2024-09-17 07:35:27

Financiers expect banks to refuse 1/2 of the applicants for mortgage loans

You want a BGN 200,000 mortgage loan with a repayment period of 30 years at an interest rate of 2.89%. The monthly contribution is then BGN 830, which means that candidates with an income of at least BGN 1,800 have a chance to consider applications. However, this is the first step, as they may not receive it if the property offered as a pledge does not received an assessment of at least BGN 170,000 and the applicant does not have BGN 30,000 of own funds.

“24 Chasa” chose the amount of BGN 200,000 provided by a bank as an example, because it is currently difficult to buy a home in the big cities of Bulgaria for less.

The new BNB rules for mortgages come into force next month. According to them, banks can lend up to 85% of the valuation of the purchased property, the term of the loan cannot be more than 30 years, and the monthly installment must be up to 50% of the income.

The combination of these is expected to stop applicants who have so far managed to sneak in and get a loan. And over 50% of requests will not be approved after October 1. Financiers are adamant that the new mandatory rules introduced by the BNB

will cut off a number of loan applicants

Forecasts are for a rise in refusals by at least another 5%, which will reduce the pressure for loans by at least BGN 500 million.

According to the governor of the BNB, Dimitar Radev, the goals are twofold – to reduce credit expansion and to protect people from excessive indebtedness. (Watch the flash interview below).

In fact, a large number of banks already use methodologies that have quite strict requirements. Therefore, the financing rate can reach up to 85% for properties whose price is expected to grow, and up to 50% for those that are not assessed as promising.

BNB statistics show that in the majority of cases, the money taken from the bank covers about 80% of the value of the property, but there have also been cases where it reached over 90%. This means that from next month there will be no possibility to use minimum own financing.

Some of the banks already estimate not only the ratio of income to contribution to be two to one, but

also examine the number of household members who depend on that income,

as well as future costs. In addition, it takes into account how long the candidate has been working at their current job, what are the forecasts for the development of the sector, as well as data on general unemployment and inflation for the next five years.

The shortening of the loan repayment period to a maximum of 30 years – 5 years shorter than the current ceiling, aims to further minimize the risks with long-term forecasting and to have the most reliable forecast for property prices.

So far, this shorter term is not too restrictive, because currently the average duration of withdrawn mortgage loans has reached 25.2 years. The main reason for this is the rise in housing prices. Since this term is below the bar set by the BNB, the influence of this criterion will be indirect for now – through higher monthly contributions and hence to a higher required income.

And the BNB made another attempt to control the boom in mortgage loans, after they increased by nearly 25% in a year and exceeded BGN 22 billion. The rules from October 1 apply to newly issued loans and will not affect contracts already concluded.

The central bank sets a new condition when approving or renegotiating loans with parameters that deviate from the introduced requirements. And that is that the total amount of approved or renegotiated credits in a given quarter cannot be higher than 5% of the total gross value of the newly granted or renegotiated credits in the previous year. In order to monitor compliance with this condition, the BNB introduces additional reporting.

The analysis for the second quarter of this year shows that

credit activity further accelerates

The BNB claims that there is a movement towards a higher risk category of indicators such as credit growth, indebtedness, overvaluation of housing, average size of loans, etc.

Experts have not yet identified a deterioration in the weighted average indicators of credit standards, but there were potential areas of vulnerability because of the pool of loans.

The BNB reminds that the new requirements supplement the capital buffers applied so far, which are one of the highest in Europe. Despite these decisions, the central bank emphasizes that the banks are stable, the level of non-performing loans is low, the yield is high, which means that the property market does not show overheating.

Dimitar Radev, Governor of the BNB to BTA:

With the new measures, we aim to control expansion, not stagnation

– Mr. Radev, the BNB announced requirements for credit standards indicators when granting loans secured by residential real estate. Could you summarize exactly what this is about?

– It is a question of mandatory limits for banks on indicators for mortgage lending, which come into force on October 1 of this year. They are on three lines – the ratio between the amount of the loan and the value of the collateral is 85 percent, the ratio between the amount of the monthly debt payment and the borrower’s monthly income is 50 percent, and the maximum term under the loan agreement is 30 years.

– You allow up to 5 percent of mortgage loans to deviate from these requirements. Why?

. To cover the specific cases. For example, when, in addition to residential real estate, another type of collateral is used.

– You have indicated several times in the last year that the BNB is ready to introduce similar measures. Why right now?

– We are reacting to the trends in the mortgage market, which have deepened in recent months and about which we regularly inform the public. This decision is a logical step in our systematic approach to this topic.

Let me remind you that earlier this year we switched from statistical to supervisory monitoring of mortgage lending with corresponding mandatory requirements for banks.

– Will the banks be able to prepare for the implementation of these measures from October 1?

– Without any doubt. The system for effective process management is fully established and includes methodology, accountability and control mechanisms.

– What is the expected effect after the implementation of the measures?

– The expected and sought-after effect is a containment of expansion, not stagnation in terms of loans secured by residential real estate.

– Regarding consumers, how will these measures affect borrowers? Will existing mortgages be affected in any way?

– No, existing credit contracts are not affected by these measures. They only apply to new borrowers, the idea being, among other things, to protect them from excessive debt.

In Sofia, half of the real estate deals are with credit

The share of mortgages in housing transactions in Bulgaria is quite large and in the first half of this year it even became even higher than in the same period last year. This is shown by the statistics of the Registration Agency and regional registration offices.

