2024-07-26 18:49:08

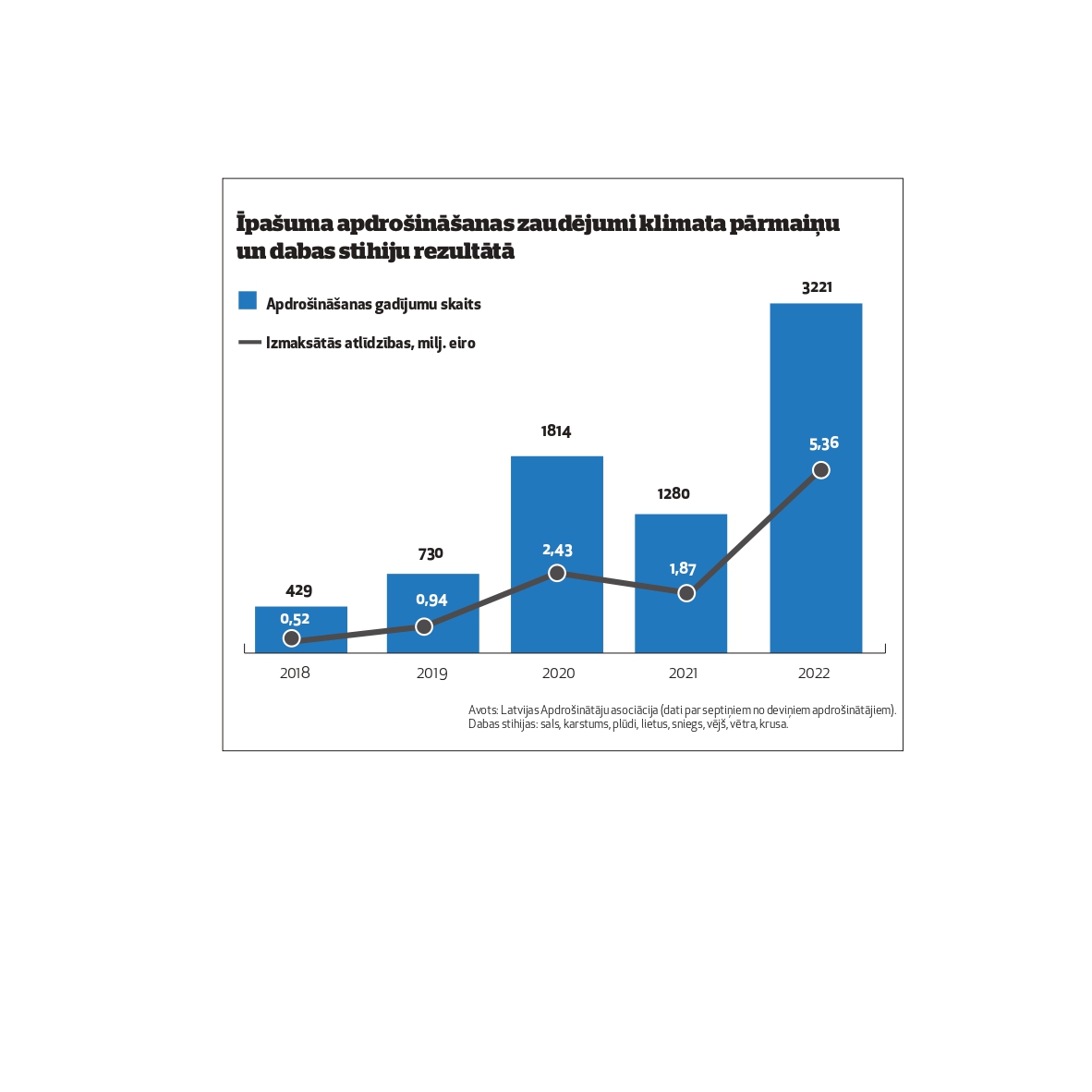

Over the past five years (2018-2022), property insurance losses in Latvia as a result of climate change and natural disasters have increased tenfold, with compensation paid out in 2022 reaching 5.4 million euros. The compensations paid to farmers have also grown significantly, especially for volumes.

