Read more in Calcalist:

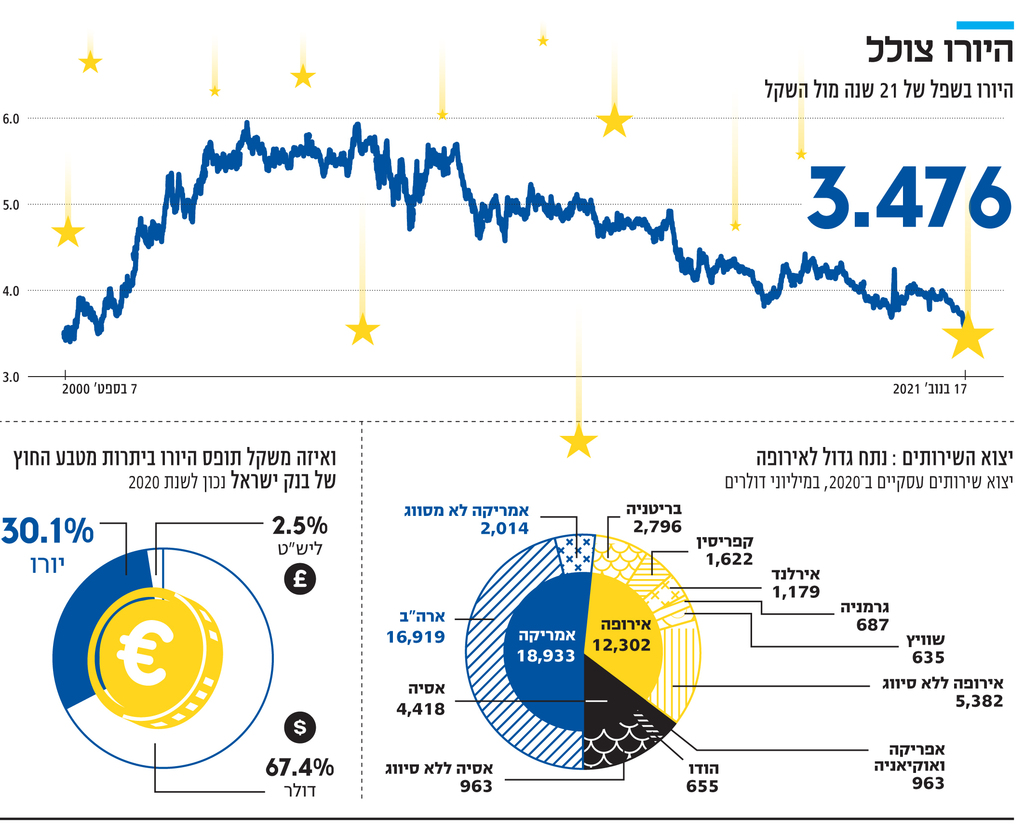

But yesterday it was the euro – the currency of the European bloc that is the main trading partner of the Israeli economy (yes, more than the US). The European currency traded around NIS 3,476 yesterday and broke the psychological barrier of NIS 3.5. The reasons for the strengthening of the shekel are known , And it all starts with the basic economic factors: much more euros coming in than going out.First of all, the phenomenon is reflected in a huge surplus in the current account of the balance of payments mainly in the services account (exports of services far exceed imports).

3 View the gallery

According to the data, this year it is expected to reach more than $ 26 billion, double the level recorded just two years ago, in 2019, on the eve of the corona crisis (about $ 13.3 billion). In the services account, the story is even more impressive: in the first half of 2021, it crossed the $ 20 billion mark and is on its way to breaking a new record (which was already broken last year, when the services account reached $ 30 billion). So true, the US is much more significant in its weight in Israeli services exports but a third of Israeli services exports reach Europe when a quarter of it lands in the eurozone.

When looking at the long-term development of the euro-shekel – similar to the dollar-shekel – the trend is clear and leaves no room for doubt: over the years, the euro has weakened against the shekel quite consistently and continuously.

A profound and unusual change that took place this year and contributed to a dramatic strengthening of the shekel against other currencies is the onslaught of foreigners on Israeli shares, with foreigners, of course, including European financial institutions. According to data from the Bank of Israel, if in 2019 net financial investment (foreign investment in Israel minus Israeli investment abroad) was negative and amounted to $ 6.5 billion (Israelis bought more abroad than foreigners purchased in Israel), the situation was reversed last year and there was a surplus. The Bank of Israel publishes the data in dollars for simplicity and convenience, but some of the buyers are European and for the purpose of buying the same Israeli shares, they sell euros and buy shekels – which weakens the currency. The European is similar to what happens with the American currency.

