2024-07-26 19:03:33

Tax Revision Bill… Inheritance Tax Reform for the First Time in 25 Years

The more children you have, the lower your inheritance tax burden.

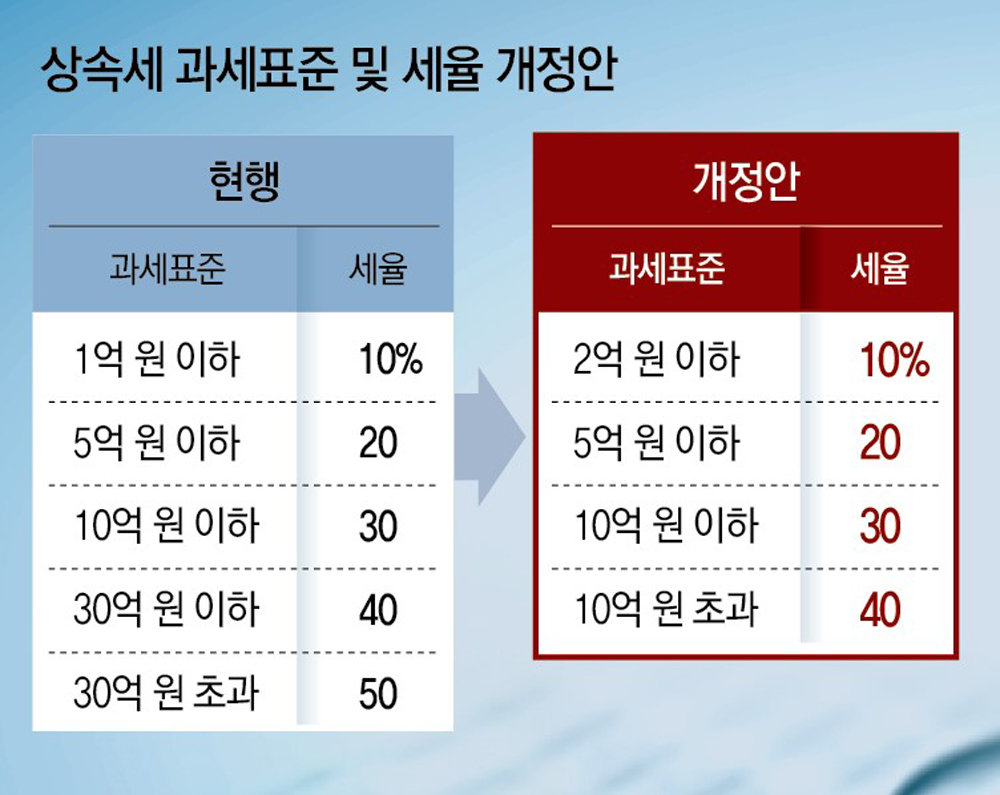

Top tax rate lowered from 50% to 40%

Must pass the National Assembly… Opposition Party: “No tax cuts for the wealthy”

Starting next year, when imposing inheritance tax on property passed on to children, the amount deducted per child will increase tenfold. The highest tax rate will also be lowered from 50% to 40%. This is the first time in 25 years that the highest tax rate has been adjusted, and the first time in 9 years that the inheritance tax deduction limit has been revised. However, since the Democratic Party of Korea has opposed it, saying, “We cannot give tax cuts to the rich,” it is expected to be difficult to pass the bill through the National Assembly.

The Ministry of Strategy and Finance held a Tax System Development Deliberation Committee meeting at the Banking Association Building in Jung-gu, Seoul on the 25th and finalized the ‘2024 Tax Law Amendment’ with these contents. In a prior briefing, Deputy Prime Minister and Minister of Strategy and Finance Choi Sang-mok announced, “We will lower the top inheritance tax rate, which is the highest in the world, to 40% and significantly increase the inheritance tax child deduction amount from 50 million won to 500 million won to reduce the inheritance tax burden on the middle class, especially families with many children.” If the child deduction amount is increased to 500 million won, 500 million won will be deducted from the total inherited property to calculate the inheritance tax.

