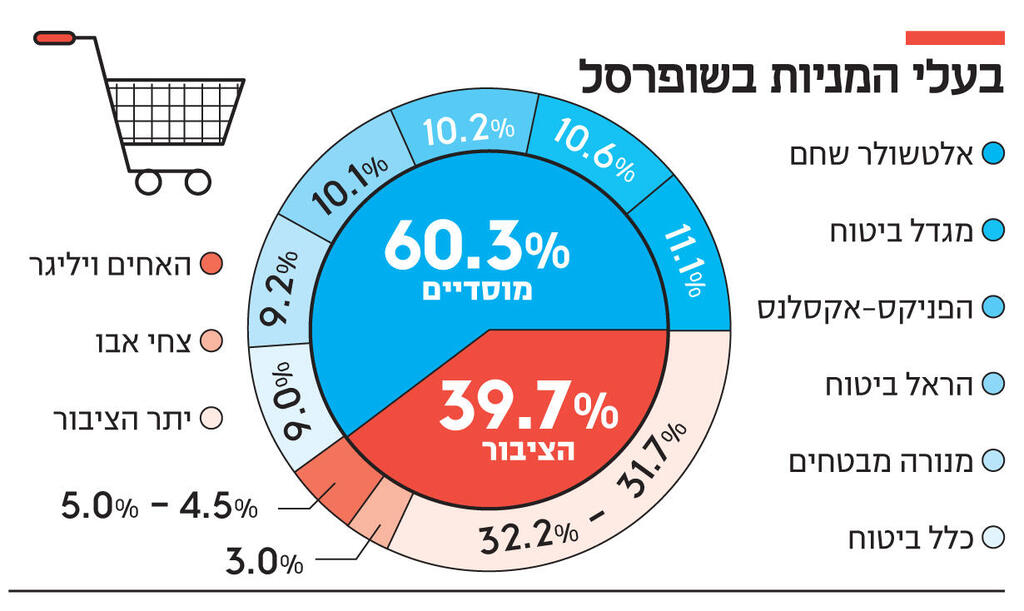

4 View the gallery

Shufersal shareholders

Willy Food is the 16th largest supplier in the food and consumer goods market, which according to Sterncast data holds 1% of the industry’s sales. But with the Williger brothers, it always seems that the interest is far beyond the sales of cheese and various dairy and food products, which it markets at low prices relative to local brands. The control of the company they established, sold and bought back twice in recent years. For the first time, the brothers sold control of the company to oligarch Arkady Gaydamak, and after it ran into cash flow difficulties, they regained control.

The second time, the Williger brothers sold the company to Alexander Granovsky, who ran into difficulties and sold it to Gregory Grotboy. Disruptions during Grotboy’s era led to the brothers’ takeover by buying BSD Crown shares, in which they held 38%. With the assistance of the court, the two were able to translate this holding into the replacement of directors on behalf of Grotboy in the company and appointed themselves and representatives on their behalf.

4 View the gallery

Right: Zvi Williger and Yossi Williger, against the background of the Shufersal branch

(Yariv Katz Uriel Cohen)

Since returning to the company, its activity has grown and in 2020 it was declared by the Competition Authority as a major supplier, one that imposes restrictions on commercial relations with retailers.

Shufersal’s position, which is held by a number of institutional entities, has led to the acquisition of 20% of the company, making the buyer the actual controlling shareholder. Against this background, a market source does not rule out the possibility that the brothers are much more interested in influencing the buyers of Shufersal or one director on their behalf. “They can be content with being the largest private shareholders at the moment, but they can also reach an understanding with one of the institutional bodies, and act in coordination, as the most significant body in relation to others,” the same food market source describes an even more disturbing scenario.

According to an antitrust official, on the face of it, the competition authority can argue that there is no reason to prevent a medium-sized supplier from investing in the network. “Ostensibly, the competition authority has nothing to do with it, because with a 5% holding and with less than a quarter of the board, they have no material impact and they can not direct the corporation’s activities. This is different from a situation in which a significant supplier in a centralized field would acquire a substantial share of the network and then there would be fears that the network would worsen the conditions of suppliers competing with the investor and the investor would worsen the trading conditions of competing chains.

At the same time, a senior official restricts it and claims that if the Competition Authority does intend to abide by its statements regarding the containment of market concentration, it cannot ignore the entry of a supplier into the network. According to him, the authority can see the entry of a supplier into the ownership of a retail chain, a fear of possible harm to competition, due in part to the exposure of the supplier holding two hats, to inside information of the chain. “The very fact that the supplier has an interest in the network gives it access to sensitive information. If Williger has a director at Shufersal, he has access to information that is not public about relationships with suppliers and competitors. This can certainly provoke competition problems, when he knows, for example, when a competing supplier gives discounts to Shufersal or preferential terms or future promotions. ”

4 View the gallery

Interim Shufersal Chairman Ran Gottlieb. Attempts by a number of factors to take over a retail market leader

( Photo: Screenshot: Youtube )

According to the same source, if the acquisition of the shares leads to Williger having a representative on the board, the competition authority will be able to attack the move. “Such an arrangement raises the concern of significant harm to competition in the market, and as such it may constitute a prohibited restrictive arrangement, which the Competition Authority can attack and stop.” According to him, the authority will have to conduct an economic examination, in which it will be examined, by requiring data from the parties involved, to what extent the arrangement may harm competition. If at the end of the examination it comes to the conclusion that this does indeed harm competition then you can apply to the court for an order to terminate the settlement, by charging the sale of the shares, or you will reach an agreed order with conditions that prevent competition concerns.

Immediately afterwards, it was the controlling shareholders of Delek Israel, Lahav L.R., controlled by Avi Levy, Uri Mansour and the Delek Group controlled by Yitzhak Tshuva, who proposed a merger in which Shufersal would receive the full share of Delek Israel in exchange for 10% of its shares to Delek Israel shareholders. Option to increase to 20% within a year. The deal, which included a commitment not to change the composition of the board of directors, half of whom, including former chairman Yaki and Damani, were up for re-election, raised concerns raised in line with the needs of the chairman who has since been removed from office.

Delek Israel’s proposal was rejected, and at the same time a proposal from the real estate company Yield Amot, controlled by Aloni Hetz (56%), to examine various investment alternatives in the company’s real estate group, landed on Shufersal’s board of directors. And the offer of the Cypress and JTLV funds to inject NIS 540 million into Shufersal Real Estate, in exchange for 15% of its shares.

The competition authority stated that “we do not know (the details – NK) and prefer not to comment.”