The fashion sector continues to lead the revenue of Melisron malls, even if there has been a decrease in the proportion it occupies in the revenue mix. Reports from the Melisron Group, controlled by Liora Ofer, show that the fashion industry accounted for 46% of the revenues of the group’s malls, compared to 49% in 2021.

One of the trends that characterized the year 2022 as well as its predecessor is a demand from the fashion tenants to increase the commercial space of stores and the entry of international brands from the fashion and lifestyle field. In the case of Melisron Castro, she closed the store in the Ramat Aviv mall and so did Yanga, and in their place international sports brands such as Alo Yoga and Lulu Lemon entered the mall, and the Fox group opened the Ruby Bey youth brand store instead of Yanga. In the coming year, stores of the underwear brand Victoria’s Secret and the fashion brand Forever 21, which made a comeback to Israel, will also be opened in malls across the country, alongside branches of Sun Glass Hat glasses.

Also the entry of the food giants Carrefour, Saban Ilban and Sapar, at the same time as the stock chain developed by Harel Wiesel, Jumbo Evan, generate demand for extensive commercial areas.

1 Viewing the gallery

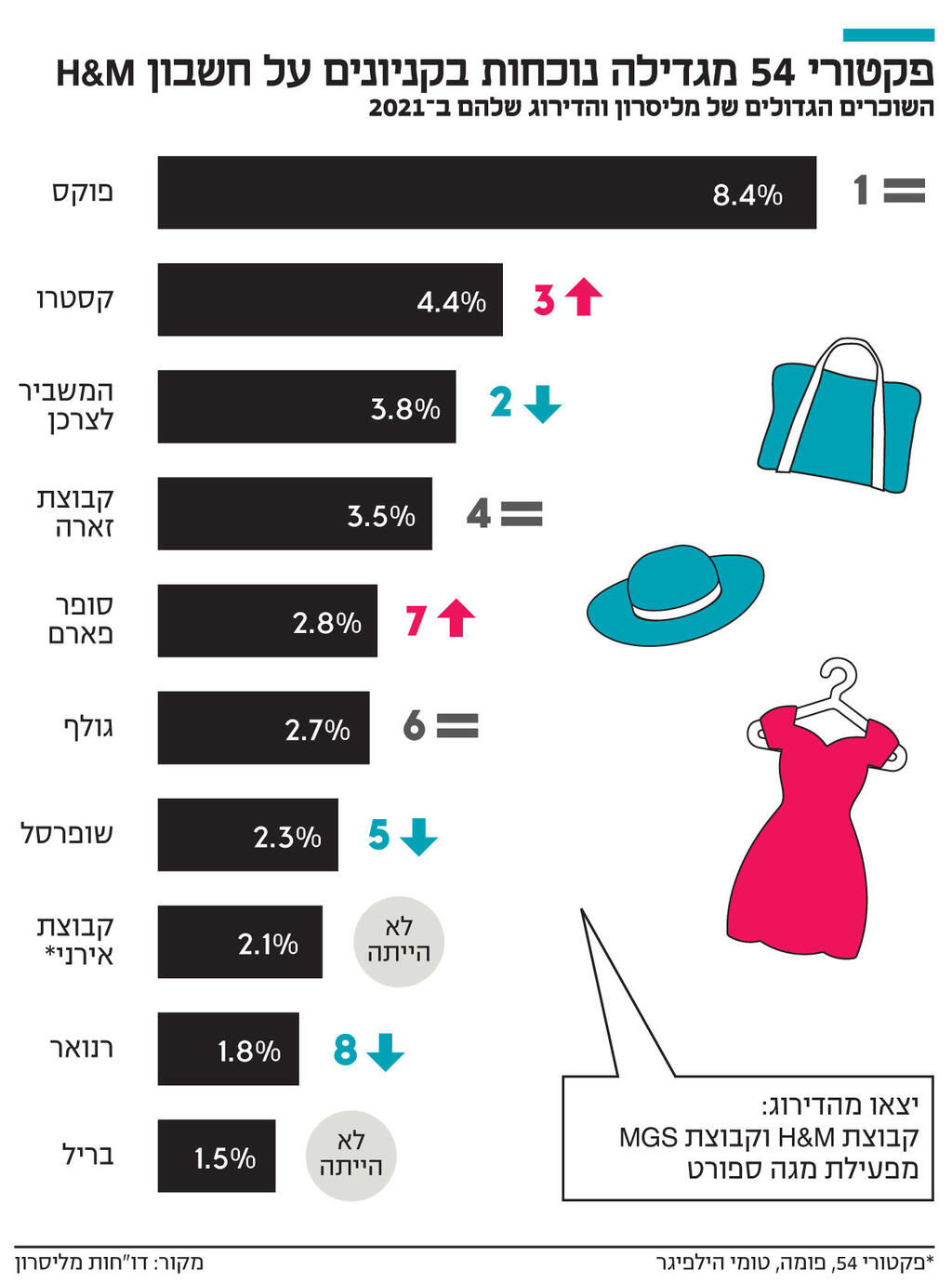

These expansion moves mainly characterize the large retail groups, led by the Fox Group, which increased its power as the largest tenant in Liora Ofer’s malls. The rent and management fees paid by the Fox Group to Melisron in 2022 accounted for 8.4% of all income from its tenants. Fox is the retail group with the largest number of chains in shopping malls, and operates Fox, Fox Home, Nike, Footlocker, LaLynn, Shilv, American Eagle, Mango, Children’s Place, Billabong, Saks, Ruby Bay, Flying Tiger, Sunglass Hat and Dream Sports .

In 2021, Fox’s rental fees accounted for 8.2% of the total rental and management fees paid by tenants in Melisron malls.

Fox’s power is also reflected in the gap in the amount of rent it pays to those of the other tenants. In second place is the Castro fashion group, which in 2021 was in third place. The rent paid by Castro to the real estate group was 4.4%, even though the group reduced some of its retail space, for example in the Ramat Aviv mall. In 2021, Castro’s rent was 3.8% of the total rent of Melisron malls. In 2022, Castro took the place of Mishbir To the consumer, which dropped to third place in Melisron’s ranking of the largest tenants, and the rents it paid to the group last year accounted for 3.8% of revenues compared to 4.8% in 2021.

