[다시 짙어진 ‘반도체 겨울’]

Samsung Electronics’ 4th quarter performance falls below expectations

Semiconductor operating profit declines by KRW 1 trillion… Industry: “DRAM struggles continue until the first half of the year”

Annual sales recovered to KRW 300 trillion in 2 years… Stock prices rise due to relief from ‘confirmation of bad news’

The tentative performance for the fourth quarter of last year (October to December) announced by Samsung Electronics on the 8th showed the shadow of a ‘semiconductor winter’ once again, following the third quarter (July to September). As Chinese companies aggressively produce general-purpose DRAMs and miss out on artificial intelligence (AI) specialties represented by high-bandwidth memory (HBM), the industry predicted that the memory market will continue to struggle through the first half of this year (January to June).

● DRAM market recession takes a direct hit, semiconductor operating profit decreases by KRW 1 trillion

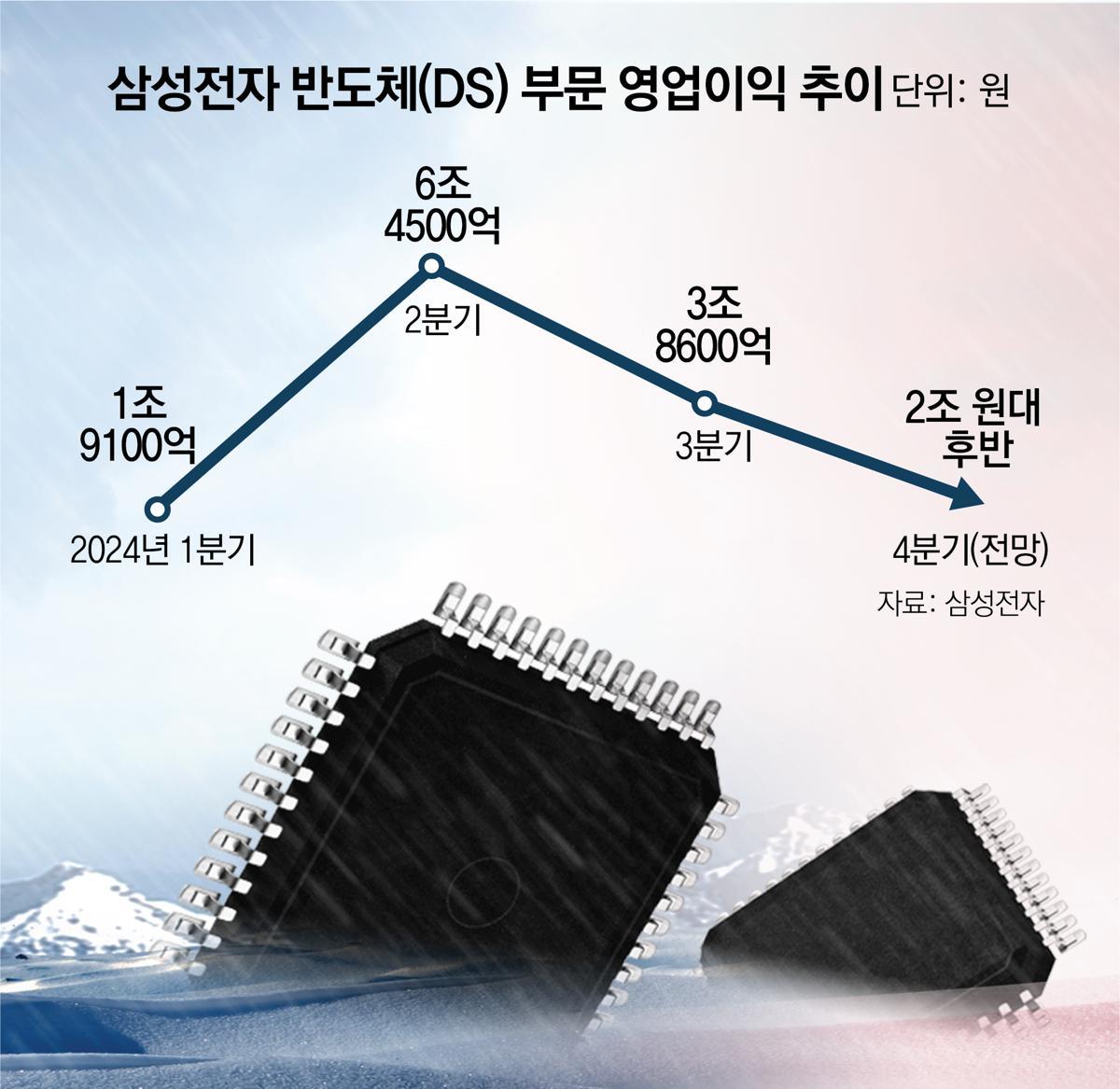

Although detailed performance by business division was not disclosed in today’s provisional performance announcement, securities companies estimated that Samsung Electronics made an operating profit in the late 2 trillion won range in the semiconductor (DS) division in the fourth quarter. This is a decrease of approximately 1 trillion won compared to the third quarter (3.86 trillion won).

Samsung Electronics’ DS division previously posted an annual deficit of 14.88 trillion won in the 2023 semiconductor market downcycle (recession). Afterwards, operating profits of KRW 1.91 trillion in the first quarter (January to March) of last year and KRW 6.45 trillion in the second quarter (April to June) were expected to recover, and a ‘semiconductor spring’ was expected, but fell again after the third quarter. .

The biggest reason for the sluggish performance of semiconductors is the slump in the DRAM market for information technology (IT) devices, which is Samsung Electronics’ mainstay. As the PC and smartphone markets, which were expected to recover at the end of the year, continue to freeze, major customer companies are reducing their memory inventory. In addition, Chinese memory manufacturers Changshin Memory Technology (CXMT) and Fujian Jinhua (JHICC) released general-purpose DRAM quantities at half the market price, leading to an oversupply in the market. In December of last year, market research firm Trend Force predicted that DRAM prices would fall by 3-8% in the fourth quarter and by 8-13% in the first quarter of this year.

