The objections to Petrochemical’s debt settlement, which should give it exclusive control of Bezan, together with the Green Oil company of Benny Steinmetz’s sons-in-law, are growing stronger. Among other things, there are political and environmental factors, which are part of the organizations that will oppose the settlement as part of its approval process in court. The fear that drives them is the continuation of Bazen’s polluting activity in Haifa Bay.

The objections concern two main issues. The first is the cancellation of approximately one billion shekels of debt to bondholders. The second issue is more strategic and concerns the long-term consequences of the deal.

The sale of control of Bezan by the Israel Company and Idan Ofer is seen as a deal that gives impetus to the state’s desire to evacuate the refineries from Haifa Bay.

However, the fact that Green Oil will be part of the controlling group of Bazan Petrochemicals raises concerns that this is a strategic group that wants to develop the company in the field of polluting refining. On the other hand, the controlling owners of Hajaj Real Estate, the brothers Tzachi and Ido Hajaj, who were already on their way to purchase Bazen from the Israel company, explicitly stated that their goal is to combine the real estate with the refining plants.

The Israel company already signed an agreement in February of this year to sell control of Bezan to the Hajaj brothers for NIS 550 million.

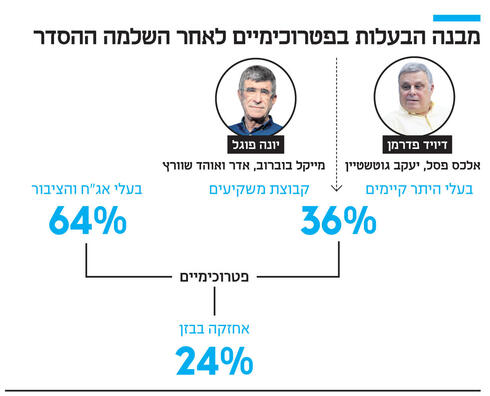

The Israel company controls Bezan together with Petrochemicals, which is controlled by David Federman, Yaakov Gutstein and Alex Psal. Petrochemical is an insolvent company that has not met its NIS 1.65 billion debt to its bondholders, to whom its holdings in Bezan – 15.6% of the company – have been pledged. Petrochemical has the right to refuse the transaction with Hajj. That is, it can decide that it is the one that carries out the the deal and buys the shares itself.

Petrochemicals reached agreements with the bondholders’ representatives, which were approved on Thursday by the bondholders’ vote, that together with other investors, the controlling owners will inject NIS 100 million into the company, raise a new debt of NIS 485 million and recycle NIS 245 million of the old debt.

In this way, the control of the company will remain in their hands and in the hands of their new partners – Green Oil, which recycles industrial oil and is under the control of Eder Schwartz and Ohad Schwartz, sons-in-law of Benny Steinmetz, and Michael Bobrov, the representative in Israel of the representative of the global energy giant Trafigora. Yona Vogel, who was the CEO of Paz, Bezen’s competitor, also joined them. All partners have experience in the field of old energy, which increases the fear of their intentions regarding Bezen plants.

Petrochemical is in a race against time, as it must complete the deal by September 15, the date by which it is bound by the right of refusal agreement with an Israeli company. Petrochemical submitted a request for approval of the settlement in court and at the same time it must receive the approval of the Ministry of Finance for a new control permit in Bazan, which will not include the Israel company. Such a permit was not received until the end of the week and is still under discussions with the Treasury.

In March of this year, the state passed a decision on eviction in Zen and designates the area that will be vacated for mixed uses, centered on employment, residences, logistics and open spaces. Also, in the program it is proposed to support the establishment of research and development centers based on the academic institutions of Haifa. Idan Ofer (The Israel Society) publicly supported the evacuation, and the estimates among environmental organizations are that the Hajj brothers are also committed to the evacuation.

The Union of Haifa Bay Area Cities, which represents 12 local authorities, has been accompanying the government’s policy on the matter in recent years and is even working to promote measures to revive the Haifa Bay and to close the petrochemical industry in the bay in accordance with government policy. In the objection that will be submitted to the court this morning, the union writes that “the purchase of shares in Zen by a company from the petrochemical industry instead of a real estate company is a decision with extensive public consequences that also requires consideration on behalf of the state. The approval of the settlement is expected to lead to the fact that the owners of the debt and control will have a great interest in developing the refining activity in order to maximize the value of the shares in their hands and thus endanger the clean future in Haifa Bay. The continuation of petrochemical activity in the long term is in complete opposition to the government’s decision of March 22, 2022 to stop refining activity in the Gulf.”

According to the union, the identity of the buyers has importance and consequences for the very implementation of the government’s decision. “Approving the debt settlement while introducing a new petrochemical partner to the balance sheet – without hearing and taking into account the union’s position – could postpone for many years the evacuation of the refineries from the Haifa Bay. This is different from the sale of shares in Zen to the Hajaj Real Estate Group, whose line of business aligns well with the government’s plans to close the factories and to develop other areas in the city, among them residential construction and employment,” claims the union.

Last week, the union contacted Prime Minister Yair Lapid about this matter.

Other political parties also turned to Lapid. MK Naama Lazimi, the head of the Peretz revival lobby, wrote to Lapid that it is not possible to agree to the settlement and the group’s takeover of Bezen. business companies,” she wrote.

MK Alon Tal from the state camp and chairman of the subcommittee for the impact of the environment and climate on health, also sent a letter to Lapid. Tal requests that the settlement not include a haircut of one billion shekels from the pension funds of Israeli citizens.

According to him, if the arrangement is approved, it will be an incentive for the controlling owners to maximize the value of the shares in their hands by developing the refining activity. He demands that every buyer of Bazen’s shares provide a letter of irrevocable commitment according to which he undertakes to comply with the government’s decision to evacuate the factories within a decade.

The court hearing on the settlement will take place tomorrow. In the meantime, Petrochemicals began a road show with institutional bodies to raise the new debt series of NIS 485 million. The road show is led by Adi Federman, David Federman’s son, and Rafi Arad, the CEO of Petrochemicals. In the presentation published by the company, only Vogel and Borbov, who is defined as the CEO of Trafigora Israel, are presented by the investors, while the names of the two sons-in-law of Benny Steinmetz – Ohad Schwartz and Ader Schwartz – are not mentioned at all . This is despite the fact that they are partners in the new company established for the purpose of acquiring control of Bezan.

The bonds that Petrochemical will raise are for 4.7 years and the fund will be repaid in one payment on April 30, 2027. The expected interest rate is 6%-7% and will be paid over the years until maturity. The investors will inject NIS 100 million and secure a purchase offer for NIS 70 million in the company’s shares. from bondholders who wish not to participate in the settlement. The investors are defined in the presentation as having added value in the field of trade, operations, logistics, financial management and more.