“`html

Is Your event Protected? The Evolving Landscape of Event Insurance in America

Table of Contents

Imagine pouring your heart and soul into planning the perfect outdoor music festival, only to have it washed away by a sudden, unexpected downpour. Or picture a political rally disrupted by unforeseen public disorder. these aren’t just hypothetical scenarios; thay’re the realities event organizers face in an increasingly unpredictable world. The question is: are you prepared? The event insurance market is experiencing notable growth as businesses and individuals recognize the importance of protecting their investments in events [[2]].

The Rising Tide of Cancellation and Curtailment Insurance

cancellation and curtailment insurance, once a niche product, is rapidly becoming a must-have for event organizers across the united States. This type of insurance covers unforeseen disruptions beyond organizers’ control, offering a financial safety net when the unexpected strikes. But whatS driving this surge in demand?

The Weather Factor: A Growing Threat

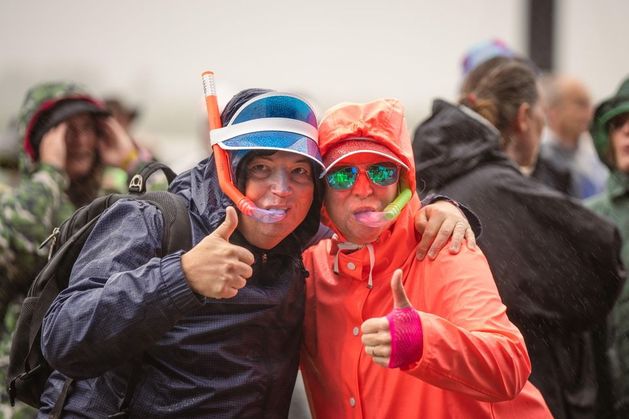

Severe weather events are becoming more frequent and intense, fueled by climate change. From scorching heatwaves in the Southwest to devastating hurricanes along the Gulf Coast and unexpected blizzards in the Northeast, the American landscape is increasingly vulnerable. Just ask the organizers of the “Forever Young” festival in Ireland, who had to temporarily exclude day-ticket holders due to severe rainfall [[Source Article]]. This is a cautionary tale for any outdoor event, anywhere.

Insurers are now placing a greater emphasis on how organizers address adverse weather conditions [[Source Article]]. This means having proactive measures in place, such as:

- Additional woodchip to manage muddy grounds.

- Trackway systems to ensure emergency vehicle access.

- Crowd-cooling measures like shaded areas or misting stations.

These aren’t just suggestions; they’re becoming expectations. Some local authorities are even setting cancellation and curtailment cover as a condition of event licensing [[Source Article]].Think of it as the new normal for event planning.

Beyond the Weather: Public Disorder and Evolving Risks

While weather remains a primary concern, the risks facing event organizers extend far beyond Mother Nature.Growing social and political polarization has led to an increase in public disorder, posing a significant threat to events of all kinds. Brady Insurance noted evolving risk concerns beyond the weather with growing interest in securing insurance cover for public disorder risks [[Source Article]].

Consider the potential for protests, demonstrations, or even acts of violence to disrupt an event. The financial consequences can be devastating, from lost revenue to property damage and potential liability claims. Event insurance can provide crucial protection against these risks, helping organizers navigate an increasingly volatile habitat.

The American Event Insurance Market: A Closer Look

The event insurance market in the United States is a dynamic and evolving landscape, shaped by a unique set of challenges and opportunities. Understanding the key players,trends,and regulations is crucial for event organizers seeking extensive protection.

Key Players in the US Market

Several major insurance companies offer event insurance policies in the United States, each with its own strengths and specializations. Some of the leading providers include:

- Travelers: A well-established insurer with a broad range of event insurance products.

- Allianz Global Assistance: Known for its expertise in travel and event-related insurance.

- The Hartford: Offers customized event insurance solutions for various types of events.

-

Time.news speaks with industry expert, Arthur Sterling, about the growing importance of event insurance in the face of increasing uncertainties.

Time.news: Arthur, thanks for joining us.The event insurance market seems to be booming. What’s driving this increased demand?

Arthur Sterling: It’s a pleasure to be here. You’re right, the event insurance market is experiencing significant growth. A major factor is the increasing awareness of potential risks associated with hosting events, as people are recognizing the importance of event insurance [[2]]. organizers are realizing that protecting their investments is paramount in today’s unpredictable climate.

Time.news: Cancellation and curtailment insurance is mentioned as a “must-have.” Why is this type of event insurance so crucial now?

Arthur Sterling: Cancellation and curtailment insurance provides a financial safety net when the unexpected happens: unforeseen disruptions, things beyond the organizer’s direct control. Given the rise in extreme whether events and other potential disruptions, it’s becoming indispensable for event organizers.

Time.news: Weather seems to be a major concern. How are changing weather patterns impacting the event insurance industry?

Arthur Sterling: Absolutely. Severe weather is undeniably a key driver. We’re seeing more frequent and intense events, from heatwaves to hurricanes and blizzards. These events can force cancellations or significant curtailments, leading to considerable financial losses. Organizers need to consider all the potential weather-related perils specific to their event’s location when selecting their insurance policies. Paying close attention to the specific weather-related perils covered is crucial. Policies should cover not only rain and snow but also extreme heat, wind, and other potential hazards relevant to your event’s location.

Time.news: What proactive measures are insurers looking for from event organizers to mitigate weather-related risks?

Arthur Sterling: Insurers are putting more emphasis on risk management. They want to see that organizers have taken steps to address adverse weather conditions. This includes things like providing extra woodchips to manage muddy grounds, using trackway systems for emergency vehicle access, and implementing crowd-cooling measures like shaded areas or misting stations.

Time.news: Are these just recommendations, or are they becoming requirements?

Arthur Sterling: They’re becoming expectations. Some local authorities are even making cancellation and curtailment cover a condition of event licensing. It’s the new normal for event planning, really.

Time.news: The article also mentions public disorder as a growing concern beyond weather. Can you elaborate on that?

Arthur Sterling: Yes, unfortunately, we’re seeing an increase in social and political polarization, which can lead to protests, demonstrations, and even acts of violence at events.These situations can result in significant financial losses due to lost revenue, property damage, and potential liability claims. It’s essential to consider this risk, as Brady Insurance also noted on the growing interest in securing insurance for public disorder risks.

Time.news: Are there event insurance policies specifically designed to cover public disorder?

Arthur Sterling: Yes, many policies now offer specific coverage for public disorder, including protection against property damage, bodily injury, and lost revenue resulting from protests or demonstrations. It’s worth exploring these options with your insurance provider.

Time.news: What key players should event organizers be aware of in the American event insurance market?

Arthur Sterling: There are several major players, each with their own strengths: Travelers, Allianz Global assistance, and The hartford are a few of the leading providers. It’s vital to research and compare their offerings to find the best fit for your specific event needs. it is also estimated that the Event Insurance market is estimated to reach $1,045.48 million in 2025 with a CAGR of 12.9% from 2025 to 2032 [[2]]

Time.news: Any final advice for event organizers navigating this evolving landscape?

Arthur Sterling: My advice is to be proactive. Don’t wait until the last minute to think about event insurance. Assess all potential risks specific to your event and location, and then work with a reputable insurance provider to create a thorough policy that meets your needs. understanding the evolving trends and regulations is also crucial for event organizers seeking comprehensive protection. Remember, investing in event insurance is an investment in the success and security of your event and can protect you for years to come.