[2024 미국 대선 D-60]

Whether semiconductor subsidies will continue remains unclear… Investments ‘on hold’ as policy uncertainty grows

Harris-Trump Oppose US Steel Sale… Economic Vote Over Alliance, ‘America First’

The 20 trillion won acquisition of US Steel by Nippon Steel, which was called the US-Japan “steel alliance,” is now in danger of falling through. This is because not only Republican presidential candidate Donald Trump but also Democratic presidential candidate Kamala Harris have clearly stated their America First policy by saying, “US Steel must be owned by Americans.”

This is cited as a symbolic case that even Japan, America’s closest ally, cannot overcome the barrier of America First. On the 5th, a business world insider said, “This means that no matter who wins the close US presidential election, the ‘America First’ keynote will be strengthened,” and “It can be interpreted to mean that alliances may not work in the face of US economic logic and public sentiment, so Korean companies cannot help but be nervous.”

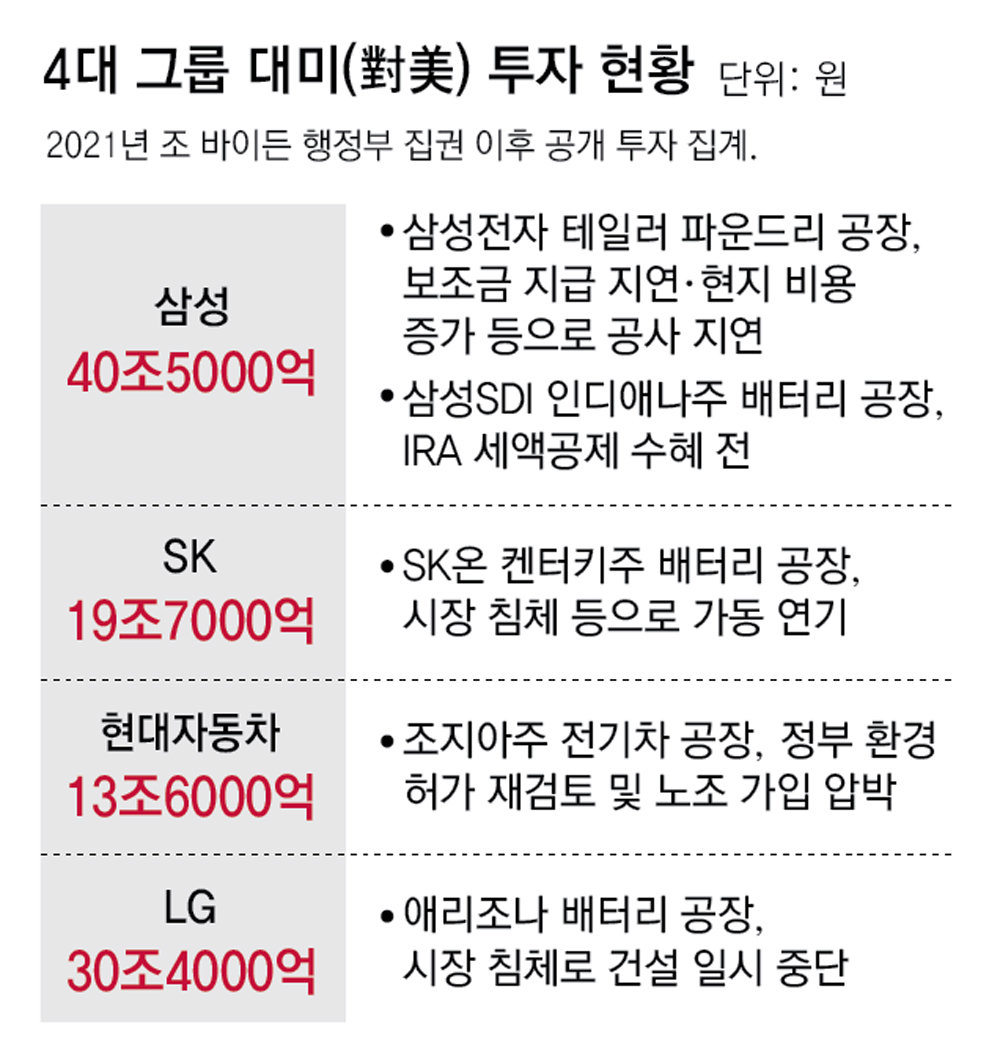

As both U.S. presidential candidates have revealed their own America First policies, Korean industries that have increased their investments in the U.S. under the Joe Biden administration are also not immune to the impact. According to the Dong-A Ilbo’s analysis of the U.S. investments by the top four domestic conglomerates under the CHIPS Act and the Inflation Reduction Act (IRA) since the Biden administration, the total investment amount revealed so far has been tallied at 104.2 trillion won.

The ‘investment bundle’ of these four groups is also being tested due to the growing uncertainty over the next administration’s economic policy after the presidential election and the slowdown in the U.S. economy. There are also increasing cases of quietly holding off or delaying investments.

Samsung Electronics’ Taylor Foundry (semiconductor contract manufacturing) plant in Texas, USA, which invested 25 billion dollars (approximately 33.6 trillion won) and broke ground in the first half of 2022 (January to June), was originally scheduled to start operation in the second half of this year (July to December). However, it has been reported that the mass production date has been delayed to after 2026 due to increased local construction costs and subsidy payment issues. The US government announced in April of this year that it would pay Samsung up to 9 trillion won in subsidies under the CHIP Act, but the actual payment has not yet been made.

The battery industry, which had made a large inroad into the local market during the Biden administration due to IRA tax deduction benefits and joint ventures with local automakers, is also concerned. This is because uncertainty has grown over whether the new administration will continue to support IRAs, and the stagnation in the battery market is also prolonged.

SK On’s US battery plant operation delayed, LG Ensol construction postponed