3 View the gallery

On the right, Finance Minister Avigdor Lieberman and Governor Amir Yaron

(Photos: Tal Shachar, Alex Kolomoisky)

2. But the story of the euro-shekel is much more complex than that of the dollar-shekel. First, because, unlike the dollar, the euro has weakened in the world, especially against the dollar. Thus it weakened from a level of 1.22-1.2 dollars to the euro in early 2021 to a level of 1.16 about a month ago. From the beginning of November, the European currency appears to be “falling apart” against the American currency and has already reached $ 1.13 per euro – a 16-month low. These data show that what is happening with the euro-shekel is not only related to the shekel, but also to the euro itself, the European economy and the European Central Bank (ECB).

To understand the phenomenon, one must reach the structural characteristics of Europe: monetary union without fiscal union. That is, they have a common currency – and therefore have a common central bank that issues it – but each country decides on its deficit, and therefore, on its level of debt and borrowing. And the countries in the eurozone, as is well known, are very heterogeneous, both in their economic characteristics but also in their cultural characteristics and even in their priorities. It is known that the inflation hatred of the Germans is much higher than that of the Italians, Greeks and Spaniards, with the latter showing much greater hatred towards unemployment.

How can one agree on a policy when the priorities are so different? This is a question that bothers the Europeans and they have not yet been able to solve it. This time, too, it all started with an idyll: a few months after the outbreak of the corona plague, it was thought that Europe would emerge stronger and more cohesive than the crisis. Although the epidemic has managed to consolidate the very different European countries under the auspices of programs such as NEXT GENREATION EU amounting to 750 billion euros (which is about 3% of European GDP) also through the raising of debt that all countries guarantee. But the plan faded with a weak response.

The epidemic highlighted the gaps between countries in Europe and also within content. When you look at the dry economic data, the picture becomes clear: The European economy is not really recovering even after the outbreak of the plague, after it suffered a very severe recession in 2020 when its GDP fell by 6.3% (much higher than that of the US, OECD and the world. The International Monetary Fund (IMF) forecasts for this year also do not look particularly gratifying and have also moderated to a level of positive growth of 5% when the growth forecast of Germany – the continent’s largest economy – has been updated downwards to only 3% compared to 6%. In the US and 5.2% in developed countries.

The OECD composite index (a leading index that seeks to predict the continued development of economic growth) shows optimism about developed countries, but when diving into “blocs”, the eurozone sub-index indicates a further slowdown and a very unflattering “growth in moderation” score. And this is not the only curve that is bothering Europe these days: even the epidemiological curve due to the corona does not bode well. The infection rate there has reached 406 cases per million people compared to 254 in the US and 63.7 on average in the world, while in countries like Austria and Belgium, this number has already crossed the 1,000 infected per million population.

In addition, Europe is heading for an acute energy crisis for a variety of reasons: a surge in global energy demand as a result of economic recovery; The temporary decline in Aeolian (wind) energy production in Europe; The dramatic drop in Russia’s gas sales; The decline in gas supplies from Norway; The jump in gas consumption at the beginning of the year due to cold weather caused prices to rise already in the spring and summer, which led to an increased purchase to sell it later in the year. The surge in energy prices – which completed an annual increase of almost 24% in October – has boosted inflation on the continent. Yesterday, the Central Bureau of European Statistics (EUROSTAT) announced that annual inflation jumped to 4.1% last October from 3% two months ago, 2% four months ago and minus 0.3% a year ago. In 11 European countries, inflation is already over 5%, including Ireland, Spain and Belgium. Price increases, by the way, are in all sections and not just in energy. The European future looks these days, while its currency is diving, quite gray.

3 View the gallery

European Central Bank President Christine Lagard

(Photo: AP)

3. What also did not contribute to the European currency were the remarks made in recent days by the President of the ECB, Christine Legard (who served as the IMF’s chairman and France’s finance minister). To understand them, it is worthwhile to understand the background: At the end of October, the German tabloid Bild (the most popular newspaper in Europe) published in its headline an article called “Madame Inflation” with a large picture of Lagard claiming that while Lagard buys luxury clothes, inflation on the continent and zero interest rates erode The disposable income of Europeans and bite into their pensions and savings.

If Lagard seemed to understand the message, the experienced politician was unimpressed and explained earlier this week that “tightening monetary policy now to curb inflation could stifle the recovery of the eurozone”, thus shutting off hopes of rising interest rates. Lagard did not hide the fact that inflationary pressures may remain on the horizon for some time but it will not raise interest rates – not even next year. This is in contrast to economies that have already begun to raise interest rates and, of course, compared to estimates in the US, where the Fed is expected to start raising interest rates as early as 2022. On the developments in the European economy, in the Israeli economy and in the world economy, the continued weakening of the European currency should no longer surprise anyone.

.