[美대선 불확실성 커진 韓기업]

Whoever wins, strengthening ‘America First’

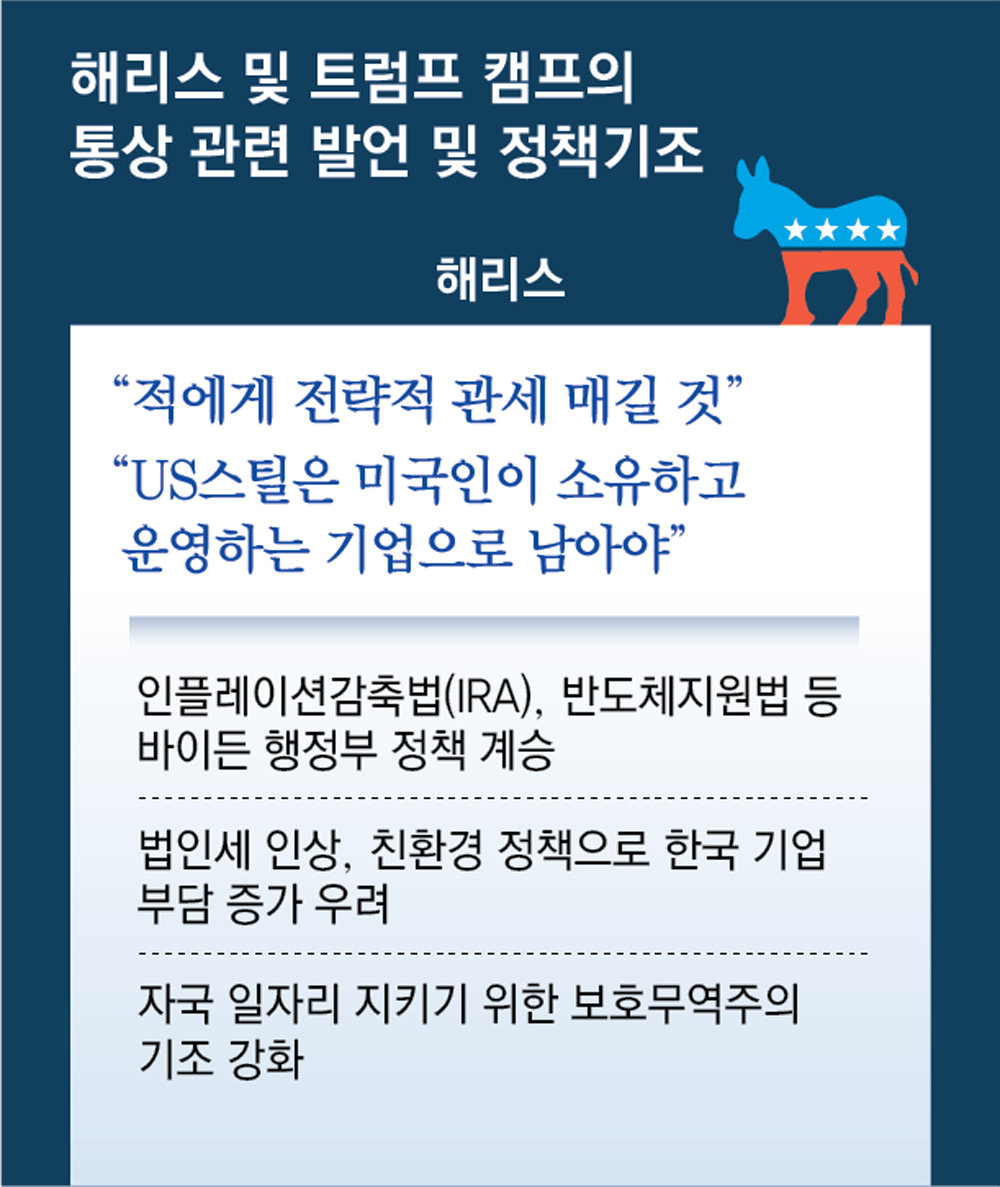

Trump, Automobile-Steel Trade Pressure Likely to Increase… Republicans Announce Retaliatory Tariffs on Trade Surplus

Harris, Corporate Tax Increase-Environmental Burden… Democratic Party Emphasizes ‘Buy American’ Policy

“Policy uncertainty is the biggest risk”

“I will impose a 10% universal tariff on all American imports.” (Republican presidential candidate Donald Trump)

“We will create the strongest ‘Buy American’ policy in decades.” (Democratic Party Platform)

Regardless of whether Trump or Democratic presidential candidate Kamala Harris wins the US presidential election in November, the next US administration’s foreign trade policy is expected to strengthen the current America First policy. As the political landscape in the US changes, uncertainty in the economic and trade sectors between Korea and the US is also increasing.

● “Trump may demand revision of Korea-US FTA”

