Posted Feb 28 2023 at 9:11 amUpdated Feb 28. 2023 at 5:30 PM

Inflation continues to rise in France. In February, consumer prices increased by 6.2% over one year, after 6% in January, according to the provisional estimate published by INSEE on Tuesday morning. Over one month, the rise was also more robust at +0.9%, against 0.4% despite the decline in energy prices.

Has the peak finally been reached? In its latest forecasts published in early February, the Institute of Statistics estimated that from March onwards, the rate of price increases would finally slow down.

This hoped-for beginning of a calm could be explained by base effects. Oil prices, which had soared in the wake of the outbreak of Russian hostilities in Ukraine, have since calmed down. The rise in prices should therefore return to around 5% at the end of June. A consistently high standard.

“Margin of uncertainty”

In reality, the course of the film is no longer so obvious today. “There is a margin of uncertainty in our inflation forecasts,” recognizes Julien Pouget, head of the economic affairs department at INSEE.

Food has indeed become the leading contributor to inflation, far ahead of energy. In February, food prices jumped 14.5% year on year. And while trade negotiations between manufacturers and large retailers are due to end on Wednesday, further increases are expected on the shelves. Even if Bercy dismisses the idea of a “red march”, the Federation of Commerce and Distribution reported earlier this week an increase to come of around 10%.

“Pressure will remain strong on food prices as past shocks continue to spread. However, future increases should be smoothed over time because distributors probably have stocks to sell. As a result, this should not create a big staircase on inflation in March,” observes Julien Pouget.

On the other hand, “core” inflation – which excludes products with volatile prices but includes food products excluding fresh products – could be higher than expected (5.7% at the end of June) in the coming months. . “This is all the more so as the prices of services are accelerating under the effect of successive revaluations of the SMIC”, he explains. Questioned in the National Assembly, the Minister of the Economy Bruno Le Maire promised this Tuesday “measures” in the coming days to “contain inflation” food

“Backlash from the energy check”

These new price increases are not good news at a time when growth in France is slowing down: GDP only improved by a modest 0.1% in the fourth quarter of 2022, confirmed INSEE this Tuesday.