[美대선 불확실성 커진 韓기업]

Investment in the US Trapped in a Maze

“Japan, Establishing a Pan-Government Action Plan

“Korea also needs active cooperation between government and industry”

Korean battery companies that have advanced into the U.S. are starting to adjust their investment speeds. SK On announced last year that it would postpone the start of operations of its second battery plant in Kentucky, which it was building in partnership with Ford. LG Energy Solution also halted construction of its ESS battery plant in Arizona, which it had invested 3.2 trillion won in in June, just two months after it began construction.

Not only Korean companies, but also other global companies that have invested in the US are delaying their investments due to concerns about policy consistency ahead of the US presidential election. According to the Financial Times (FT), out of the total US$227.9 billion in major manufacturing investment projects announced for 2022, the first year of the CHIPS Act, about 40%, or US$84 billion, has been delayed for at least two months to several years or has been suspended indefinitely.

There are also concerns that the economic slowdown in the U.S. and the America First policy converge, and that even allies will become more resistant to support for overseas companies in the future. This means that the so-called “subsidy bills” could increase. Public opinion pressure from local labor unions and social groups is a variable for domestic companies.

In fact, Hyundai Motor Company’s electric vehicle plant in Georgia, which was scheduled to be completed in October, is facing a review of its environmental permit by the U.S. government due to environmental groups’ claims that regulators failed to properly assess the impact of the plant’s water use on the local water supply. Georgia is one of the key swing states in the U.S., and there is analysis that the government has backed down due to public unrest. Hyundai Motor Company’s plant is also under pressure to join the United Auto Workers (UAW), which controls Democratic votes.

Amid growing uncertainty, the four major groups are paying keen attention to the direction of the presidential election, such as increasing their spending on U.S. relations in the first half of this year (January to June) by 10% compared to the same period last year. There are also suggestions that a joint response system should be established beyond the industrial sector and involving related ministries and the political and business worlds.

Park Hyo-min, a lawyer on the overseas regulation team at Sejong Law Firm, said, “Japan is responding by establishing a system, such as organizing an economic security action plan at the government level and conducting public-private dialogue. We are also in a time when active cooperation is needed so that the ministry and industry can closely discuss and implement response measures.”

Reporter Kwak Do-young [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-06 01:58:31