In recent years insurance companies have had to adapt to a world where interest rates are nil. Such a low interest rate hurts insurance companies in two ways: First, it obliges them to increase cash reserves, given the risk of future customer claims as a result of changes in capitalization. That is, if at a risk-free interest rate of 4% in the economy for each insured, an insurance company should confine NIS 1 million for 18 years, at 0% interest it should confine NIS 2 million, since the million shekels the company was supposed to receive over the years as a result of interest in the economy no longer exist. The increase in reserves is recorded as a loss in the financial statements of the insurance companies and is reflected mainly in compulsory, health and liability insurance. Of customers.

Read more in Calcalist:

Due to this, and against the background of the companies’ complaints, this week the Commissioner of the Capital Market, Moshe Barkat, announced that the Authority is changing the interest rate at which they should take into account the balance sheets for all insurance businesses: general, life, nursing and health.

Although the commissioner did not touch on the risk-free interest rate, he did change the liquidity premium that the companies take into account. The premium is a kind of supplement to the interest rate used in the economy, charged by the insurance companies for the supply of capital for debt assets and non-marketable investments, and it will now change from 0.26% to 0.54%. That is, if the risk-free bonds, ie the CPI-linked ten-year government bonds, bear a yield of 0.1%, together with the previous risk premium, the discount rate was 0.36%. The interest rate is now rising to 0.64%.

The rationale for this lies in the fact that in many cases non-marketable assets yield high returns, but due to the inability to realize them quickly, an accounting reduction is required for them. Raising the liquidity premium compensates insurance companies for this and should allow them to more reliably reflect the capitalization of the asset portfolio.

In recent years, in order to reduce the impact of zero interest rates on bond prices, insurance companies have increased their holdings in non-marketable assets. In the coming year, Migdal Insurance will increase its holdings in non-marketable investments from 8% to 14%, Harel will increase from 9% to 14%, Clal will increase from 8 % To 10%, a lamp from 9% to 10% and the Phoenix from 4% to 5%.

4 View the gallery

In view of the continuing damage to the assets of the insurance companies following the zero interest rate, the insurance companies approached the Capital Market Authority and asked it to change the registration laws in the financial statements.

According to a senior insurance company official, “This is a directive from the Ministry of Finance from a decade and a half ago. Which the same companies hold, and therefore the conflicting effects almost eliminate the effect of lowering the interest rate on the companies’ assets. “So today the changes in quarterly liabilities in Israel are immeasurably higher than those in Europe.”

“The power of insurance companies stems from the fact that they can provide huge amounts of assets for decades, without demanding them back. They are supposed to charge a premium for this service – and the Capital Market Authority is aware of this and encourages it. The premium rate once again, “the senior explains.

4 View the gallery

Eyal Ben Simon, CEO of Phoenix; Yehuda Ben Asaig, CEO of Menora Mivtachim; And Yoram Naveh, CEO of Clal Insurance

(Photos: Fabian Koldorf, Amit Shaal, Sivan Faraj, Yonatan Blum, Vardi Kahana)

