Financial market ‘on thin ice’ amid political chaos

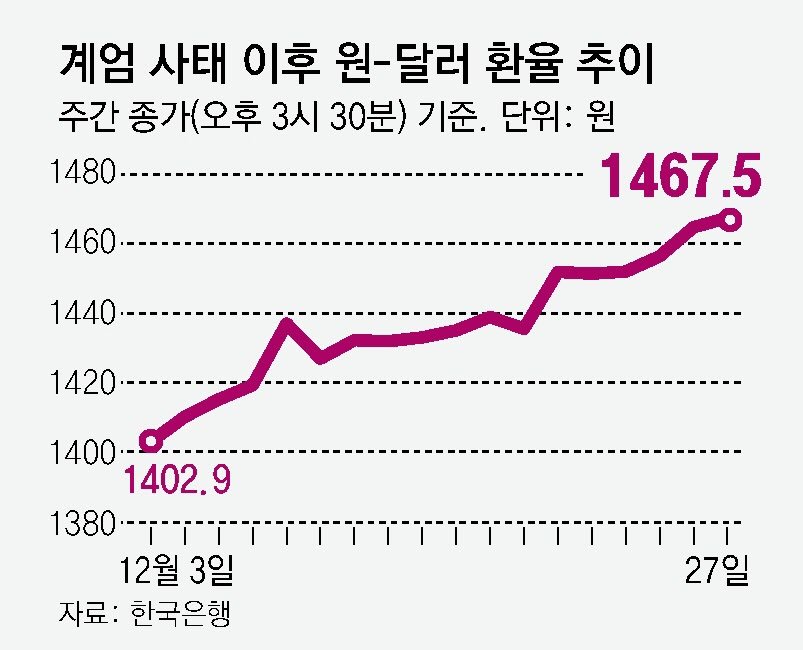

The won-dollar exchange rate, which has been rising rapidly since the ’12/3 martial law’, soared to the late 1,480 won range during the day due to the impeachment of Acting President Han Deok-soo. Based on the weekly closing price (3:30 p.m.), it rose by more than 10 won in two days. As political uncertainty grows, the foreign exchange market faces its worst situation since 2009, immediately after the global financial crisis.

On the 27th, the won-dollar exchange rate in the Seoul foreign exchange market closed weekly trading at 1,467.5 won, up 2.7 won from the previous day. The rise decreased significantly in the afternoon, but at one point during the morning it soared to 1,486.7 won. This is the first time since March 16, 2009 (1488.5 won) that the exchange rate was in the 1,480 won range based on the intraday high point. Starting on the 26th, when the opposition party decided to impeach Acting President Han, the weekly closing price jumped 11.1 won. In night trading after the impeachment was passed, the exchange rate once again exceeded 1,479 won, rising by more than 11 won from the weekly closing price.

As the exchange rate soared and the exodus of foreign investors continued, the KOSPI also fell below the 2,400 level during the day. On this day, KOSPI closed at 2,404.77, down 24.90 points (1.02%) from the previous trading day. In the morning when the exchange rate exceeded 1,480 won, it plummeted 1.7% during the day, reaching 2,388.33. As the exchange rate decreased, the KOSPI’s decline also decreased, but it was the first time in four trading days since the 20th that the KOSPI fell below the 2,400 level.

After martial law, the exchange rate surged by 80 won… There is also a prediction that “it will soon surpass 1,500 won”

[초유의 권한대행 탄핵] Exchange rate fluctuates, exceeding 1,480 won during the day

“Political uncertainty is increasing due to successive impeachments… “External credibility – a blow to overseas investment sentiment”

Exchange rate reaches new all-time high every day… If the exchange rate continues to be high, there are concerns about corporate bankruptcies.

Financial Supervisory Service holds market situation review meeting

The won-dollar exchange rate rose at a frightening pace, even exceeding 1,480 won during the day. Although the strong dollar phenomenon continues around the world, the value of the Korean won is taking a direct hit due to increasing domestic political uncertainty. As the impeachment bill was passed for President Yoon Seok-yeol and acting President Han Deok-soo, the possibility of prolonged political instability is increasing, and the forecast that the exchange rate will hit 1,500 won early next year at the latest is becoming a reality. There are concerns that a high exchange rate comparable to that of the past global financial crisis will further shrink the Korean economy.