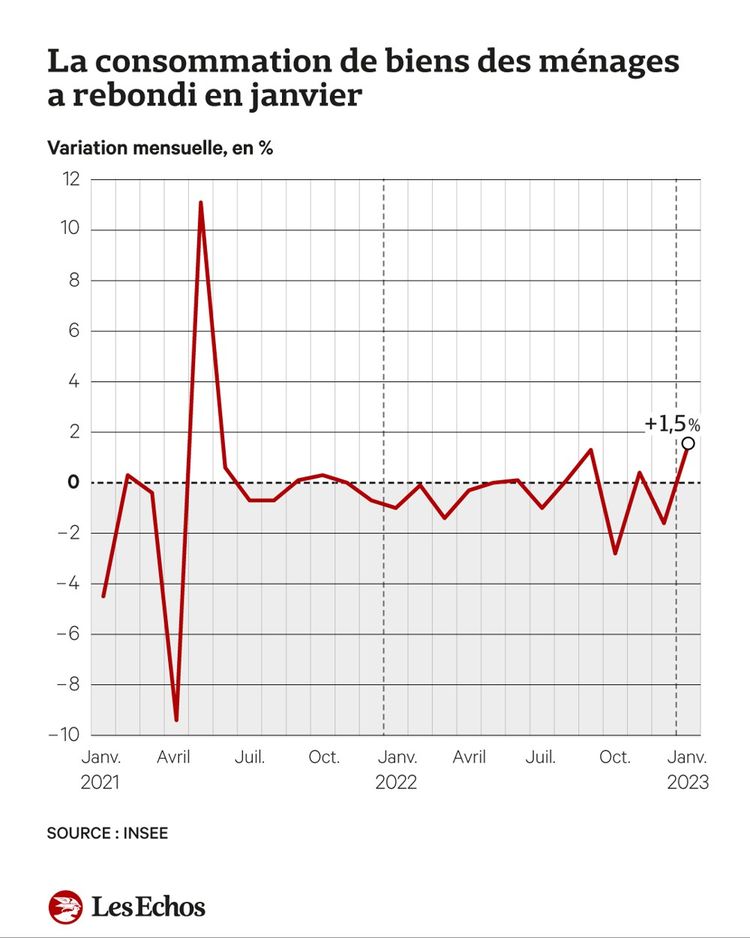

While the French economy has progressed well by 2.6% over the whole of 2022, household consumption, the traditional engine of growth, has continued to slow down over the months, even falling in the last quarter (-1.2%). In January, a rebound was nevertheless recorded, fueled by energy expenditure “in response to the energy cheque”, according to INSEE, but also by the resumption of purchases of manufactured goods and food products (respectively +1.3 % and +0.6%).

“France is in a scenario of very low growth. The only thing that allows it to resist is public spending and household savings”, believes Ludovic Subran, chief economist of the Allianz group, who recalls that “over the last six months, 250 billion euros have been spent on support measures.

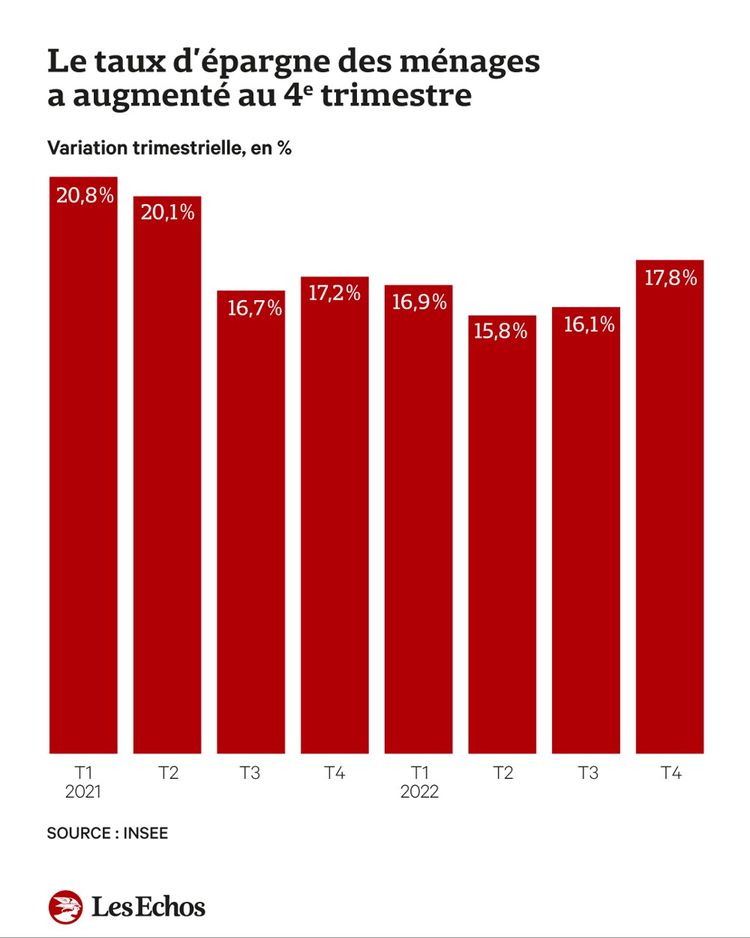

A savings rate of 16.6%

Even if this is not the feeling of the French, purchasing power was preserved last year by the intervention of the State, whether to limit the impact of soaring energy prices or lower taxes (TV license fee, housing tax). Measured in consumption units – to take into account the composition of households – it only fell by 0.2% in 2022, a figure which, however, masks strong disparities.

“The public spending cushion could limit the decline in inflation in the coming months,” warns Ludovic Subran. For now, Bercy expects prices to rise by 4.2% this year, relying on the firmness of the European Central Bank to slow down the price dynamic.

The latest survey on household morale, however, confirms the concerns of the French about their future standard of living. While their disposable income rose by 2.5% in the third quarter and then by 2.9% in the fourth, they chose to fill their woolen stocking: in the second half, their savings rate soared to end the year at 16.6% of gross income, much more than the 15% posted on average before the health crisis. And it’s not over: in 2023, those who can will continue to save money even if inflation erodes their savings.