[2024 미국 대선]

Trump: “If you don’t use dollars, there will be 100% retaliatory tariffs”

Harris: “The winner of the AI race is the US, not China”

U.S. and China to Put All-Out Pressure on Korean Companies

“Any country that leaves the dollar will not be able to do business with the United States.”

Former US President Donald Trump, the Republican presidential candidate, said that he would “impose a 100% tariff” on countries that use the Chinese yuan instead of the US dollar. At a campaign rally in Wisconsin on the 7th (local time), he declared his intention to escalate the US-China trade war into a “reserve currency” hegemony battle and to retaliate with retaliatory tariffs on countries that side with China.

As the US presidential election heats up, each candidate’s plans for a ‘Season 2’ US-China trade war are also intensifying. China, which has been actively responding to the trade war with the US, may also play the retaliatory card, so the Korean economy, which is highly dependent on exports, is likely to find it difficult to avoid pressure from all sides as it gets caught up in the US-China conflict.

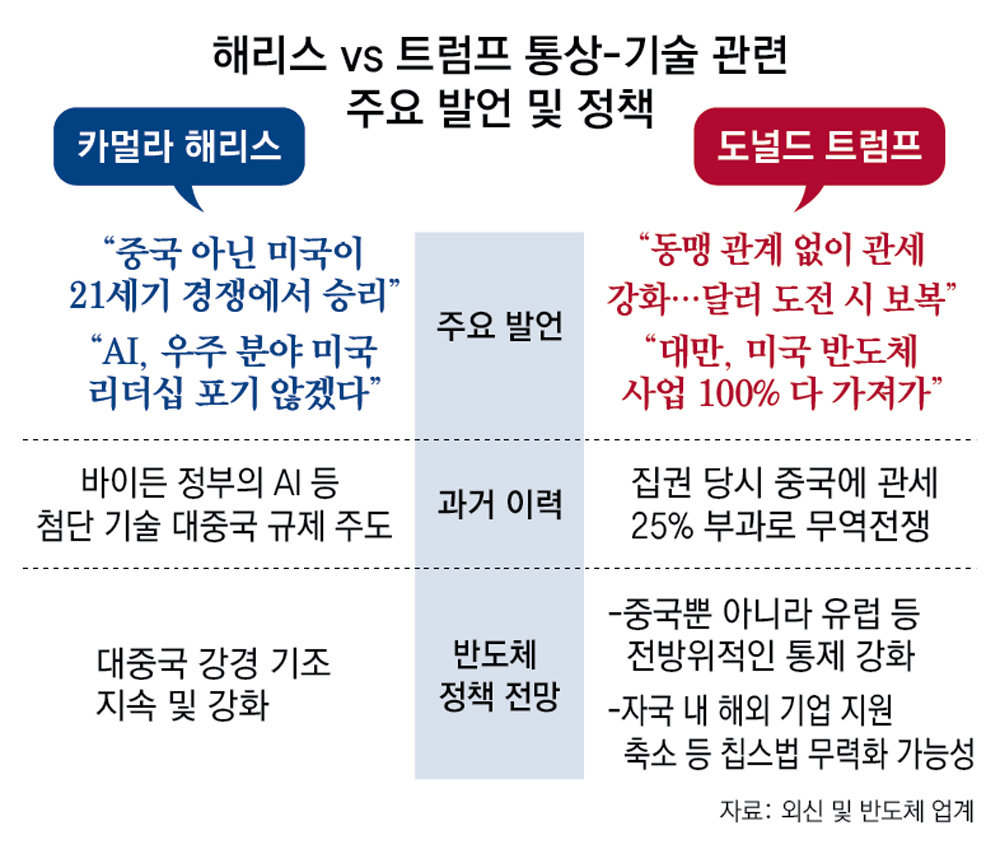

Vice President Kamala Harris, the Democratic presidential candidate, has also hinted at containing China’s cutting-edge industries. In her speech at the Democratic National Convention last month, she said, “We will ensure that the United States, not China, wins the 21st century competition,” and “We will lead the world in AI and space, and we will not give up America’s global leadership.” There are also predictions that the two candidates’ first TV debate on the 10th will reveal their keynotes on China policy more clearly.