● The exchange rate at the level of the financial crisis is likely to exceed 1,500 won by the end of the year.

According to the Bank of Korea on the 27th, the won-dollar exchange rate, which was 1,406.0 won as of the high point on the 3rd of this month when martial law was declared, soared to 1,486.7 won on that day and rose by more than 80 won on the 24th. After reversing the gains in the afternoon, weekly trading ended at 1,467.5 won, and some are interpreting in the market that there was intervention by the foreign exchange authorities in the market. After hitting the 1,450 won range on the 19th, it surpassed the 1,460 won range on the 26th, four trading days later, and a day later, it broke through to the 1,480 won range, hitting the highest level of the year every day. This is equivalent to the 1997 foreign exchange crisis and the 2009 financial crisis.

Many analyzes say that the sharp rise in the exchange rate on this day was mainly due to domestic political risks. Seo Jeong-hoon, senior research fellow at Hana Bank, said, “Until the 26th, external factors such as trade uncertainty due to U.S. President-elect Donald Trump and the U.S. Federal Reserve’s hawkish (preferring monetary tightening) interest rate cut stance also had a complex impact. “In this case, this day is strongly driven by Korea’s unique political risks,” he said. “Just the impeachment of one president creates significant political uncertainty, and the situation in which the acting president is also impeached is likely to increase Korea’s external credibility and the investment of foreign investors.” “It would have been a huge psychological blow,” he explained.

The prevailing view in the market is that it will inevitably surpass 1,500 won in the near future. Jeong Yong-taek, chief economist at IBK Investment & Securities, said, “The trading volume of most financial institutions, including foreign companies, is already low at the end of the year, so the exchange rate can fluctuate with even a small transaction. However, as anxiety over the impeachment situation grows, it is expected to rise sufficiently to 1,500 won by the end of this year or early next year. “It can be done,” he predicted. Seo Ji-yong, professor of business administration at Sangmyung University, also said, “The rate of exchange rate appreciation is accelerating due to political issues,” and added, “There is a possibility that it will hit 1,500 won by the end of the year.” Park Hyeong-joong, an economist at Woori Bank, said, “If political instability prolongs, household and corporate delinquency rates rise, and doubts about financial institutions’ loss absorption capacity and foreign currency liquidity increase, there is a risk that the won-dollar exchange rate of 1,500 won next year will become the new normal.” He advised.

● “If the high exchange rate continues for a long time, the number of bankrupt companies will increase.”

The problem is that the Korean economy currently lacks the power to withstand the current rapid rate of increase in the exchange rate. Growth is expected to be in the 1% range next year, and with both domestic demand and exports being sluggish, inflation pressure is increasing due to the high exchange rate. In addition, the ability to respond is weakened as active fiscal policies cannot be implemented due to a leadership vacuum. Moreover, some point out that the golden time to respond to the second-term Trump administration’s tariff bomb has already been missed. Kim Sang-bong, professor of economics at Hansung University, warned, “If the Korean economy is in a state of long-term low growth and is very vulnerable, and the exchange rate is maintained in the 1,500 won range, it could lead to a foreign currency debt crisis and put the economy at risk of being shattered.”

The possibility of companies going bankrupt was also raised. Economist Park said, “I have never experienced an exchange rate like the current one other than during the financial crisis.” He added, “If the exchange rate continues at the current level in a situation where domestic demand is deteriorating, quite a few companies, especially marginal companies and small and medium-sized enterprises, will go bankrupt within a month or two.” “A lot can happen,” he pointed out.

On this day, the Financial Supervisory Service held a financial situation review meeting presided over by Senior Vice-Director Lee Se-hoon to examine the recent surge in exchange rates and year-end financial market trends. The financial sector also had a busy day due to exchange rate fluctuations. Major financial groups have begun managing foreign currency liquidity and asset soundness by operating early warning systems such as capital adequacy and liquidity indicators.