Europe’s automotive Crisis: Can Legacy Brands Survive the Perfect Storm?

Table of Contents

- Europe’s automotive Crisis: Can Legacy Brands Survive the Perfect Storm?

- The triple Threat: China, the US, and a Weakening Home Front

- The Rise of Chinese EVs: A Closer Look

- Eastern Europe: A Glimmer of Hope?

- The Road Ahead: Recovery or Decline?

- Navigating the Crisis: Strategies for Survival

- The American Viewpoint: Implications for US Automakers

- FAQ: Understanding the European Automotive Crisis

- What are the main factors contributing to the crisis in the European automotive industry?

- How are chinese EVs impacting European automakers?

- What impact are US tariffs having on European automakers?

- Is there any hope for recovery in the European automotive market?

- What can european automakers do to survive this crisis?

- Pros and Cons: The Future of European Automakers

- europe’s Automotive Crisis: Expert Weighs In on Legacy brands’ Survival

Is the golden age of European automotive giants coming to an end? A confluence of factors – chinese EV dominance, US protectionism, adn weakening domestic demand – is creating a perfect storm that threatens the very foundation of Europe’s automotive industry. Legacy brands like Volkswagen, Mercedes-Benz, and BMW are facing unprecedented challenges, and their future hangs in the balance.

The triple Threat: China, the US, and a Weakening Home Front

For decades, European automakers thrived on a robust export model, relying heavily on markets like Russia, china, and the US. These external markets provided the scale and stability needed to fuel innovation and profitability. But in 2025, this model is crumbling. Let’s break down the threats:

The Chinese EV Onslaught: A Technological and Economic Tsunami

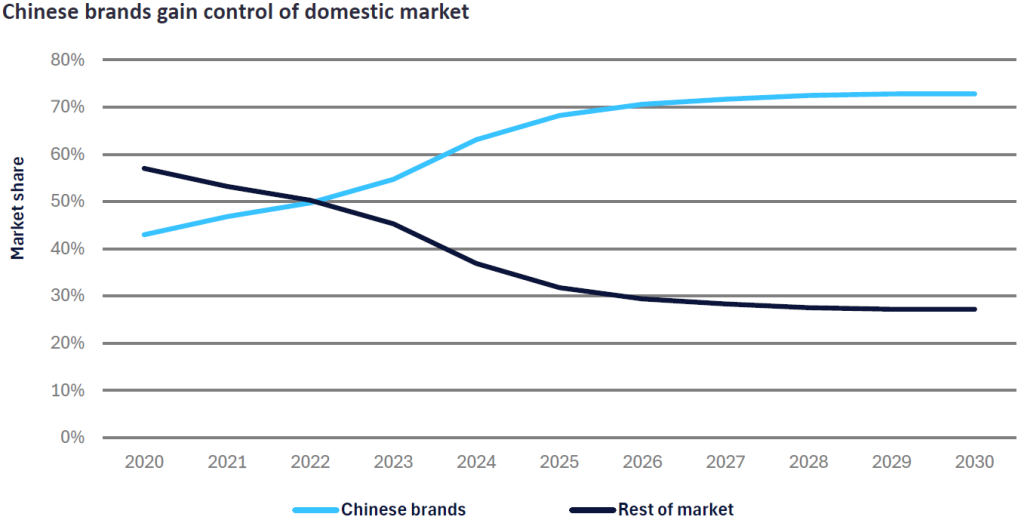

Chinese domestic brands, particularly in the electric vehicle (EV) segment, are rapidly gaining ground in Europe. Companies like BYD and MG are offering competitively priced EVs with impressive specifications, directly challenging European OEMs. This isn’t just about cheaper cars; its about technological advancement and a willingness to embrace the future of mobility.

Expert Tip: Keep an eye on battery technology. Chinese EV manufacturers are frequently enough ahead of the curve in battery innovation, giving them a significant cost and performance advantage.

The impact is already being felt. European OEMs are experiencing margin erosion and declining market shares.The pressure to compete on price is intense, forcing them to make tough decisions about investment in future technologies.

The American Protectionist Wall: Tariffs and Trade Wars

Across the Atlantic, the US has adopted an increasingly protectionist stance. The Trump governance’s 25% tariffs on imported foreign-made cars represent a major blow to European OEMs. The European Automobile Manufacturers Association (ACEA) reports that European manufacturers export up to 60% of their US-made vehicles. The US is the most important export market for Germany’s auto industry.

BMW warned that growing trade conflicts could cost the company $1 billion this year,while Porsche and Mercedes-Benz are facing a potential $3.7 billion blow from new US tariffs on imported cars. These tariffs make European cars more expensive in the US, reducing their competitiveness and impacting sales volumes.

Did you no? The “chicken tax” of the 1960s, a 25% tariff on light trucks, is a past example of US protectionism that substantially impacted the European automotive industry.