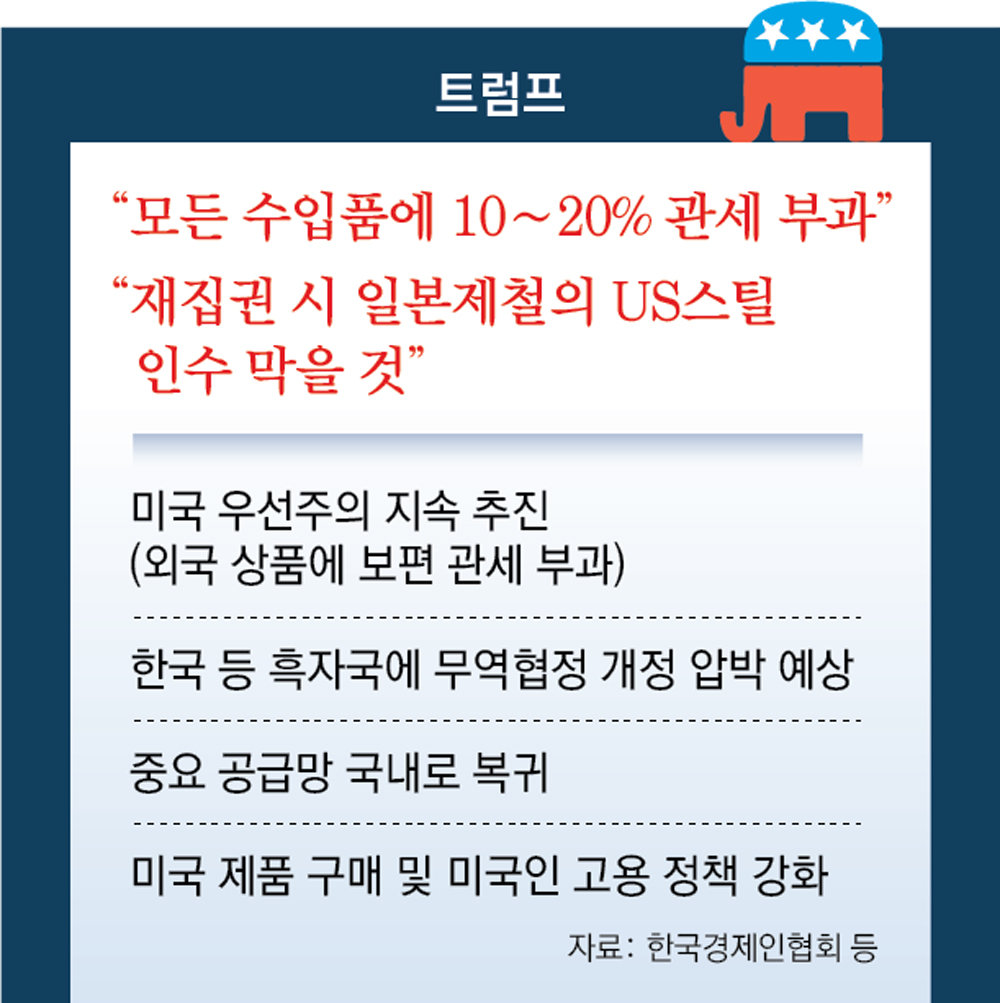

Candidate Trump made clear his America First policy in the trade sector through the Republican Party platform announced in July. In particular, he repeatedly stated his intention to impose a 10% “universal basic tariff” on all foreign products if he is re-elected. The Republican Party also nailed down the imposition of retaliatory tariffs based on the size of the trade surplus as a party policy in the platform. Accordingly, there is speculation that he may pursue revision of trade agreements with countries with a trade surplus with the US, including Korea.

Domestic experts point out the uncertainty about what cards Trump will actually play if he is re-elected as the biggest risk. Former Trade Negotiation Chief Yeo Han-koo said, “Trump’s universal tariff is an issue we must take seriously, but it is unclear how it will actually be used due to concerns about rising prices,” and “Ultimately, it can be used freely in the way the U.S. wants.” Professor Heo Yoon of Sogang University’s Graduate School of International Studies also diagnosed, “While the U.S. is clearly determined not to run a deficit while pursuing a resulting balance in trade, the fact that it is not considering its allies makes it difficult to predict what policies it will implement toward Korea.”

● Harris’s trade policy evaluated as “more radical than Biden’s”

The Democratic Party clearly stated in its platform announced last month that it intends to create good jobs through “Buy American.” The Democratic Party pointed out that “for too long, America’s trade policy has been to send middle-class jobs overseas and undermine our supply chains.” In addition, candidate Harris said she would raise the corporate tax rate from the current 21% to 28%. Since the US corporate tax is levied equally on foreign corporations, if this becomes a reality, it could also increase the burden on Korean companies. Kang In-soo, a professor of economics at Sookmyung Women’s University, said, “The biggest risk is that it is unclear how the Biden administration’s policy direction will be inherited.”

Experts also pointed out that policy uncertainty could be greater than expected, considering that candidate Harris is younger and more radical than President Joe Biden. Ahn Hye-young, a researcher at Hana Financial Management Research Institute, expressed concern, saying, “The Biden administration is attracting investment from Korean companies through the Inflation Reduction Act (IRA), but in the long term, if they fail to separate their supply chains from China, they could end up not receiving the promised subsidies.”

● “We must prepare to attack the trade surplus and respond to environmental issues”

First of all, there is speculation that responding to the trade surplus problem in traditional American industries including automobiles and expanding the use of eco-friendly energy could be important tasks. Kim Tae-hwang, a professor of international trade at Myongji University, said, “If Trump takes office, the industries that will be most worrisome are automobiles, steel, and petrochemicals,” and “He could attack Korea’s trade surplus by highlighting the fact that Hyundai Motors is increasing its sales in the United States, but American cars are not sold in Korea.” As the issue of U.S. Steel being acquired by a Japanese company has emerged as an election issue, there is a high possibility that steel exports will also be regulated by raising the issue of indirect exports of Chinese products.

“If Harris wins, the Democratic Party is likely to use environmental and climate change issues more strongly,” said former Chief of Staff Yeo. “A U.S. version of the Carbon Border Adjustment Mechanism (CBAM) that the European Union (EU) is already implementing could be implemented.” The idea is that the U.S. could introduce a system that measures the amount of carbon generated during the production process and imposes taxes on it, thereby increasing the price competitiveness of U.S. companies while also securing taxes.

Sejong = Reporter Kim Do-hyung [email protected]

Sejong = Reporter Sosulhee [email protected]

Reporter Lee Ho [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-05 21:07:35