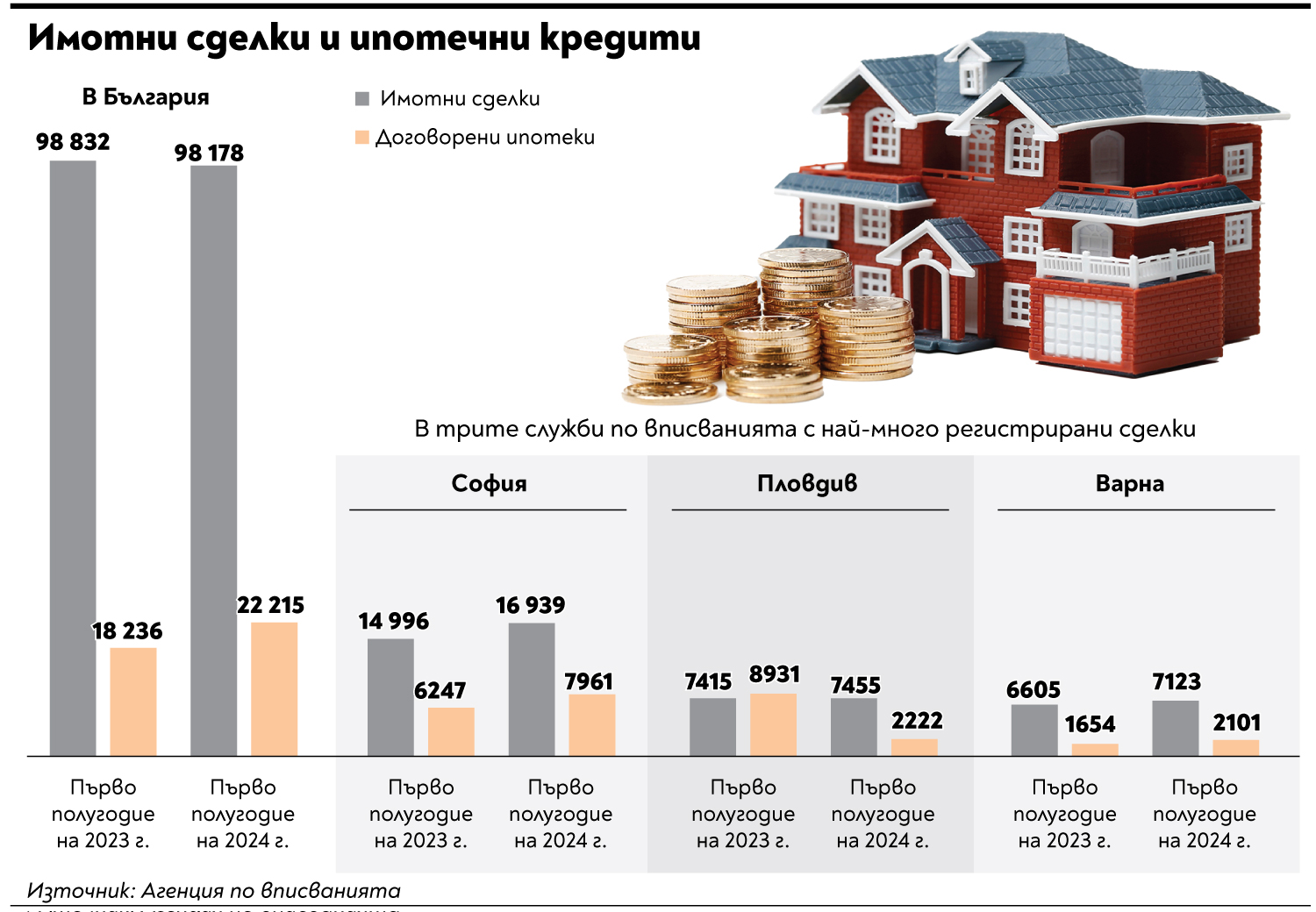

At the national level, it does not appear that many of the deals are being done with the help of a drawn down loan. In the first half of last year, for example, 18,236 mortgage loans were negotiated, while the total number of transactions was significantly higher – 98,832.

In the first half of 2024, however, the number of transactions decreased, while the number of withdrawn loans increased, although it was still only about a quarter of the number of transactions. But it should be borne in mind that these statistics include absolutely all real estate transactions concluded throughout the country, including those related to inheritance, divisions or unification of fields, forests, agricultural plots, etc. With many of them, there is usually no cash payment and no credit required.

The situation is different in the three largest cities in the country, where the real estate market is the liveliest and, in principle, most transactions are concluded for the purchase of housing.

In the capital, for example, during the first 6 months of last year, the number of registered mortgages was almost equal to half of the number of real estate transactions (see the infographic). During the same period this year, the number of real estate transactions increased by 12.9%, but during the same period, the number of mortgages increased by 27.4%.

In Plovdiv, in the first half of 2023, the number of registered mortgages is even greater than the number of property transactions themselves. But it should be borne in mind that the entry of the mortgage does not necessarily coincide exactly in time with the real estate transaction itself. In Plovdiv, there is also a large residential construction, in which the loan is often granted at an early stage of the construction, and the transaction itself is acknowledged after receipt of act 16.

A slightly smaller share of real estate transactions are made with mortgage loans in Varna, where construction is flourishing in the resorts located close to the city.