Another major factor is missing the HBM market, which is on the rise thanks to the AI boom. In fact, SK Hynix, which exclusively supplies HBM3E products, the 5th generation HBM, is expected to record an operating profit of 8 trillion won in the fourth quarter. Previously, Micron, the world’s third largest DRAM company, also formalized the supply of HBM3E to NVIDIA in February last year. Samsung Electronics is developing the redesigned HBM3E 12-layer product in the first half of this year and the 6th generation HBM4 product in the second half of this year (July to December) with the goal of mass production.

In addition, it is known that the deficit of the foundry (semiconductor consignment production) division and the system LSI division, which is in charge of semiconductor design, has increased compared to the previous quarter. It is estimated that the two divisions combined suffered a loss of over 2 trillion won in the fourth quarter due to difficulties in securing yields and customers. An official in the semiconductor industry said, “The wide gap with the market consensus was likely due to the sluggish performance of foundries and system LSIs.”

● ‘Has it hit bottom?’ Samsung Electronics stock price rises

The device experience (DX) sector is also expected to have performed weakly due to the impact of the off-season, although detailed performance has not been announced. According to the securities market on this day, the mobile experience (MX) and network divisions are expected to have made operating profits in the low 2 trillion won range, the display divisions around 1 trillion won, and the TV and home appliance divisions around 300 billion won.

Samsung Electronics’ annual sales last year were provisionally 300.8 trillion won, recovering to the 300 trillion won range in two years. Annual operating profit recorded 32.73 trillion won.

Despite announcing performance that was below expectations, the stock price showed an upward trend on this day. According to the Korea Exchange on this day, Samsung Electronics’ stock price closed at 57,300 won, up 3.43% from the previous day. It is interpreted that this reflects the sense of relief that all negative news has been confirmed, as well as the expectation that the semiconductor industry will improve from the second half of this year. Su-rim Lee, a researcher at DS Investment & Securities, said in a report that day, “It will be difficult for foundries to significantly reduce their losses until the first half of the year,” but added, “DRAM prices are expected to rebound in the second half of the year, so starting from the first quarter, we can find opportunities to bottom out in performance and turn around the industry.” “He evaluated.

Reporter Kwak Do-young [email protected]

Reporter Lee Dong-hoon [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog