4 View the gallery

Tel Aviv Stock Exchange, “The declines in the bond market will continue”

The decline in government bonds significantly hurts Israeli investors because they are known to be the solid component of the investment portfolio. The declines in the bond market since the beginning of the year have been sharper than those of some stock indices – Cut by tens of percent.

“Since the beginning of the year, there has been a decline in all bond channels – in the short and long term, in shekels and closely. In fact, the only place where the decline is found is in the index-linked bonds with a short-term price (bonds that are redeemed for up to two years; AA), “explains Eran Klinsky, VP of Investments at Moor Gamel. He said the sharp drop in government bonds was the result of a failed forecast that occurred last year in markets that believed inflation was at most temporary and stemmed from supply disruptions as a result of the corona. Therefore, central banks were in no hurry to raise interest rates.

“As the months have passed, it has become clear that this is rigid inflation, and the rise in prices will not decrease with the plague subsiding. Inflation in the US last year was 8% -7%, and it is increasing this year,” Klinsky adds. The central banks are being pressured by this – and now they are being forced to raise interest rates aggressively. “Klinsky notes that in markets outside the West, such as Poland and Romania, double-digit inflation and five-year government bonds are trading at up to 8%. To Israel (which is currently trading at just under 3%).

4 View the gallery

Surprisingly, some investment managers welcome the slump in the government bond market and see it as a “return to normalcy,” and those who did not understand that in recent years investors have behaved in a crooked environment will continue to suffer. Government has been an anomaly in recent years, and today we are anticipating a ‘normalization’ of yields. Interest rates have been nil for years, and central banks have bought bonds to push interest rates down in the markets. As a result, the 30-year interest rate was traded at a negative interest rate. Those who conducted the market understood that this was an abnormal and only temporary situation. “

He further notes that “the decrease in the value of the bonds is not specific to Israel but is a global process and it embodies an aggressive interest rate increase in the next year and a half. The beginning of this will be seen this week when the Bank of Israel and the Federal Reserve will probably raise interest rates by another 0.5%, and the process of raising interest rates will not stop there. This causes the yields on bonds to rise, both in the index and in those that do not. “

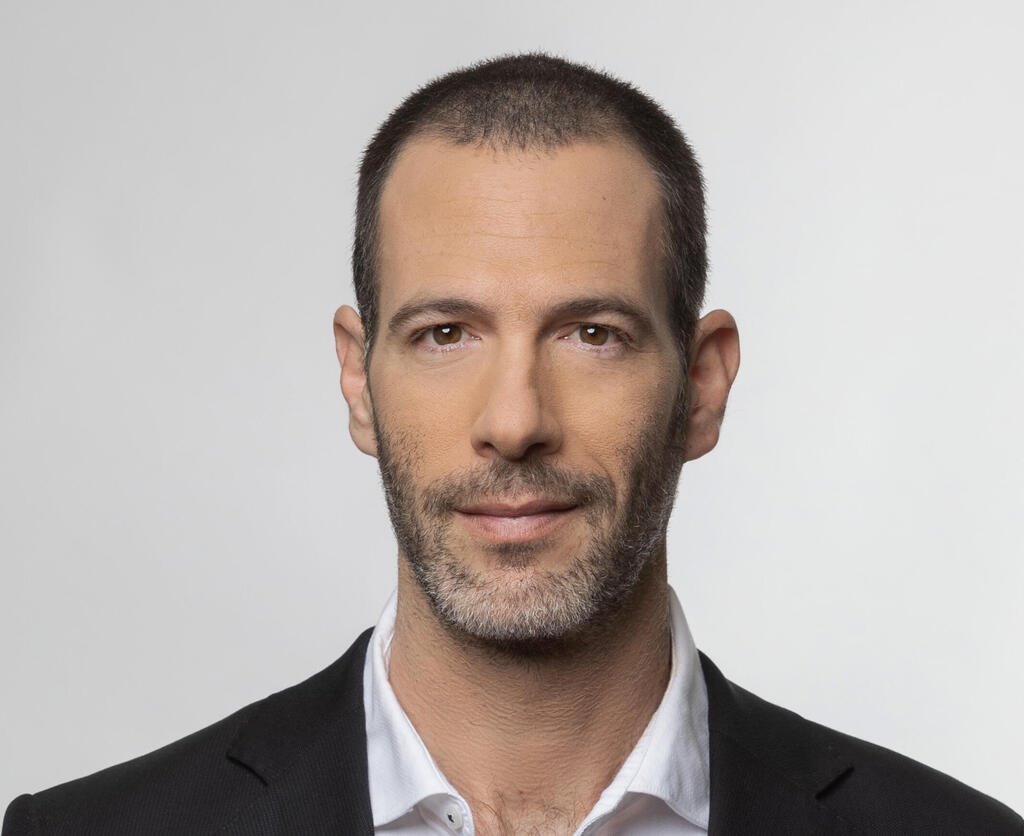

4 View the gallery

Erez Migdali, Director of the Migdal Investment Division

(Photo: Courtesy of Migdal)

Back to normalcy, or not, some executives state that this is a situation that has not been recorded in the markets for several decades. According to Erez Migdali, director of the investment division at Migdal Insurance, “The inflationary demon has come out of the bottle after 30 years, and now the market must find a new equilibrium. The pricing process will take a long time and the declines in bonds will continue. “Israel was in a delay with the United States, because inflation appeared later in the domestic market and at lower intensities. But in February-March, the Bank of Israel changed the disc (regarding its determination to fight price increases by raising interest rates; AA) and it has an effect.”

