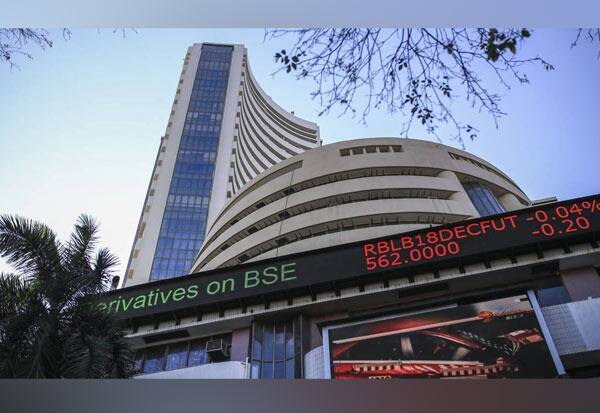

Indian stock markets had hit new all-time highs a few days ago. Already fears of an economic recession are looming around the world. Sensex fell by around 1,000 points today on fears of a new type of covid spread. Nifty also declined by 1.7%.

All the sector indices except the pharma index gained big gains today. Many domestic and foreign investors are already making good profits. Negative news like this makes them keen to take profits and cash out. Nifty Metals, Nifty Realty, Nifty Media and Nifty Public Sector Bank all fell by 4 percent today.

Covid

Despite fears of a global recession, the Indian stock market has been a hot spot for global investors. That’s why stock markets recently hit all-time highs. While some were predicting the Nifty to touch 19,000, economic watchers insisted on cautious stock selection.

That is what happened. The Nifty 50 index, which crossed the 18,000 mark for just a few days, fell to 17,800 today. One of the main reasons for this is the increase in the spread of Covid in the countries of the world. A recession is expected to occur in 2023 due to the next interest rate hike. If that happens, it will be detrimental to the stock market.

Not only the Indian stock markets but also the global stock markets are witnessing more profit booking than investment this week. US markets closed lower on Thursday. The Dow Jones retreated more than 1 percent. Meanwhile, the Nasdaq fell 2.18%. The S&P 500, the US stock market index of 500 companies, is on track for a 19.8% decline in 2022. This is the biggest decline since the 2008 financial crisis.

Also Asian stock indices Singapore Nifty, KOSPI, Taiwan Weighted and Nikkei 225 also traded down more than 1 percent. This trend was also reflected in Indian stocks.

Domestic investors invested Rs.3,398 crore

|

The information about the trade done by foreign investors (FIIs) and domestic institutional investors (TIIs) for Friday has been released. Domestic investors sold shares worth Rs 4,411 crore and bought new shares worth Rs 7,810 crore. Accordingly, the value of net purchased shares is Rs.3,398 crore.

FIIs have sold Rs 4,838 crore and invested Rs 4,131 crore. If you look at its net worth, they have sold it for Rs.706 crore. FIIs have been net buyers for the past one month.

Subscribe Dinamalar channel for new news