2023-05-07 12:34:34

After expanding the programs and reducing interest rates, the Jalisco branch of the Institute of the National Housing Fund (Infonavit) adds seven thousand 400 credits in the first quarter of the year, which represents an advance of the annual operating program. “The workers are taking advantage of the financing with a lower interest rate, which will continue until the end of the administration,” stressed delegate Ramón Gómez, who stressed that three out of 10 loans are requested in Tlajomulco, and two out of 10 in Zapopan. These two municipalities represent half of all guaranteed loans in the State.

Among the new programs that are successful, he highlighted the case of “Unimos Créditos”, with which Jalisco has the largest number of beneficiaries nationwide.

Rodrigo Gil Ramírez, president of the National Housing Chamber (Canadevi) in Jalisco, stressed that the Institute is making significant efforts in terms of the range of products for the placement of credits. “What we have done as an industry is to adapt to the new conditions to offer the best products to the right holders.”

Gil Ramírez emphasized that there are more than 22 thousand houses that are available.

Infonavit pointed out that in 2022 they closed their registry with 30,404 loans granted. THE INFORMANT. Navarrese

They give loans for housing only in neighborhoods with services

Many workers have abandoned their homes because they did not have the necessary services. That is why the delegate of the Institute of the National Housing Fund (Infonavit) in Jalisco, Ramón Gómez, affirmed that in 2022 the rules for granting credits changed to avoid a repetition of these situations.

“For the Institute to grant a loan, it must be within the urban consolidation zone. They must have the basic services that we know: water, electricity and drainage. Now it is established that you must have a health center, that is not further than two kilometers from the location, a supply center, school, transportation. If you don’t have them, you can’t grant a loan”.

He pointed out that last year they closed with 30,404 loans.

“For the purposes of setting the goal, we must see what is registered in the Unique Housing Registry System.”

He stressed that in March 2022 they had 2,162 shares in the Single Housing Registry and ended the year with 9,889.

“Fortunately, this 2023 we already have 3,786 records for the month of March. If the housing industry increases and the houses are finished, more mortgage loans will be given. We hope to exceed the goal.”

Rodrigo Gil Ramírez, president of the National Housing Chamber (Canadevi) in Jalisco, agreed that it is no longer possible to grant an Infonavit loan to a home that does not meet basic services.

He explained that in the Single Housing Registry they have to upload all the documents that support it and have the authorization of the City Council on issues of drainage, drinking water, electricity, etc.

“One loads all the georeferenced maps and they can identify everything with the information they have downloaded. If you do not comply, there is no credit. Yes, the issue that the new credits, based on the new operating rules of the Institute: that the credits are destined to functional housing, was shielded.

Another of the goals of the Delegation in Jalisco is to open a fourth service center in the municipality of Lagos de Moreno, to serve the population that lives in Los Altos de Jalisco. The other offices are in Guadalajara, Tlajomulco and Ciudad Guzmán.

NO NEED FOR MARRIAGE

They boast “Let’s Unite Credits”

Delegate Ramón Gómez highlighted that the program “Let’s Join Credits” allows workers to join their credits without the need to be married.

“In Jalisco, this program has been very successful. We have 11 thousand 172 credits as of 2019. Friends or friends are pooling their credits to have a greater purchasing power.

Among the benefits of this program stands out that Those interested can obtain a loan of up to four million 671 thousand 885 pesos jointly and obtain a fixed interest rate that goes from 3.09% to 10.45%, depending on your income level.

He said that other changes implemented have to do with increasing credit capacities.

“A worker who earns more than 12 or 15 minimum wages can already access financing of two million 595 thousand pesos, but also a worker who earns a minimum wage.”

He emphasized that they also went from 65 years to 70 years as the term age to request a loan.

“A worker who at age 50 requests a loan previously had only 10 years to repay the loan, therefore it was reduced. But now he already has 20 years to repay that loan ”.

Besides, began with care for workers without active employment at the Mexican Institute of Social Security (IMSS), but with savings of Infonavit. They already have 113 formalized credits.