In addition, the government decided to raise the minimum tax rate of 10% from 100 million won to 200 million won. The system of adding a 20% surcharge when the largest shareholder of a company inherits stocks will also be eliminated. However, the spousal deduction of up to 3 billion won and the lump-sum deduction of 500 million won will be maintained.

The government also decided to introduce a marriage tax credit that will reduce taxes by up to 1 million won when newlyweds report their marriage in order to increase marriages and childbirths. This applies to newlyweds who report their marriage between January of this year and 2026. In addition, the tax credit of 150,000 to 300,000 won per child will be increased by 100,000 won to 250,000 to 400,000 won.

The comprehensive real estate tax reform plan was not included in this year’s tax law revision bill. This is because the number of people paying the comprehensive real estate tax and the amount of tax already decreased significantly last year, and reforming the comprehensive real estate tax would inevitably have a negative impact on local finances. A Ministry of Strategy and Finance official said, “We will watch the National Assembly’s discussions.” The taxation of virtual asset investment income, which was originally scheduled to be taxed starting next year, has been postponed for two years.

If the tax law is revised as proposed by the government, tax revenue will decrease by a total of 18.4 trillion won over the next five years. As tax revenue continues to fall, there are voices of concern about the sustainability of the government’s finances as the Yoon Seok-yeol government continues its tax cut policy for the third year since taking office.

Inheritance tax of 1.7 billion won, if there are 2 children, 150 million won → 0 won

[2024년 세법 개정안]

Last year, 19,944 people were subject to the tax… Improvement of inheritance tax that has been distorted into a ‘middle class tax’

Democratic Party: “We can’t agree on tax cuts for the super-rich… We can discuss deductions if they are at a reasonable level”

As the government is moving to reform the inheritance tax system for the first time in 20 years, the issue that the inheritance tax, which used to be a tax on the wealthy, has recently changed into a tax on the middle class is likely to be largely resolved. However, it is expected that measures such as lowering the maximum inheritance tax rate from the current 50% to 40% and abolishing the surcharge on stocks held by the largest shareholder will not be easily passed by the National Assembly.

● From now on, a deduction of 500 million won per child

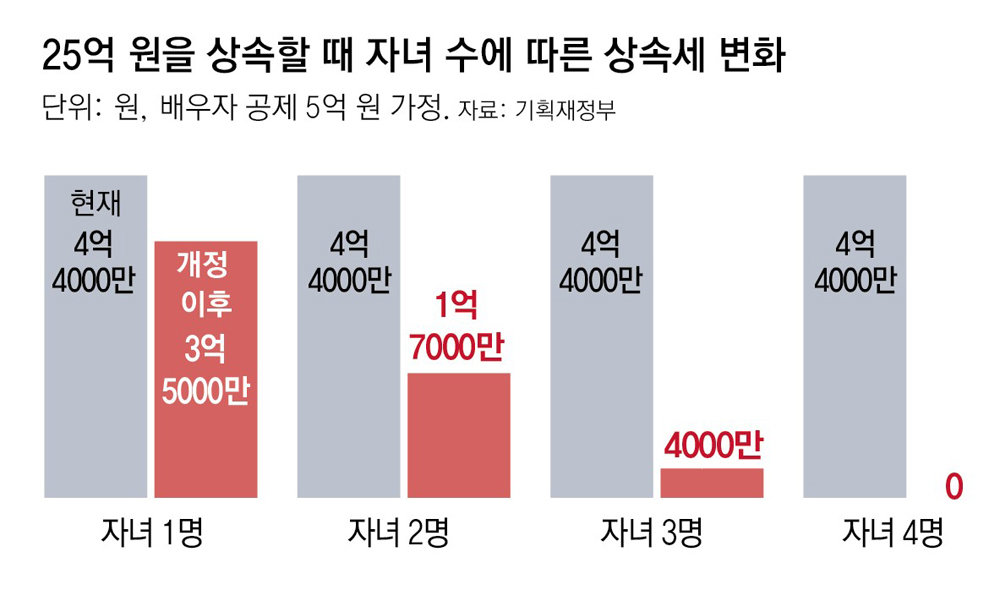

One of the key points of the inheritance tax reform that the government announced on the 25th through this year’s tax law amendment is the drastic increase in the child deduction amount from the current 50 million won per person to 500 million won. If this amendment is passed through the National Assembly, the inheritance tax burden in the case of passing 2.5 billion won of assets to a spouse and two children will be greatly reduced from the current 440 million won to 170 million won.