Domestic Demand Dries Up: Economic Headwinds and Consumer Hesitation

With exports weakened, Europe itself has become the primary battleground for volume. However, domestic demand is not rising fast enough to support the industry. Sales have dropped in the first three months of 2025, with major markets such as Germany, Italy, and france all recording negative growth. The recovery seen in 2023 has stalled, and the region is now experiencing a downturn.

Economic conditions are a major factor behind the decline.Eurozone GDP remains sluggish,and high inflation persists,leaving the European Central Bank (ECB) facing increasing uncertainty regarding its monetary policy and decision to cut interest rates. Affordability has become a central barrier, and even with the introduction of more hybrid and electric options, price sensitivity remains high, with consumers holding off on making purchases.

Speedy Fact: the average price of a new car in Europe has increased significantly in recent years, making it harder for consumers to afford new vehicles.

The Rise of Chinese EVs: A Closer Look

The rapid advance of Chinese automakers in the european market, particularly in the EV segment, is a game-changer. Brands such as BYD and MG are steadily increasing their market shares across several European countries, offering competitively priced EVs with strong specifications.This is intensifying competition and placing downward pressure on pricing, especially for legacy European OEMs struggling to produce EVs at scale.

For domestic manufacturers,this means not only dealing with slowing demand but also losing share within the demand that remains. The challenge is twofold: competing on price and keeping up with the rapid pace of technological innovation in the EV space.

Eastern Europe: A Glimmer of Hope?

In contrast to Western Europe’s stagnation, Central and Eastern Europe offer a limited but notable source of resilience. countries such as Poland,Hungary,and Romania are experiencing modest growth in both vehicle demand and local production capacity.

The region benefits from lower labour costs, rising middle-class consumption, and supportive government policies. Several OEMs have increased investment in Eastern European facilities to reduce production costs and improve proximity to key markets. These countries are becoming increasingly important manufacturing hubs and, to a lesser extent, as developing consumer markets.

Reader Poll: Do you think eastern Europe can become a significant growth engine for the European automotive industry? share your thoughts in the comments below!

While Central and Eastern Europe cannot compensate for the scale of lost sales in China or the US, they provide OEMs with cost-efficient production bases and incremental sales growth.

The Road Ahead: Recovery or Decline?

The European automotive market in 2025 is not in freefall but is clearly stagnating. Russia, China, and the US have simultaneously lost their ability to support EU sales volumes. With domestic demand weakening under the weight of economic headwinds and the structural transition to electrification, the industry is entering a period of subdued growth and increasing regional fragmentation.

Moderate recovery is expected beyond 2025, as GlobalData forecasts western European LV sales to grow by approximately 2.2% annually in 2026 and 3.0% in 2027, provided that economic conditions stabilize, and affordability improves. until that recovery materializes, sales will remain fragile and uneven, increasingly reliant on small gains in developing markets in Central and Eastern Europe. without structural improvements in consumer confidence and pricing, Europe’s LV market will continue to operate below its full potential, caught between global dislocation and an incomplete domestic rebound.

So, what can European OEMs do to navigate this challenging landscape? Here are a few potential strategies:

Focus on Innovation: Investing in Next-Generation Technologies

European automakers need to double down on innovation, particularly in areas like battery technology, autonomous driving, and connectivity. This requires significant investment in research and development,as well as strategic partnerships with technology companies.

Embrace Electrification: Accelerating the Transition to EVs

The transition to electric vehicles is certain. European OEMs need to accelerate their EV development programs and bring competitively priced EVs to market. This includes investing in battery production and charging infrastructure.

Reduce Costs: Streamlining Operations and Improving efficiency

Cost reduction is essential to compete with Chinese EV manufacturers. European OEMs need to streamline their operations, improve efficiency, and reduce manufacturing costs. This may involve restructuring, plant closures, and job losses.

Explore New Markets: Diversifying Export Destinations

European automakers need to diversify their export destinations and reduce their reliance on traditional markets like China and the US. This includes exploring opportunities in emerging markets in Asia, Africa, and South America.

Lobby for Government Support: Seeking Policy Changes

European OEMs need to lobby for government support to help them navigate the challenges they face. This includes advocating for policies that promote EV adoption, support research and development, and protect against unfair trade practices.

The American Viewpoint: Implications for US Automakers

While this article focuses on the European automotive industry,the challenges faced by European OEMs have implications for US automakers as well. The rise of chinese EVs and the potential for increased protectionism could disrupt the US market and put pressure on domestic manufacturers.

US automakers need to learn from the experiences of their European counterparts and take proactive steps to prepare for the future. This includes investing in EV technology, reducing costs, and diversifying their export markets.

FAQ: Understanding the European Automotive Crisis

What are the main factors contributing to the crisis in the European automotive industry?

The main factors include the rise of Chinese EVs, US protectionism, and weakening domestic demand in Europe.

How are chinese EVs impacting European automakers?

Chinese EVs are offering competitively priced vehicles with strong specifications, putting pressure on European OEMs to lower prices and invest in EV technology.

What impact are US tariffs having on European automakers?

US tariffs are making European cars more expensive in the US, reducing their competitiveness and impacting sales volumes.

