The difference between being poor and the possibility of a better future is having a house; the creating wealth is a good investment that allows people to have stability and to be able to inherit a more dignified life for their children, having a home is a human right.

But in a country where the majority of Mexicans receive an average salary of 7,380 pesos per month, according to Inegi data, it would be impossible to buy a home without agencies like the National Institute for Housing Promotion (Infonavit).

Without this government agency, 1,452 people a day would not be able to access a mortgage loan whether to buy a home, build, remodel or acquire land; that is, 500,000 families in a year would be left homeless.

“It is very important because of the 21 million workers who have benefits, and therefore Infonavit, the vast majority become the only way to have a home, because to collect enough to buy a house can take a lifetime,” said in an interview with MILLENNIUM Héctor Márquez Pitol, president of the Mexican Association of Human Capital Companies (AMECH).

I assure you also without the existence of the institute, many people would not have a decent retirement. The savings generated in working life, due to the additional payment made by employers under the concept of “housing savings”, if not used, can be fully withdrawn in retirement.

Information from Infonavit itself shows that In the first half of 2021, mortgage loans totaled 258 thousand 300 million pesos, 24 percent more than last year; the institute represents 30 percent of this amount, that is, 3 out of every 10 pesos that are lent for the purchase of a home comes from the coffers of the government agency.

Birthday

The Infonavit turns 50 this Sunday of being the government agency in charge of giving about 70 percent of housing loans in Mexico, to a greater extent of social interest and which is one of the most important social security benefits for workers.

“It is the heritage of the efforts of millions of workers that must be taken care of; not put these funds at risk, because there is always the temptation to want to use them precisely to promote development, to create more progress, well-being, jobs. Yes, it is very good in the speech, but in fact we have to take care of the workers’ funds, it is the future of families, that is the future of Mexicans,” said President Andrés Manuel López Obrador at the institute’s 125th Ordinary General Assembly.

Since its creation, it has made it easier for more than 12 million families to have a home, of the 37 million households in the country, according to data from the INEGI Population and Housing Census 2020, that is, a third were financed to some extent by this body.