According to an estimate by the Ministry of Strategy and Finance, if it is assumed that 500 million won of the 2.5 billion won in assets will be passed on to the spouse and 2 billion won to two children, inheritance tax is currently imposed on 1.5 billion won, excluding the 500 million won spouse deduction and the 500 million won lump sum deduction. This is because the deduction based on the number of children is not very meaningful, as the child deduction is only 50 million won per person.

However, if the child deduction increases to 500 million won per person, if there are two children, the spouse deduction of 500 million won, the basic deduction of 200 million won, and the child deduction of 1 billion won are applied. Inheritance tax is levied only on 800 million won, excluding 1.7 billion won from the 2.5 billion won inheritance. Also, if there are three children, the inheritance tax is reduced to 40 million won, and if there are four or more children, the deduction amount exceeds the inheritance amount, so no tax is paid.

If the inheritance is worth 1.7 billion won and there are two children, you don’t have to pay any inheritance tax at all. Currently, you have to pay 150 million won in inheritance tax. According to the Seoul Real Estate Information Center, the average selling price of an apartment in Seoul as of May is about 1.2 billion won. This means that even if you pass on a decent apartment in Seoul, you don’t have to pay any tax.

The government’s preparation of this measure is interpreted as taking into account the fact that there has been no significant change in the inheritance tax deduction for 27 years since the introduction of the 500 million won lump-sum deduction in 1997. The reason is that due to the rapid rise in real estate prices, it has become difficult to avoid paying inheritance tax even if you inherit just one apartment in Seoul. A Ministry of Strategy and Finance official said, “This is an improvement plan that takes into account the fact that if you don’t have a spouse, you can be subject to inheritance tax even if the inherited property exceeds 500 million won.”

● The opposition party opposes ‘tax cuts for the super rich’

The number of people subject to inheritance tax in Korea increased from 2,805 in 1997 to 19,944 last year. Accordingly, both the ruling and opposition parties in the political world have reached a consensus that the deduction amount needs to be increased to reduce the number of people paying. Recently, the ruling party as well as the Democratic Party of Korea have proposed specific measures to increase the blanket deduction from 500 million won to 1 billion won.

However, there is expected to be some difficulty in the National Assembly discussion process regarding the reduction of the highest tax rate, etc. This time, the government also announced a plan to lower the highest inheritance tax rate from 50% to 40% and to abolish the 20% surcharge on the inheritance of stocks of the largest shareholders of large corporations. It is a comprehensive reform plan that revises not only the deduction but also the tax base, the highest tax rate, and the surcharge.

The Democratic Party of Korea immediately protested the Ministry of Strategy and Finance’s proposed inheritance tax revision, calling it a “tax cut for the rich.” In his commentary that day, Democratic Party floor leader Noh Jong-myeon criticized the proposal, saying, “The tax reform bill that lowers the tax burden on the super-rich is making the trend of tax cuts for the rich, which has continued since the beginning of the administration, even clearer.”

However, regarding the increase in the deduction amount, he left room for negotiation, saying, “If it is a reasonable level, it can be adjusted.” Regarding the increase in the inheritance tax deduction amount for children to 500 million won, a Democratic Party policy committee official said, “It is excessive,” but added, “After comprehensively reviewing the inheritance tax imposition details, etc., the deduction amount can be adjusted to an agreeable level.” Inheritance tax reform requires revision of the National Assembly law, including not only the tax rate but also the increase in the deduction amount.

Sejong = Reporter Lee Ho [email protected]

Sejong = Reporter Sosulhee [email protected]

Reporter Yoon Myeong-jin [email protected]

Sejong = Reporter Kim Do-hyung [email protected]

2024-07-26 19:03:33