Read more in Calcalist:

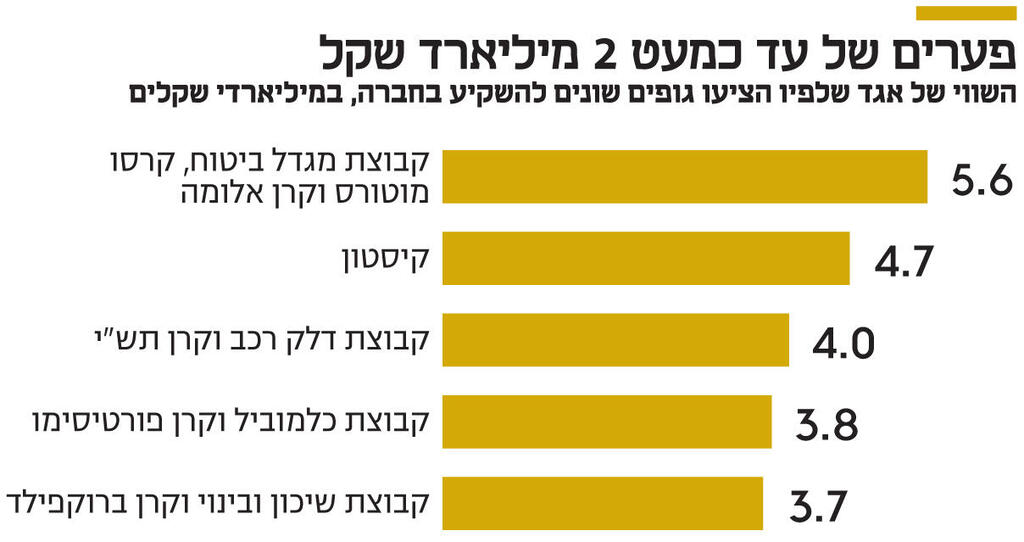

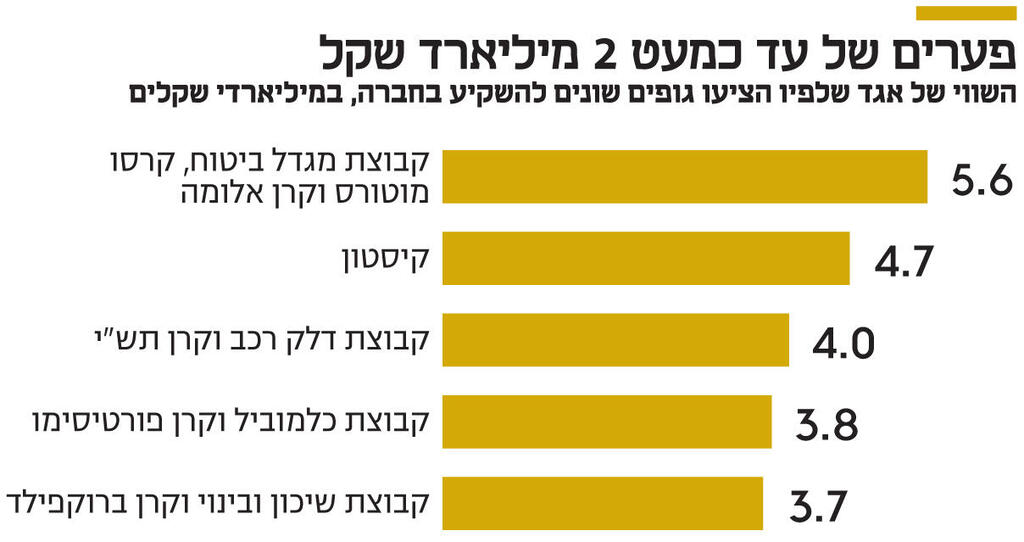

Keystone, founded by Gil Deutsch, Roni Biram and Navot Bar, who serves as CEO, offered to buy 60% of Egged for NIS 2.8 billion and at a company value of NIS 4.7 billion, almost NIS 1 billion less than the offer of the Migdal Insurance Group, Kerso Motors and the Aluma Fund. Keystone will be required to provide 15% of the amount offered, ie NIS 420 million, by May 8 and present a financing agreement signed for the balance until May 12. This is not a trivial task for Keystone, which is traded on the stock exchange at NIS 830 million. At the end of 2021, the fund has cash and cash equivalents of approximately NIS 530 million.

Accordingly, the group that consists of Gil Agmon and the subsidiary Veridis, Keren Tashi, which is managed by Yaron Kastenbaum, Harel Insurance (which is also the anchor investor in Keren Tashi), Menora Mivtachim and Clal Insurance, are the ones that stand by and watch what happens. This group is expected to win the tender if Keystone does not meet the schedule and contacts with it will be terminated. Calcalist has learned that this group has submitted an investment offer in Egged at a company value of NIS 4 billion. Next in line is the group consisting of Colmobil of the Harlap brothers, the Fortissimo Fund and the Phoenix, who offered to invest in Egged at a value of NIS 3.8 billion. The lowest bid was from Shikun VeBinui and the Brookfield Fund, which gave the company a value of NIS 3.7 billion.

