The era of great inheritance with increasing deaths

Parents’ house remains a liability, not an asset

Old houses are not selling and only taxes are being paid

Inheritance renunciation on the rise, empty houses on the rise

‘National ownership’ skyrockets as no one inherits

“Where there is reward…” Legacy donations also↑

As the number of deaths increases in Japan, a super-aging society, the term “high-death society” is becoming popular. The number of deaths, which was an average of 1.3 million per year, increased to 1.57 million last year, and it is expected to peak at 1.67 million to 1.68 million in 2040. Even now, it is becoming common to wait one to two weeks for a funeral due to the lack of crematoriums.

Naturally, as the number of deaths increased, so did the number of inheritances. In particular, the expression “the era of great inheritance” has begun, in which an inheritance of about 50 trillion yen (about 460 trillion won) is inherited annually due to the deaths of elderly people who accumulated wealth during the period of high economic growth.

However, from the perspective of the inheritor, real estate assets are increasingly operating in the red, leading to disputes between surviving family members. This is because house prices are falling and they are not being sold. In fact, the number of consultations related to inheritance at Japanese family courts has doubled to about 180,000 cases per year compared to 10 years ago.

An era where inheritance leads to debt

The emergence of baby boomers after the end of war is a common phenomenon worldwide. In Japan, the Dankai generation (born 1947-1949), of which more than 8 million were born over a three-year period, is a typical example. Although this is a compressed period compared to the baby boomers in the United States (born 1946-1965) or Korea (born 1955-1974), it is considered a symbolic group that reflects the times in Japan.

They accumulated wealth by spending their 20s and 30s during the period of rapid economic growth and their 40s during the bubble economy. They also created a second baby boom by giving birth to the Dankai Junior Generation (born between 1970 and 1974).

![“I don’t want to inherit the house” In the era of great inheritance, inheritance disputes in Japan are… [서영아의 100세 카페] “I don’t want to inherit the house” In the era of great inheritance, inheritance disputes in Japan are… [서영아의 100세 카페]](https://dimg.donga.com/wps/NEWS/IMAGE/2024/08/23/126662254.1.jpg)

According to the 2023 edition of Japan’s Aging Society White Paper, the home ownership rate among seniors aged 65 and over reached 87.4% in 2021. 75.6% owned single-family homes, and 11.8% owned condominiums.

By 2030, the Dankai generation will all be over 80 years old, and the Dankai Juniors will be in their 60s. This is a structure that will inevitably lead to inheritance for millions of households in the future. The Japanese media is calling this the “inheritance of despair.”

The biggest reason is the downward trend in real estate prices. Excluding some large cities such as Tokyo and Osaka, real estate prices in Japan are generally falling. The population began to decline after peaking in 2008, but new houses are continuously being supplied, resulting in a mismatch of oversupply. In addition, millions of old houses where Dankai generations lived will be left behind as they die.

The vicious cycle of negative assets

Once population decline begins, the social infrastructure becomes outdated and industries decline. Young people leave and redevelopment stops. As a result, real estate prices fall again, creating a vicious cycle.

Even if you inherit a single-family home from your parents, many of your children, who are already in their 60s, own a home in an urban area. If it is located far from their residence, it is not easy to manage. Nevertheless, you have to pay property taxes and maintenance fees every year, and you have to take responsibility for safety management such as collapse and fire. If you neglect the building, it will deteriorate rapidly, making it difficult to rent it out to others or sell it.

So if you inherited it, you should sell it as soon as possible, and if that is difficult, you should demolish it. The problem is that in Japan, houses built more than a few decades ago are rarely sold. However, if you try to demolish the house, it will cost millions of yen and increase the tax burden.

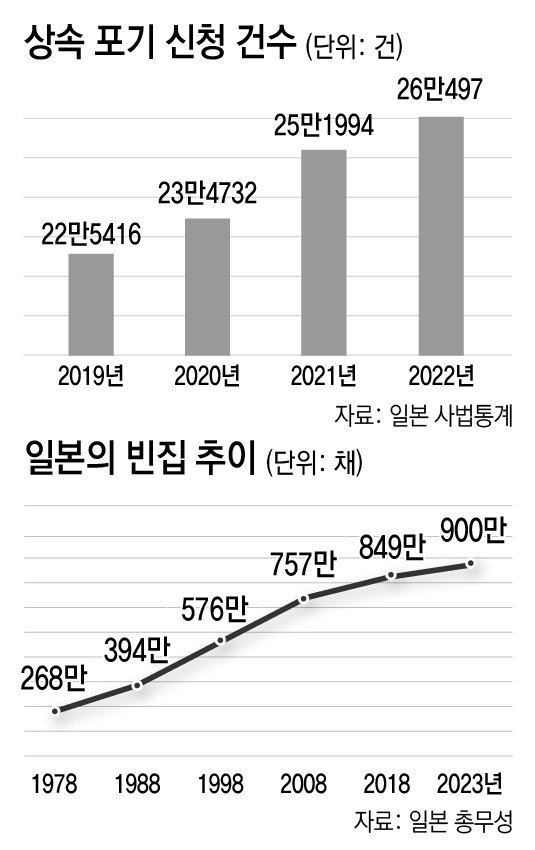

This is the reason why the number of abandoned houses is increasing throughout Japan. As of 2023, there will be 9 million vacant houses nationwide. The government is also struggling to come up with measures for abandoned houses and land. The Japanese government has been enforcing the ‘Vacant House Countermeasures Special Measures Act’ since 2015.