The Inditex Group, which operates the Zara, Paul & Barr, Bershka, Stradivarius, Massimo Dutti and LEFTIS chains, maintains fourth place in the ranking, with rents accounting for 3.5% of the total revenue of Melisron malls. The rent paid by Super Pharm constitutes 2.8% of all revenues, compared to 2.6% in 2021, and it is placed in fifth place. It is followed by a golf group with 2.7% of revenues, compared to 3.2% in 2021, and Shufersel with 2.3% of revenues, compared to 3.2% in the year before it.

The MGS group (Mega Sport, Adidas, Skechers, JD and other chains) as well as the H&M group, which were ranked ninth and tenth in 2021, left the ranking of Melisron’s ten largest tenants. Their place was taken by the Irani Group, which owns the chains Factory 54, Puma, Tommy Hilfiger, Levi’s, Diesel, Original and Paul & Shark, which placed in eighth place with rents that make up 2.1% of all revenues, and Brill, which operates the chains Gali, Lee Cooper, Nine West , Timberland and Nautica, which is placed in tenth place with 1.5% of revenues. The Renoir Group fell in Melisron’s ranking from eighth to ninth, and its rents are 1.8% compared to 2.4% in 2021.

In the past year, the consumer goods sector accounted for 75% of the revenue mix in Melisron malls, a decrease of 2% compared to 2021, which was registered in favor of an increase in businesses from the healthcare and business services sector, which in the previous year made up 13% of the business mix in the malls. The field of leisure and experience accounted for 10%, unchanged from 2021.

The catering and cafe sector, which recorded a sharp recovery in redemptions from the beginning of 2022 compared to the year of the Corona virus, still constitutes 8% of the revenue mix of Melisron Malls. Private service providers make up 8%, clinics and pharmacies 6%, supermarkets 5%, department stores 4%, and movie theaters, which have not returned to pre-coronavirus activity, and gyms 1% each.

According to Melisron, two significant events are clouding the shopping mall industry: the rise in interest rates and the high inflation that increase the fear of a decline in private consumption; And returning the scope of international flights to the pre-corona period. In 2022, 8.4 million Israelis went abroad, and in 2019, 9.2 million Israelis went abroad. However, the prices of plane tickets have increased greatly, and most passengers prefer to travel with only a small suitcase. These patterns moderate shopping abroad and reduce the damage to commerce in Israel.