The recent decline in the Israeli bond market is indeed linked to changes in US interest rate expectations. If a few months ago the market thought that the Federal Reserve could stop at an interest rate of 2.75% to calm prices, today it is already targeting 3.5%. According to Towers, the change in U.S. bond prices indicates that the market has moved from fears of inflation only to a scenario in which the war on inflation will drag the U.S. into recession.

Erez Migdali, director of the investment division at Migdal Insurance: “The inflationary demon has come out of the bottle after 30 years, and now the market must find a new equilibrium. The declines in bonds will continue.”

According to him, the decline in the S&P 500 since the beginning of the year is two-thirds of the average decline in the stock market that is characterized by a recession. So in fact, the bond market and the stock market are currently experiencing the same scenario for the US economy – a recession scenario. However, in his view, in Israel there is still no certainty of entering a recession. “Israel has high exposure to high-tech, and the drop in technology stocks will affect some local industries, including real estate prices, and that will be challenging.”

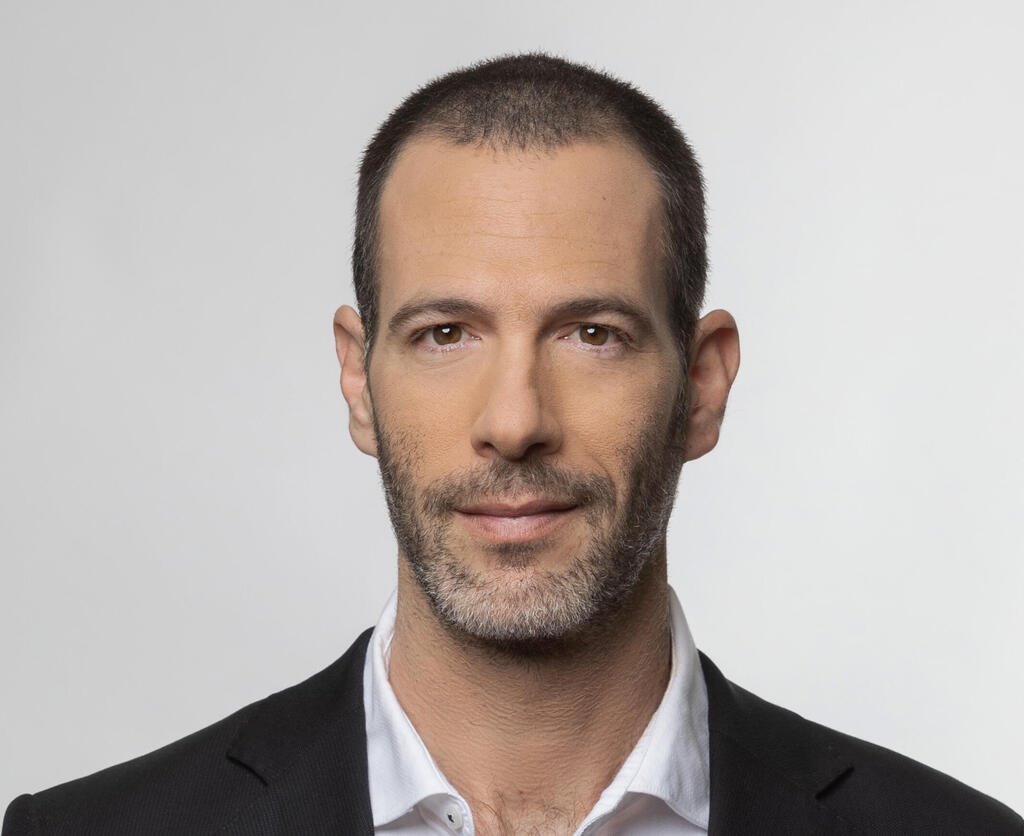

4 View the gallery

Eran Klinsky

(Photo: PR)

The declines in the bond market also have a significant effect on short-term savings. Provident funds, for example, are exposed to the government bond market by about 14%. Ironically, the exposure to bonds, which is considered a solid asset, increases as the saver gets older. Therefore, the declines in bonds can hurt savings close to retirement and annuity. According to Bansky, the declines in government bonds now have less effect on provident funds than in the past: The injury. “

Modi Shafrir, the chief strategist in Bank Hapoalim’s Chamber of Commerce, warns that while institutional portfolios have undergone adjustments, a recession could hurt all savings sectors: equities and corporate bonds. .