Is there any hope for recovery in the European automotive market?

Moderate recovery is expected beyond 2025, but it will depend on economic conditions stabilizing and affordability improving.

What can european automakers do to survive this crisis?

European automakers need to focus on innovation, embrace electrification, reduce costs, explore new markets, and lobby for government support.

Pros and Cons: The Future of European Automakers

Pros:

- Strong brand reputation and heritage

- Technological expertise and innovation capabilities

- Established manufacturing infrastructure

- Potential for growth in Eastern Europe

Cons:

- High labor costs and regulatory burdens

- Slow pace of EV adoption

- Exposure to trade wars and protectionism

- Competition from chinese EVs

The future of european automakers is uncertain. They face significant challenges, but they also have strengths that they can leverage to survive and thrive. The key will be to adapt to the changing landscape, embrace innovation, and find new ways to compete in a global market.

europe’s Automotive Crisis: Expert Weighs In on Legacy brands’ Survival

Keywords: European automotive industry, EV market, chinese EVs, automotive crisis, trade wars, automotive innovation, European automakers

Time.news sits down with industry expert, Dr. Anya Sharma, to discuss the perfect storm threatening Europe’s automotive giants and what the future holds.

Time.news: Dr. Sharma, thank you for joining us. Our recent article highlights the “perfect storm” facing the European automotive industry. Can you elaborate on the severity of this situation?

Dr. Anya Sharma: It’s not hyperbole to say legacy brands are at a critical juncture. The triple threat – competition from Chinese EVs, increased US protectionism, and weakening domestic demand – is a potent combination dismantling the customary European export model. We’re witnessing a basic shift in the global automotive landscape.

Time.news: Let’s delve into the rise of Chinese EVs. Is it simply a matter of offering cheaper cars?

Dr. Anya: No, it’s far more complex.Price is undoubtedly a factor, but Chinese EV manufacturers like BYD and MG have made significant strides in technology. Their advancements in battery technology, specifically, give them a competitive edge regarding both cost and performance.They’re not just undercutting on price; they’re delivering compelling EVs.

Time.news: The article also mentions the impact of US tariffs, particularly the potential $3.7 billion blow to Porsche and mercedes-Benz. How are these tariffs impacting the European automotive industry?

Dr. Anya: The US protectionist measures are creating a significant hurdle. The increased cost of importing European vehicles impacts their competitiveness in a crucial market. Many European automakersexport a large percentage of their vehicles made in the US to the US, the most critically important export market for the automobile sector, especially the German auto industry. This directly affects sales volumes and profitability, limiting their ability to invest in critical areas like EV development. We can also look back at past protectionist policies, like the “chicken tax” of the 1960s, to see how considerably tariffs can reshape the automotive landscape.

Time.news: Domestic demand in europe is also weakening. What’s driving this decline?

Dr. Anya: Several factors are at play. Eurozone GDP remains sluggish, and high inflation is impacting consumer purchasing power. the average price of a new car in Europe has risen sharply, making it challenging for many to afford new vehicles, irrespective of whether they’re internal combustion engine (ICE) or electric. This hesitancy hits European automakers particularly hard, who are already struggling to balance EV investment with legacy production.

Time.news: Are there any shining spots within Europe? The article mentions central and Eastern Europe.

Dr. Anya: Yes, Central and Eastern European countries like Poland, Hungary, and Romania are showing modest growth. Lower labor costs,rising middle-class consumption,and supportive government policies are making these regions attractive for investment and,though to a lesser degree,offering some incremental sales growth. While not a substitute for lost sales in china or the US, these markets offer manufacturers cost-efficient production bases.

Time.news: What strategies can European automakers employ to navigate this crisis and ensure their survival in the EV market?

Dr. Anya: Survival hinges on adaptability and innovation. Firstly,they must accelerate their transition to EVs,focusing on developing competitive and affordable models. This includes heavy investment in battery technology and charging infrastructure. Secondly, cost reduction is crucial. Streamlining operations, improving efficiency, and perhaps restructuring are necessary to compete with leaner Chinese EV manufacturers. Diversifying export markets and lobbying for government support to promote EV adoption and fairer trade practices are also vital.

Time.news: What lessons can US automakers learn from the challenges facing their European counterparts?

dr. Anya: US automakers should recognize that the challenges facing European automakers are not isolated. The rise of Chinese EVs and the growing trend of protectionism could easily disrupt the US market. Proactive steps, such as investing in EV technology, reducing costs, and diversifying markets, are crucial for long-term success and competitiveness.

Time.news: What’s yoru overall outlook for the European automotive industry? Is recovery possible?

Dr. Anya: While the situation is challenging, recovery beyond 2025 is plausible, provided economic conditions stabilize and affordability improves. GlobalData forecasts moderate growth, but sales will remain fragile and uneven. The European automotive industry needs to adapt, innovate, and evolve to overcome this perfect storm. It won’t be easy, but survival is absolutely possible with the right strategies.

Time.news: Dr. Sharma, thank you for your valuable insights.