There are growing concerns that Korean companies, especially semiconductor companies, could be left behind in the whale fight due to the hard-line stance of both sides on China. Not only Korean companies’ investment in China, but also cooperation with emerging countries such as India and Brazil, which have been discussing the yuan trade system with China, could fall under the sphere of influence of US regulations. Above all, the semiconductor industry, which has its main production lines and markets in China, is expected to continue to face risks.

Harris-Trump pressure on China regulation, concerns over HBM hit to Korean semiconductor industry

[‘미중 무역전쟁 시즌2’ 새우등 한국]

Whoever wins the US presidential election, ‘Trade War Season 2’

US Controls Advanced Technologies Including Quantum Computing… Samsung Electronics’ Core Technologies Also Included

SK’s Chinese factory regulations may be strengthened again… Dollar-Yuan ‘currency war’ may spark

“If additional regulations on AI semiconductors targeting China emerge, Korea’s memory semiconductor exports could be significantly damaged.” Recently, the US financial firm Bank of America released an analysis report on the Korean semiconductor industry and raised this concern. It warned that while the Korean memory industry has benefited from the growth of the AI industry, if the US-China trade war intensifies, the entire industry could face the threat of a freeze, such as a decrease in semiconductor exports to China.

In the US presidential election, both Democratic candidate Vice President Kamala Harris and Republican candidate former President Donald Trump have indicated a hard-line stance toward China, which is causing growing concerns for Korean companies. This is because the entire Korean economy, from tariffs and exchange rates to investments in China and semiconductor exports, is affected. In particular, semiconductors, which account for 20% of Korean exports, are key items subject to US regulations on China, so there are concerns that they could be hit hard.

Jeong Hyeong-gon, a senior researcher at the Korea Institute for International Economic Policy, predicted, “Regardless of who wins the U.S. presidential election, regulations on China will be strengthened, and pressure on neighboring countries such as Korea to join in the regulations will increase.”