3 View the gallery

Gil Agmon, who controls the car fuel. May win the tender

(Photo: Ronen Topelberg)

In closed-door talks, Keystone officials convey confidence that they will be able to obtain the sums needed to execute the deal on the scheduled schedule, however various business sector officials believe the task may prove impossible for the Reit Foundation. Professional-economic sources accompanying Egged in the tender, who believed that the bid of the Carasso-Motors-Aluma insurance company should have been originally rejected on the grounds that it was unrealistic, now also question Keystone’s ability to meet the task. However, the skepticism of those factors in relation to Keystone’s offer is lower than that revealed towards the offer that gave the bond a value that is one billion shekels higher than that according to which Keystone wants to acquire control of the company.

In fact, some professionals thought that in the first place, Delek Rachav-Tashi’s group should be chosen, which gave Egged the value that the company asked for in the first place, and rejected the two higher offers. The main problem in this case is that 1,300 Egged members would have difficulty Significantly high bids are outright rejected without giving the groups that submitted them the opportunity to bring the money. “It should be understood that for the members, every shekel is critical. “This is money that most of them did not have in their lives and it is impossible to explain to them that they reject high bids because they fear that the bidders will not be able to bring the money.” The opportunity to bring in the money and win the tender, in order to prevent future claims by Egged members.

Last Wednesday, Egged announced that it had decided to move forward with contacts with Keystone after the process with the Carasso-Crums-Aluma insurance group was stopped. According to the group, Egged introduced a new clause in the tender, which was not included in the original tender, according to which 15% of the winning amount must be paid within two and a half weeks, and that this is the main reason for the termination of contacts. However, various sources in the tender environment told Calcalist that Kerso Motors was surprised by the large gap between the group’s bid in which it is a member and the other bids, which led to a heated exchange with Aluma, led by Uri Yogev, regarding the bid height and data. Aluma denied the allegations and Kerso Motors did not respond. A source close to the tender claimed that the fact that Migdal Bituach, Kerso Motors and Aluma had not yet applied to the court indicates that what the group members really wanted was to run away from the deal. “They claimed they wanted the deal, but whoever wants a deal fights it and goes for a restraining order if he thinks he has been wronged. They seem to be celebrating that the burden has fallen from their necks.”

Like Aluma, Kiston is a REIT fund for investment in infrastructure traded on the stock exchange. Its managers receive management fees derived from the amount of the fund’s assets. That is, as the fund increases its assets and value, managers receive more management fees. The capital market sees this element as a major reason why the two highest bids were submitted by REIT funds. But beyond that, the financial challenge facing Keystone on the way to acquiring control of Egged is significant and tangible. Keystone will be required to bring in NIS 1.4 billion in equity to execute the deal, and obtain financing of the same amount to pay the balance of the amount. This is beyond existing financing agreements and lines of credit. Its options for obtaining funding from among the institutional ones are limited. Harel Insurance, Clal Insurance and Menora Mivtachim are members of Delek Car and Keren Tashi’s group, so they are out of the game in terms of Keystone, since they want the deal for themselves. In a higher and more expensive offer? Phoenix is also not an option, because it is a member of Colmobil and Fortissimo’s group.

3 View the gallery

: Gil Deutsch, Roni Biram and Navot Bar. Founders of the Keystone Foundation

(Shay broke)

So Keystone was left with the option of an insurance tower, however after the group in which it was a partner withdrew, apparently due to value gaps, it will be difficult for the insurance company to explain why it is joining the one that itself offered much more money compared to the one that followed.

Also, some of the institutions are shareholders in Keystone. Clal Insurance, Menora Mivtachim and Migdal Insurance hold about 10% of Keystone. There is an absurd potential here, because if Keystone buys Egged, it can be said that it does so thanks to the institutional funds that are invested in its shares and that allow it to submit a high offer that will pay off to the fund managers.

In practice, Keystone is left with the possibility of obtaining funding from the banks. These may agree to put the financing in exchange for a lien on Egged shares, but the gap between the offers may be a problem for them as well.

3 View the gallery

At the same time, in the equity segment, Keystone is trying to bring partners into the deal. Calcalist has learned that Cardan Real Estate is expected to join it if it succeeds in closing the issue of financing. However, the company is controlled by Deutsch and Biram, so such a decision would require a shareholders’ meeting – a move that requires a 35-day period Only – and the acceptance of a majority of the minority shareholders. It is also unclear whether Cardan Real Estate, which as far as is known has been examining the deal for weeks, has made a relevant decision on the board. To date, the company has not reported such a decision to the stock exchange.

Keystone has approached other market players to enter into the deal, such as the investment group Allied and Leumi Partners, its partner in the green energy company Sunflower. Calcalist has learned that Leumi is considering the possibility of providing Keystone with a Maznin loan as part of the deal. Such a loan would be considered as Keystone’s equity.

In any scenario where Keystone acquires control of Egged, it will do so in a leveraged deal. Egged members, who have already fantasized about the millions, will have to make do with lower amounts each. It is important to remember that they will remain shareholders for at least two years, if they choose to exercise their put option, so joining a professional who works in the field of infrastructure, such as Keystone, is a solid move for them. Therefore, if the Keystone deal does not materialize, the right thing for Egged members to do would be to price between the other offers.