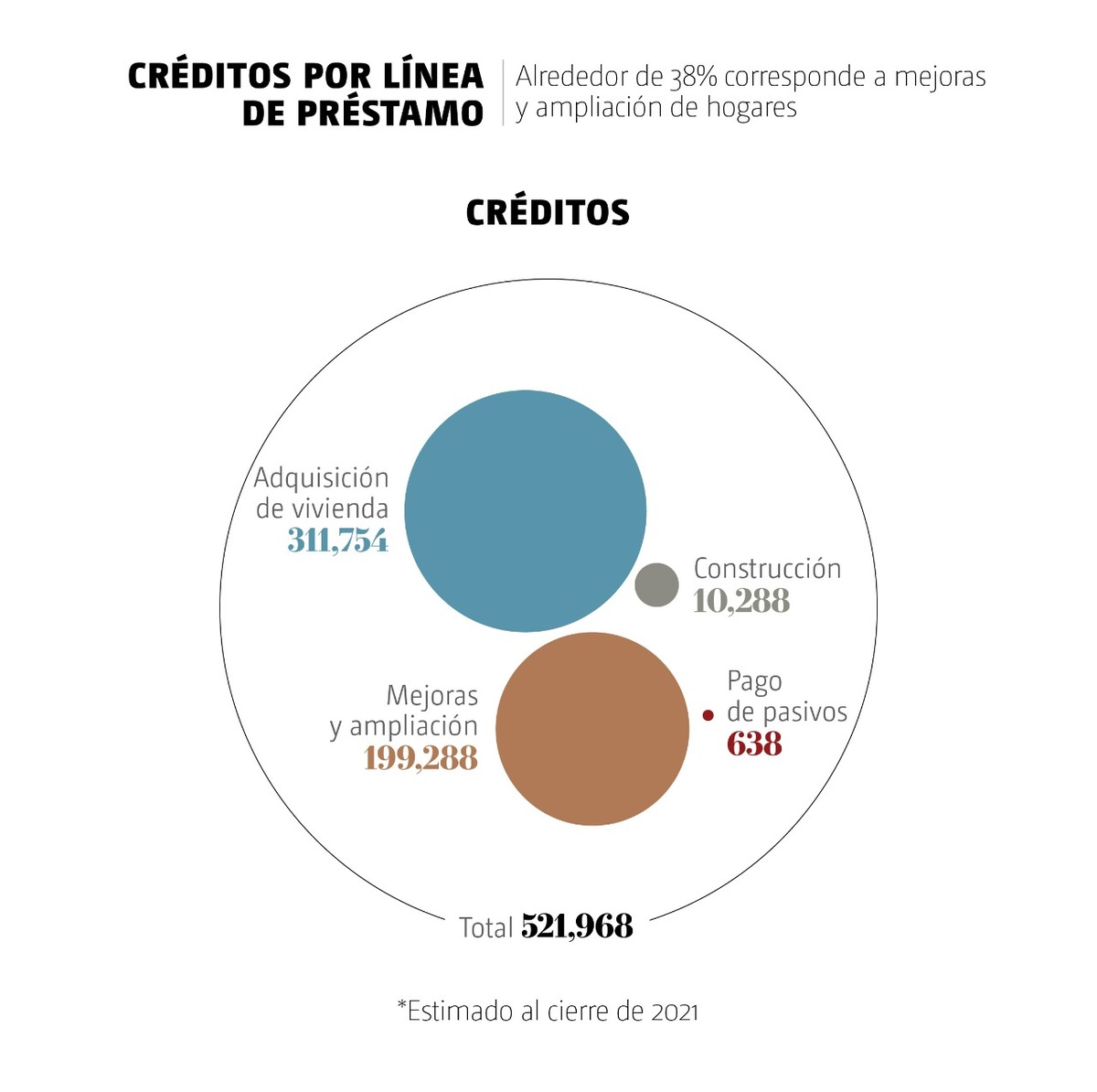

In 2021 alone, they granted 530,525 credits for acquisition, improvement and self-construction, among others.

The total of funding given by the institute last year it represented an economic spill of 234 thousand 891 million pesos destined not only to the purchase or improvement of the home, but to the entire value chain of the housing industry.

Thus, of the total financing delivered in 2021, 60.7 percent were for the acquisition of new or existing housing, construction and payment of liabilities, while 39.3 percent were for improvement or remodeling of the property.

While 49 percent of the total credits were concentrated in six entities: Nuevo León, State of Mexico, Chihuahua, Jalisco, Mexico City and Baja California.

The future

Mario Macías Robles, sectoral director of the Infonavit Workerssaid that they will continue working to guarantee access to housing through products that meet the needs of Mexicans, especially workers who earn less than 12,000 pesos per month.

“The new Infonavit that we want for the coming decades must be made up of innovative, responsible, proactive measures, but in an orderly and transparent manner, not like in the past where there were excesses and abuses. For the workers’ sector, the central objective of Infonavit, facing the next decades of operation, is to exponentially increase the number of financed homes, efficiently and responsibly taking advantage of the excesses of the financial availability of the Institute”, highlighted Macías.

According to data from Federal Mortgage Society (SHF) nationwide, the average price of a home is one million 372 thousand pesos and the average price is 796 thousand; however, the cost of homes with credit rose 7.9 percent in 2021.