“It is for those workers who do not have an active employment relationship, but have a balance in the Housing Subaccount. The Institute lends to them what has been 90% of the balance of the housing sub-account”.

They place 350 recovered houses

Infonavit had announced that it had 735 houses recovered from litigation that it could offer at lower prices. On the progress of this program, the delegate Ramón Gómez commented that they have placed 350, since not all homes are loaded into the system.

“If a person comes and asks, we give the contact to the promoter… or the promoter also contacts the worker and shows him the houses to see which one he wants.”

He indicated that in some houses the repair is very expensive, so they cannot be offered. “We do a review; even, that they are within a consolidation zone and that they have all the services”.

On the other hand, he recalled that there is insurance that covers damage to homes, to which all workers who pay a loan are entitled.

“And you have to enforce it because it is a right that the worker has.”

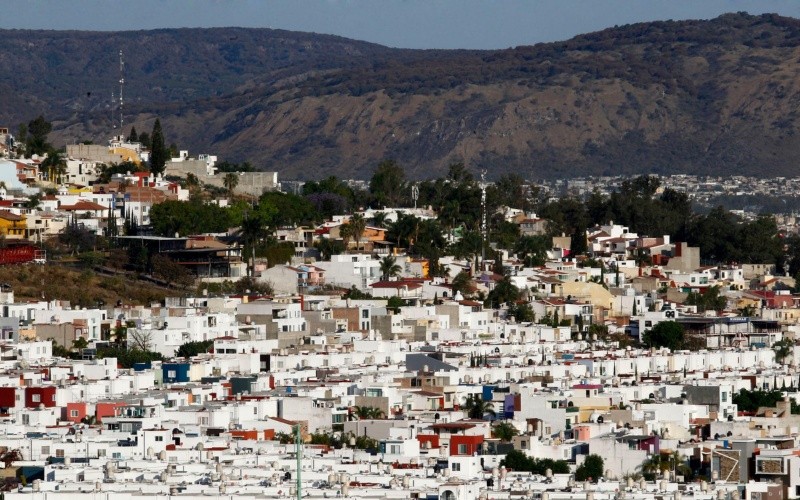

Loans are not authorized when schools or health centers are far away. THE INFORMER/Archive

GUIDE

Advance to change debts to pesos

More than 100 thousand credits in Jalisco have been changed from Times Minimum Wage (VSM) to pesos, reported Ramon Gomez. “We still have 120,000 loans pending. Right now, around 80 people a day, on average, come to make the change”.

If your Infonavit loan is denominated in Times Minimum Wage (VSM), you can prevent the monthly payment from rising in 2023 by converting the financing to pesos through the loans denominated in VSM, which register an annual adjustment linked to the increase in the minimum wage or to the Infonavit Mixed Unit (UMI), which is calculated each year based on the increase in the Measurement and Update Unit (UMA).

According to Infonavit, If you processed your credit before 2016, it is most likely that your financing is denominated in VSM. Therefore, you can make the conversion to pesos through the new Universal Window of Shared Responsibility in an easy and simple way, from the comfort of your home.

As part of the advantages are that the monthly payments and balances remain fixed throughout the agreed term, without annual increases.

KEYS

Better performance

Reasons. Why is an Infonavit credit more convenient than a bank one to buy a house? According to the Institute, they offer the best conditions for people to access a loan: the lowest rates on the market, loans tailored to your needs and support when you have difficulties paying.

Advantages. He affirms that those who earn less pay less: rate from 3.5 percent, a down payment is not required for the credit application, there are fixed monthly payments throughout the life of the credit and unemployment insurance, disability, accidents or natural phenomena. “In case of non-compliance, the accredited can access a payment solution that adapts to their working and economic conditions.”

Changes. With the reform to the Infonavit Law, he explains that the conditions were created for more people to access adequate housing that meets their needs. “We increased the maximum amount of credit, we went from 65 to 70 years of age plus the term to request a loan.”

Read Also

Get the latest news in your email

Everything you need to know to start your day

Registering implies accepting the Terms and Conditions

#Infonavit #credits #Jalisco #Tlajomulco #Zapopan