Pointing out the “mass production of moral hazard”

“We will accelerate the recovery of domestic demand.”

Deputy Prime Minister and Minister of Strategy and Finance Choi Sang-mok (second from the left) is giving a speech at the Economic Relations Ministerial Meeting and the 1st Investment Promotion Ministerial Meeting held at the Seoul Government Complex on the morning of the 2nd. Deputy Prime Minister Choi said, “We will further accelerate the recovery of domestic demand through ‘customized prescriptions for each sector.’” News 1

The government is promoting a plan to reduce the entire principal of vulnerable groups, such as recipients of basic livelihood security and people with severe disabilities, if their arrears are less than 5 million won. This is a measure to ease the burden on ordinary people who are suffering from high interest rates and high inflation.

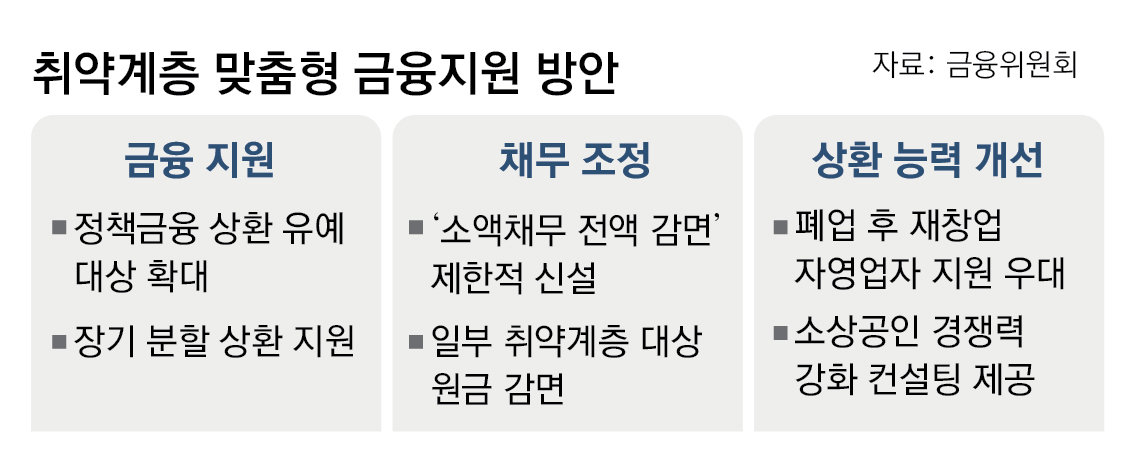

The Financial Services Commission announced a ‘plan to expand customized financial support for the common people and the self-employed’ containing these contents at the Economic Relations Ministerial Meeting on the 2nd. Considering that the living standards of ordinary people have not improved even after the end of the novel coronavirus infection (Corona 19), additional measures such as financial support and debt adjustment have been prepared.

In particular, if the principal amount of the debt is small, less than 5 million won, the entire principal amount will be reduced if the debt is not repaid even after the grace period (1 year). The current system provides a reduction of up to 90% of the principal, but a more drastic support measure has been introduced. It has been about six years since November 2017, during the Moon Jae-in administration, that a measure to write off 100% of the principal was introduced at the government level.

Some are concerned that this government policy could create ‘moral hazard’, in which people borrow money and do not repay it, even though they have the ability to repay. Regarding this, Kim Jin-hong, Director of the Financial Consumer Bureau of the Financial Services Commission, explained, “Debt exemption for small debtors will be limited and subject to external expert review and financial institution consent.”

On this day, the government also announced a ‘construction cost stabilization plan’ that includes easing regulations on importing cement and extracting natural aggregates from overseas, including China. The purpose is to minimize upward pressure on construction costs by stabilizing the prices of cement and aggregates, which account for half of the cost of ready-mix concrete, which are major construction materials.

Debt reduction for vulnerable groups, additional supply of KRW 11 trillion to small business owners… Benefits for 80,000 people per year

Customized financial support for ordinary people and self-employed people

Support for ‘digital transformation’ for self-employed business owners

Mid-term temporary investment tax credit extended by 1 year

Exports are booming, but domestic demand is not picking up and the financial situation of the common people is worsening day by day, so the government has come up with countermeasures, including a ‘full reduction of small debt’ card. The idea is to give the underprivileged some breathing room by canceling their debts, and encourage investment by providing tax benefits to small and medium-sized businesses.