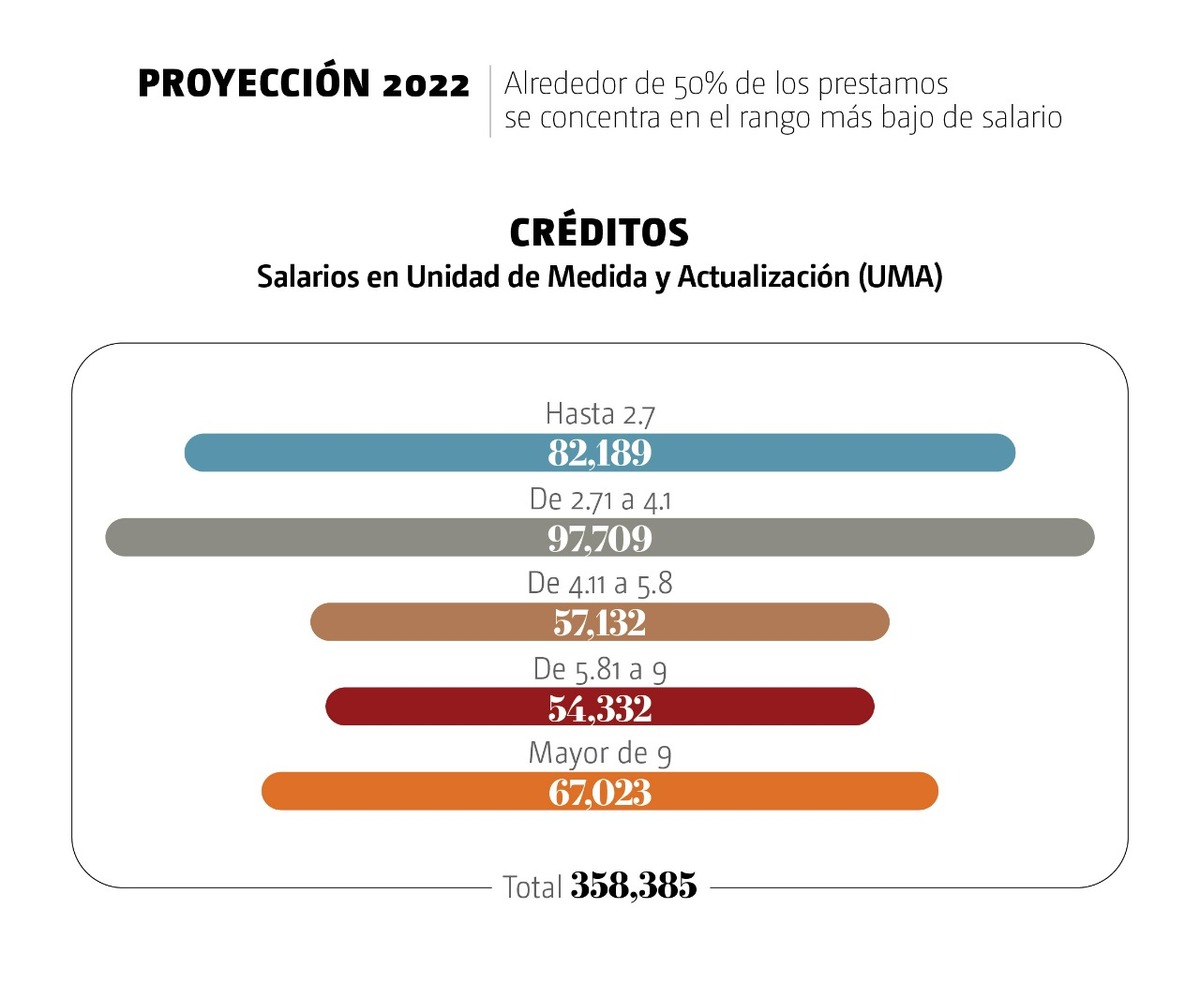

In this sense, according to Infonavit data, its projection for this year is that, of the 358 thousand 585 credits, 50 percent are for workers with lower salaries, that is, they have daily income of up to 394 pesos.

The interest rates that the institute manages this year start from 1.91 to 3.33 percent per year, adjusted to the lowest salary that can request a loan, which is 4 thousand 86 pesos each month. For a monthly payment that is greater than 16 thousand pesos, the annual interest amounts to 10.45 percent on the amount of the credit.

This body is not a bank, because as its name says, It was designed in 1972 as a fund that is responsible for collecting and managing employer contributions of each worker.

The fund is nourished by the contributions made by the employers, of 5 percent of the base salary of the contribution as established by law, but not all the money that enters the organization is used for this purpose, since it is also invested in different instruments to that I can grow.

AMP