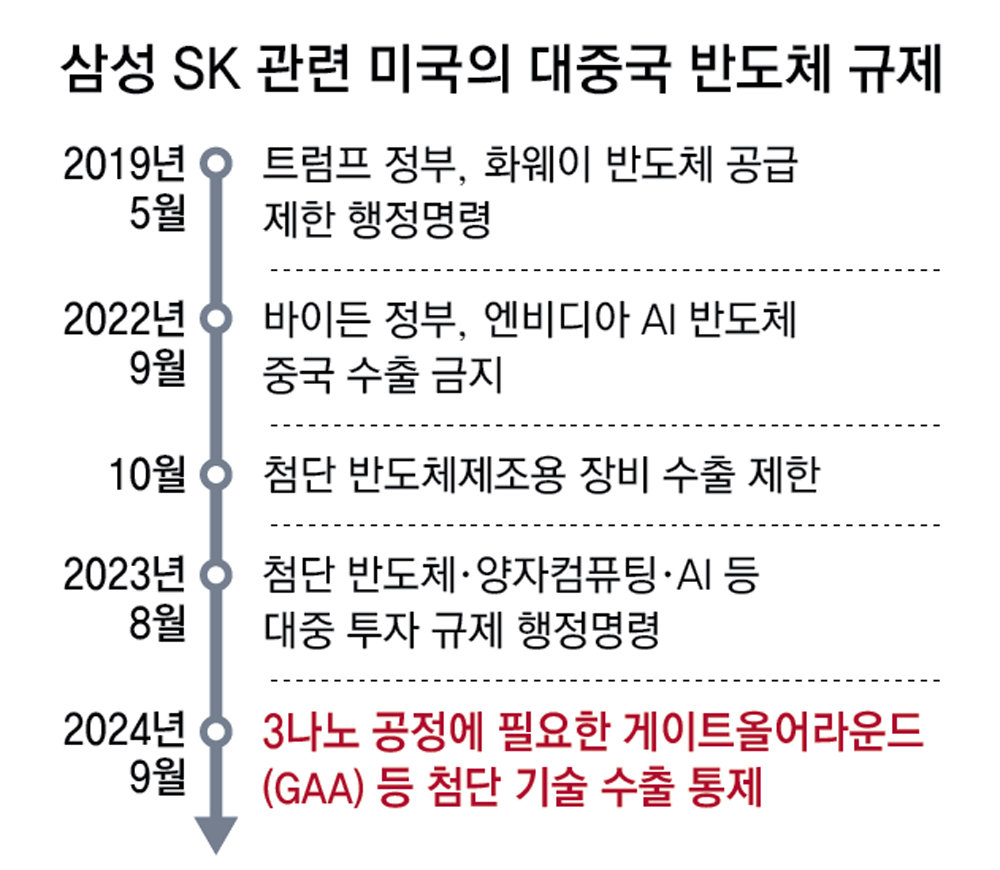

● Following Samsung and SK’s Chinese factories, HBM also has jurisdiction

According to the industry on the 8th, the US government is currently preparing a regulatory card to tighten the grip on the Chinese semiconductor industry more strongly than before, and is gradually making it visible. On the 5th, the Bureau of Industry and Security (BIS) under the US Department of Commerce announced that it would implement export controls on advanced technologies related to quantum computing and the latest semiconductors. This includes the GAA (Gate All Around) technology that Samsung Electronics uses to make advanced semiconductors below 3 nanometers. GAA, which is the core of the foundry (semiconductor contract manufacturing) fine process, is a technology that Samsung Electronics introduced for the first time in the world in 2022.

The possibility of export control of high-bandwidth memory (HBM), a new food source for Korean semiconductors, has also recently emerged. BIS has previously reviewed HBM as a target for regulation along with GAA. The share of HBM in the overall global DRAM market sales is expected to increase from 8% last year to 21% this year and more than 30% next year. Currently, Samsung Electronics and SK Hynix occupy more than 90% of the HBM market.

A semiconductor industry insider said, “Although all of these are cutting-edge semiconductor technologies, the Chinese market share is still not large, and there are concerns that this will significantly hinder the growth potential of companies as it becomes difficult to find new markets in China, the world’s largest semiconductor consumer.”

There is also great uncertainty about Samsung and SK’s local semiconductor factories in China. Instead of providing subsidies under the Chips Act, a semiconductor support bill, the US imposed restrictions on China’s increased production. Last year, through an agreement between the South Korean and US governments, the government was granted a 10-year grace period to increase production capacity by up to 5%, but there is still a possibility that controls could be strengthened again at any time.

● Regulations on China that even allies cannot avoid

As the US-China trade war intensifies, the level of pressure on allies to “join the regulation” is expected to increase. On the 7th, the Netherlands announced that it would directly control the export of two types of deep ultraviolet (DUV) exposure equipment from ASML, a domestic semiconductor equipment company. It strengthened export control not only of cutting-edge equipment but also of old semiconductor equipment. The Netherlands has been considering strengthening control, saying that “ASML is an important company for the economy.”

Companies are in trouble. ASML CEO Christophe Fouquet previously expressed his discontent, saying, “It is increasingly difficult to accept the reason of security. (The U.S.) seems to have a bigger economic reason.” Taiwanese semiconductor company TSMC, which actively participated in the U.S. semiconductor supply chain strategy, was criticized by former President Trump for “stealing almost 100% of the U.S. semiconductor chip business.”

Korea may also face a situation where it must reexamine its investment and cooperation with China, including the control of semiconductor exports to China. Some point out that if former President Trump is elected and the dollar-yuan hegemony battle actually accelerates, Korea may have difficulty accessing the yuan-centered export market. If demand for the dollar, the U.S. key currency, increases, the value of the won will fall relatively, causing import prices to surge, which will have repercussions on the Korean economy.

Experts advise that since South Korea’s participation in the U.S. public regulation is ultimately unavoidable, the country should devise a strategy that can achieve practical benefits, such as ‘regulatory exemption’, even if it means giving up what it has to give up.

Professor Kwon Seok-jun of the Department of Chemical Engineering at Sungkyunkwan University said, “If semiconductors that Korea specializes in, such as HBM, are targeted right away, they could be significantly affected,” and added, “The government needs to come up with countermeasures to find a regulatory compromise that minimizes the damage.” Park Jae-geun, president of the Korea Semiconductor and Display Technology Society, said, “Korea has no choice but to survive by focusing its investment on technologies and processes that can create higher added value.”

2024-09-09 13:52:34