The measure went a little unnoticed, perhaps because it did not arouse any controversy. The early release of employee savings was introduced by the Senate Social Affairs Committee in the bill on emergency measures for purchasing power.

Emphasizing that this text “has been enriched in the National Assembly and in committee in the Senate”, the Minister of Labour, Olivier Dussopt, explained last Thursday, at the start of the discussion in the hemicycle at the Luxembourg Palace, that the government “don’t wish[ait] not go back on several contributions”, citing in particular the release of employee savings. The wheel turns: during the first five-year term of Emmanuel Macron, in 2020, in a political context it is true very different, the senators LR had tried without success to obtain it.

Ten exceptions

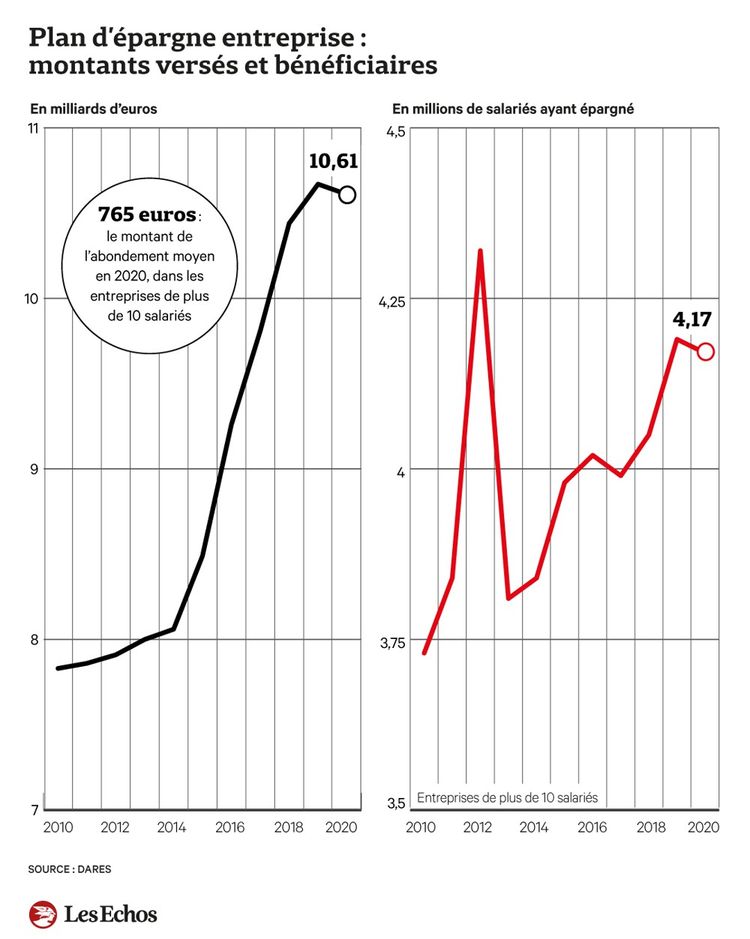

The employee savings scheme provides that when an employee receives profit-sharing – compulsory in companies with more than 50 employees – or profit-sharing – optional regardless of the size of the company -, he can choose to touch right away. But in this case, he must pay income tax on it. Another possibility: leave this savings blocked for five years and, in this case, the sums are exempt from income tax but not from social security contributions.

However, the list of exceptions has grown longer in this second case when you don’t want to wait five years. Ten reasons are now provided: birth; marriage or civil union; divorce or separation with custody of at least one child; disability; death of the employee or his spouse; over-indebtedness; business creation ; acquisition of his main residence or change of professional situation, from dismissal to the cessation of activity as an individual entrepreneur, including resignation. And now domestic violence.

Perco excluded from unlocking

An unconditional window will nevertheless open until the end of the year. Any employee who so wishes may release their participation or profit-sharing within the limit of an overall ceiling of 10,000 euros without this sum being subject to income tax or social security contributions. The only rule to be respected: that the money is not saved elsewhere but is devoted to “the acquisition of goods or the provision of services”.

The sums will be declared by the managing body or, failing that, by the employer to the tax authorities and it is simply provided that the employee is “at the disposal of [cette dernière] the supporting documents attesting to the use of the released sums”.

There are, however, two exceptions. One is total: the sums placed in a collective retirement savings plan (Perco) or in solidarity funds cannot be released. The other regulates the release of employee savings invested in shares of the company or a related company. A collective agreement will be needed for this savings to be mobilised, in whole or in part.

Mixed precedents

This is not the first time that an early mechanism for unlocking participation and profit-sharing has been put in place. There were precedents in 1994, in 1996 and closer to us, in 2004. Jacques Chirac implemented it at the time, leading to an increase in consumption of around 2 billion euros, i.e. less one-third of the funds released. The rest had been used in housing investment or… transferred to other savings vehicles.

Nicolas Sarkozy had practiced it between February and the end of June 2008 via, already, a law on purchasing power with a ceiling identical to this year’s measure: 10,000 euros. 6.5 billion euros were then released. François Hollande also used it from July to December 2013, with a ceiling doubled to 20,000 euros. The measure had had relative success: only 2.2 billion, far from the 4 billion that the executive had hoped for.