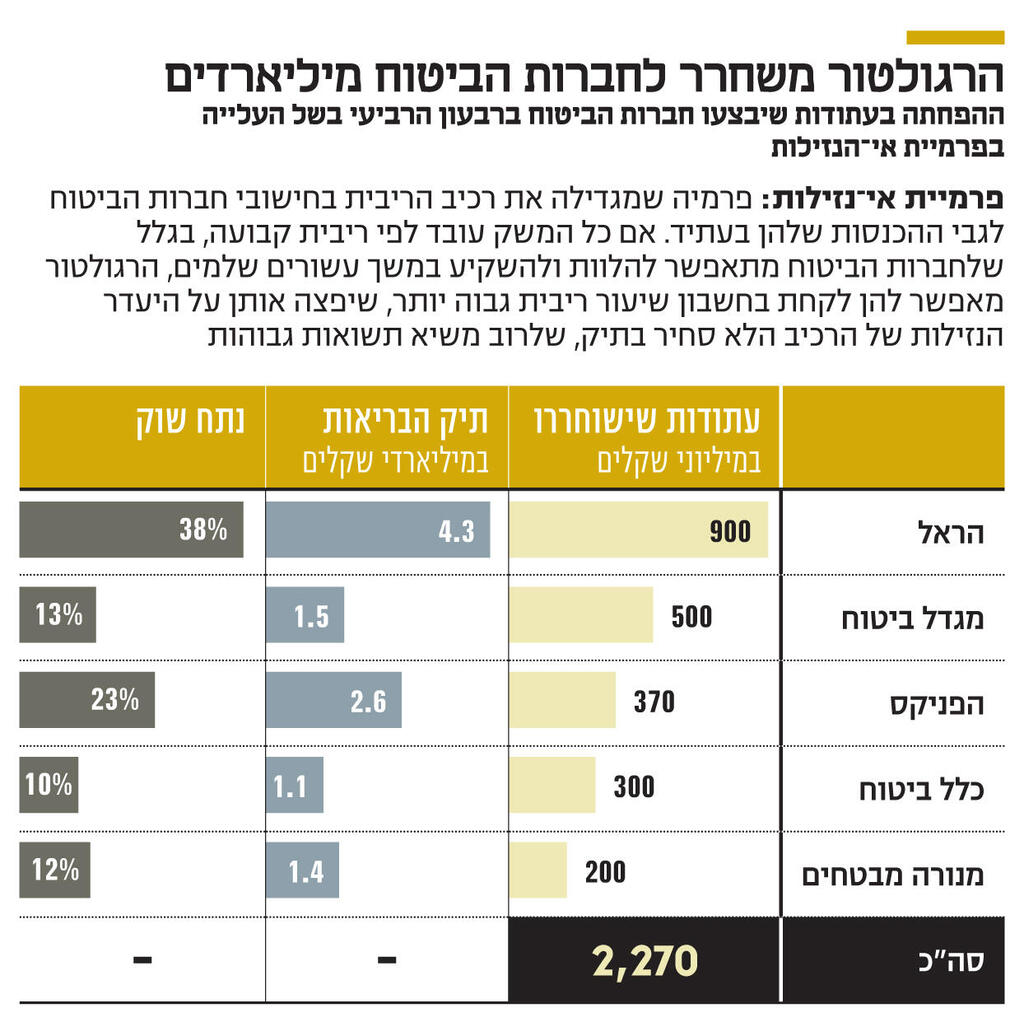

Barkat’s decision allows insurance companies to release billions of shekels that have fascinated them following the zero interest rate. According to reports from the insurance companies, Harel will release NIS 900 million, Migdal will release NIS 500 million, the Phoenix NIS 370 million, Clal NIS 300 million and Menora Mivtachim NIS 200 million. The differences in reserves are due to the exposure that each company has in assets such as health insurance and compulsory insurance. Harel is the insurance company with the largest health portfolio in Israel (about 30% of the industry) and therefore receives the most substantial relief.

“This is another step of relief for insurance companies in recent years,” an insurance analyst explained to Calcalist. “Regulation in the insurance industry ‘copied’ European regulation, after the crisis that occurred in 2008 but it copied it with errors. Therefore, in recent years Barkat has taken several decisions of a similar nature, which make it easier for insurance companies, including easing equity requirements. Solvency machines. ”

Barkat’s relief is done at the necessary timing for the insurance companies. In the fourth quarter of 2021, there was a decrease in the risk-free interest rate from 1.39% to 1.2%, a decrease that would have forced insurance companies to re-increase their reserves. According to investor insurance company announcements, the impact of the decline has been almost entirely offset by the change introduced by Barkat.

4 View the gallery

Sagi Yogev, CEO of Migdal; and Nir Cohen, CEO of Harel

(Photos: Fabian Koldorf, Amit Shaal, Sivan Faraj, Yonatan Blum, Vardi Kahana)

Now, insurance industry executives explain that this is a double profit for insurance companies. This is because the risk-free interest rate also rose in December and January, against the background of expectations of an imminent interest rate hike in the United States. The rise in interest rates that will occur this year in the United States and beyond, probably also in Israel, will allow insurance companies to release additional reserves.

4 View the gallery

Moshe Barkat

(Photo: Amit Shaal)