The gist is that if a house is originally built on land, only one-sixth of the vacant lot is taxed, but if the local government designates it as a “specific vacant house requiring management,” it will be taxed as if it were an vacant lot. This is the pressure to properly manage it or demolish it.

The problem of empty houses is not limited to single-family homes. The same applies to apartments called “sale mansions” in Japan. “Limited mansions” built during the period of high economic growth and over 50 years old are appearing in urban areas. There are also quite a few empty houses around new towns that are an hour’s commute from the city center.

Inheritance renunciation on the rise, empty houses on the rise

That is why the number of people who choose to renounce their inheritance is increasing. According to judicial statistics, the number of cases of renunciation of inheritance in Japan increased from 225,000 in 2019 to 260,000 in 2022. Renunciation of inheritance requires giving up not only real estate but also other assets such as cash and insurance money, but this number is increasing every year.

As the number of cases of loss due to real estate inheritance increases, there is concern about fights between family members trying to pass on unnecessary assets to each other. If all the surviving family members say, “I will accept the savings, but I do not need the house,” it could become a mud fight that goes beyond fighting over who gets what.

As inheritance renunciation and transfers continue, the number of troublesome real estate properties that have become ‘unknown owners’ is increasing nationwide. These properties are called ‘dead properties’ because they have reached a point where neither the administrative agency nor the family can touch them. For example, there are buildings that have been left in ruins for over 100 years without being registered, but legally no one can touch them. Cases like this are frequently reported in the Japanese media.

When cognitive impairment (dementia) occurs, assets are locked up

There is a hidden disease called cognitive impairment (dementia) that comes to the elderly as an additional burden. According to Sumitomo Mitsui Trust Bank in 2022, the total assets held by elderly people with cognitive impairment in Japan were approximately 250 trillion yen (approximately 2,300 trillion won) in 2020, and are expected to reach 345 trillion yen by 2040. During the same period, real estate is expected to increase from 80 trillion yen to 108 trillion yen.

‘Homes of parents with dementia’ is a major theme in weekly magazines and books in Japan. When elderly parents develop dementia, they are admitted to nursing homes as a natural procedure. After that, the homes they used to live in naturally become empty. According to estimates by the Dai-ichi Life Insurance Economic Research Institute in Japan, the number of homes of elderly people with dementia left in this way is approximately 2.21 million as of 2021, and it is expected to increase to 2.8 million by 2040, but legally, no one can do anything about it.

In Japan, dementia patients cannot engage in business transactions or legal acts. In order to protect the property of the increasing number of dementia patients, the Japanese government revised the Civil Code in 2020, stating that “legal acts are invalid when the person lacks the capacity to make decisions.” This means that even if a real estate purchase contract is made with a dementia patient, the contract becomes invalid if it is discovered that the person has dementia.

It is also difficult for family members to sell on behalf of the person. Even if the person agrees, real estate companies or administrative agencies will not accept a diagnosis of dementia. The Prevention of Crime Proceeds Transfer Act of 2008 was also implemented, so identity verification and medical confirmation are strictly enforced when selling real estate.

There are many cases where the bank accounts of elderly people diagnosed with dementia are frozen. In such cases, poor children end up paying for nursing homes or nursing care for their wealthy parents. Financial institutions recommend that a voluntary guardian or family trust be established before dementia is diagnosed.

One method that can be taken after receiving a dementia diagnosis is the legal guardian system appointed by the family court, but you must pay a monthly fee and be cared for by another person.

“Where there is rewarding work…” Donation wills increase

The amount of inherited property that was turned over to the national treasury due to the absence of anyone to inherit, such as children or parents, also reached an all-time high of 76.8 billion yen (approximately 700 billion won) as of 2022. This has more than doubled in the past nine years.

Meanwhile, the number of ‘legacy donations’, in which assets are transferred to non-profit organizations (NPOs) that do social contribution activities rather than to one’s family after death, is also increasing. NHK reported in February that the total amount of legacy donations had increased to nearly 40 billion yen per year. These donations are used for relief efforts for the Noto Peninsula earthquake that occurred last year and for research on incurable diseases.

According to reports, the background to the activation of legacy donations is the change in family structure, such as single-person households or those without children, and the change in family values, which means that the family does not necessarily have to receive the deceased’s property.

A typical example is a woman in her 80s who has no children or family. She left a will stating that she would donate all of her inheritance, including her home, to an organization that provides educational support to developing countries, saying, “I don’t want the government to take the money I left behind.”

The grandmother in her 70s, who had been a housewife her entire life, was introduced as feeling proud after writing a will to donate 300,000 yen of her savings to a children’s restaurant for undernourished children in the neighborhood at her son’s recommendation.

Reporter Seo Young-ah [email protected]

2024-08-23 21:04:35