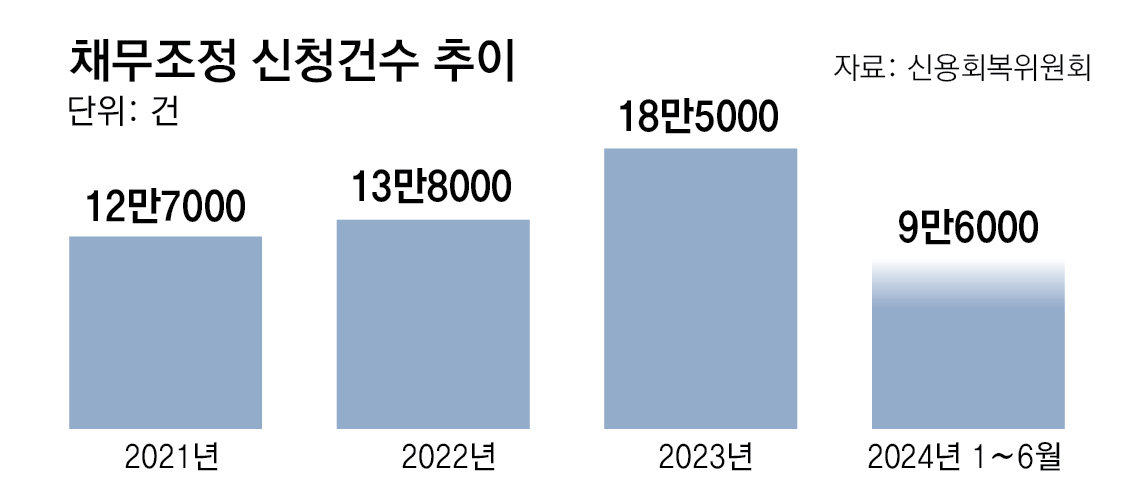

According to the Credit Recovery Committee, the number of debt restructuring applications in the first half of this year (January to June) was 96,000, and if the current trend continues, it follows the numbers in 2004 (287,000) and 2005 (194,000) right after the credit card insolvency incident. It is expected to reach the highest level in about 20 years. This means that there are many ordinary people who have given up on repaying their debt and are pushed to the limit.

Accordingly, the government decided to undertake drastic debt adjustment for recipients of basic livelihood security, severely disabled people, and senior citizens over 70 years of age. So far, support has been provided in the form of reducing the interest burden for borrowers with less than 30 days of delinquency, and the principal is reduced by up to 15% to help them recover quickly. In addition, if basic beneficiaries and severely disabled people who have been delinquent for more than one year cannot repay debts of 5 million won or less even after deferring repayment for one year, the entire principal amount will be reduced. Although concerns were raised about moral hazard, a high-ranking official from the financial authorities explained, “We took into account the fact that vulnerable groups often suffer from long-term collection activities.”

The scope of repayment deferment for policy finance will be expanded and a long-term installment repayment program will also be introduced. Currently, if a policy finance user applies for a repayment deferral for reasons such as unemployment or business closure, repayment deferral is supported for up to one year. However, starting this month, vulnerable groups who have the ability to repay but are temporarily in difficulty can also receive support for deferring repayment.

A support plan has also been prepared for the self-employed and small business owners experiencing financial difficulties. It was planned to provide 41.2 trillion won in support through a customized financial support program for the self-employed announced in July 2022, but as demand continues, an additional 11.1 trillion won in liquidity will be provided by the end of the year. We have decided to provide preferential financial support, including interest rates and guarantee rates, to self-employed people who re-start a business after closing their business, and we also plan to provide customized consulting to strengthen the competitiveness of self-employed people. In particular, a significant portion of the new budget was allocated to helping self-employed people achieve ‘digital transformation’ such as online ordering and delivery systems and smart stores.

The government expects that close to 80,000 ordinary people and self-employed people will benefit annually from this support plan, including 73,000 people per year through financial support and 5,500 people per year through debt restructuring.

In addition, several measures were put forward to restore consumption. First, starting in November, subsidies for the purchase of electric vehicles for households with multiple children will be increased, giving 1 million won and 2 million won to households with two and three children, respectively, and 3 million won to those with four or more children. It was also decided to revise the value of agricultural and marine product gifts that public officials, etc. can give and receive to ‘always 300,000 won’. Currently, it is 150,000 won during normal times and 300,000 won during holidays.

To increase investment by small and medium-sized companies, the temporary investment tax credit will also be extended for an additional year until next year. The temporary investment tax credit is a system that provides an additional tax credit of up to 10% for the investment amount exceeding the average investment amount over the previous three years.

In response to today’s measures, some voiced concerns about the side effects of the full principal reduction. Kim Sang-bong, professor of economics at Hansung University, said, “A blanket reduction of the entire amount of small debt will inevitably lead to a moral hazard problem.” He added, “There is a need to support a detailed approach by differentiating the reduction rate considering the use of the loan by vulnerable groups. “I can see it,” he pointed out.

Reporter Kang Woo-seok [email protected]

Reporter Kim Ho-kyung [email protected]

Sejong = Reporter Lee Ho [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-10-03 23:12:15