Unfortunately, statistics on damages caused by natural disasters in property, CASCO and agricultural insurance are not collected in a uniform format. On the other hand, the losses caused by the August storm last year alone have already reached 16.6 million euros (paid and reserved amounts), according to the information gathered by the Association of Latvian Insurers. This data includes CASKO, property and agricultural insurance. Last winter, the damage caused by the flood to the residents, businessmen, municipal and state institutions of Jēkabpils region reached 1.3 million euros. For the storm of July 11 this year, insurers have received about 300 compensation applications for about one million euros.

“In general, the frequency of floods has not changed much, but the frequency of storms and serious hail is increasing. Practically all European countries are exposed to the risk of floods and the consequences of sea level rise, while the water crisis, heat stress and fires are more regional in nature,” says Jānis, president of the Latvian Insurers Association Abashin. In Latvia, according to the forecasts of the State Fire and Rescue Service, the highest risk of occurrence is floods, forest and peat bog fires, and heat. Then comes a moderately high risk of sea level rise, rain, severe frost, storms, hail and drought. Latvia is least threatened (low risk) by earthquakes and wet snow deposits.

You have to change with it

Classic floodplains are relatively well known. The Environmental Geology and Meteorology Center of Latvia (LVĜMC) has good flood maps, therefore insurers cooperate with LVĜMC and use them. There is another, deeper problem here, J. Abāshins notes, asking the question why construction in such flood risk areas is allowed at all at the level of municipal planning. By allowing the construction of new houses in the floodplain of a river, it can be predicted with a fairly high degree of certainty that, if not within the next five years, then within 10 years, the property will flood.

Protecting property from damage caused by possible natural disasters must be thought about constantly, starting from the moment when construction is planned. For example, when creating zoning, municipalities should take into account the location of the territory and climatic conditions, such as flood maps. It is also worth improving the safety and durability of buildings, etc

Comparing the times of the year (winter, summer, etc.), when there are the highest costs in Latvia for natural elements, the association estimates that they are mainly floods and hailstorms in spring (in Jēkabpils, however, it was already in winter) and there is an increasing trend of summer storms and other extreme weather conditions – drought , hail, etc. On the other hand, the largest one-time damage costs were in August last year.

Click on the image to enlarge!

Each such natural disaster makes people think more about the possibilities of protecting themselves and their property in the event of an accident. Individuals are insuring more, especially in those regions where these local disasters have occurred, for example, insurers felt such an increase in interest after the floods in Jēkabpils, because the owners, who until now felt safe and far from the usual flood area, began to think about flood risks. On the other hand, legal entities do not insure more, because they have already been relatively well insured against such and other risks.

“Perhaps an issue worth investigating in Latvia would be the creation of a natural disaster fund, which would be a well-thought-out and strategic opportunity to stop paying for foreseeable losses from funds for unforeseen events,” mentions J. Abāšins.

Whole world

In general, in 2023, the compensations paid out by insurers for losses caused by natural disasters exceeded 118 billion dollars (109 billion euros). Last year, 24 countries and territories in the world recorded record high temperatures. Several temperature peaks were also recorded in Latvia last year, which will continue this year – LVĜMC just announced in July that the average air temperature in the spring of 2024 in Latvia exceeded the norm by 2.4 degrees, reaching +8.3 degrees.

The total losses of the global economy from natural disasters reached 380 billion dollars (350 billion euros) last year, which is 22% above the 21st century average. The biggest losses are usually caused by earthquakes, but nature also takes care of other “surprises”, for example, the largest fixed hailstone was 19 cm in diameter, according to the data collected by the insurance brokerage company Aon.

Affects prices

Policy premiums (prices) are affected by many factors, including the global reinsurance market, which in turn is also affected by global climate change, the risk appetite of each insurer, the number of insured customers, geographical dispersion, etc. J. Abāshins does not unequivocally say that premiums (prices) will increase, because if the number and dispersion of customers and the efficiency of insurers increase, prices may not increase either. However, it is undeniable that the increase in the number and volume of such serious natural disasters puts pressure on premiums (prices).

Click on the image to enlarge!

2024-07-26 18:49:08