2024-06-20 03:32:24

- Maker rises 8.93% in 24 hours after every week of bull run.

- Bull Run Hub Market Sentiment and Key Technical Indicators

MKR from MakerDAO it has been bullish for the previous seven days. It elevated by 4.80% within the final week and recorded a rise of 8.93% within the final 24 hours.

On the time of this publication, Maker was buying and selling at $2,414.47 with a 24-hour quantity of $109 million. MKR was additionally 61% above its ATH and recorded an increase that took present costs to 11,475% above the bottom costs.

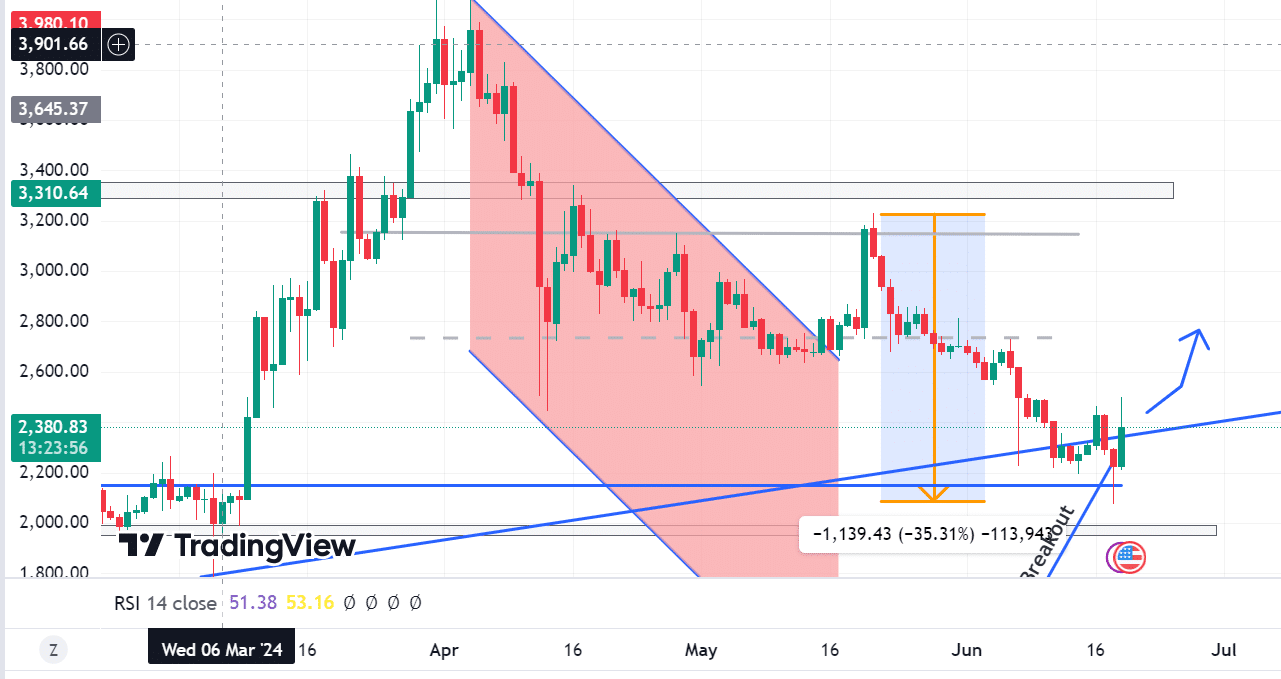

Supply: Tradingview

AMBCrypto evaluation reveals that MRK momentum is bullish because it tries to problem the closest resistance stage of round $2,729 If it breaks this stage, it can goal $3,145 for the following stage.

The present assist stage is round $2,150, and the bottom stage is $1,945.

MKR would get away with a change of two.7% and there may very well be additional features.

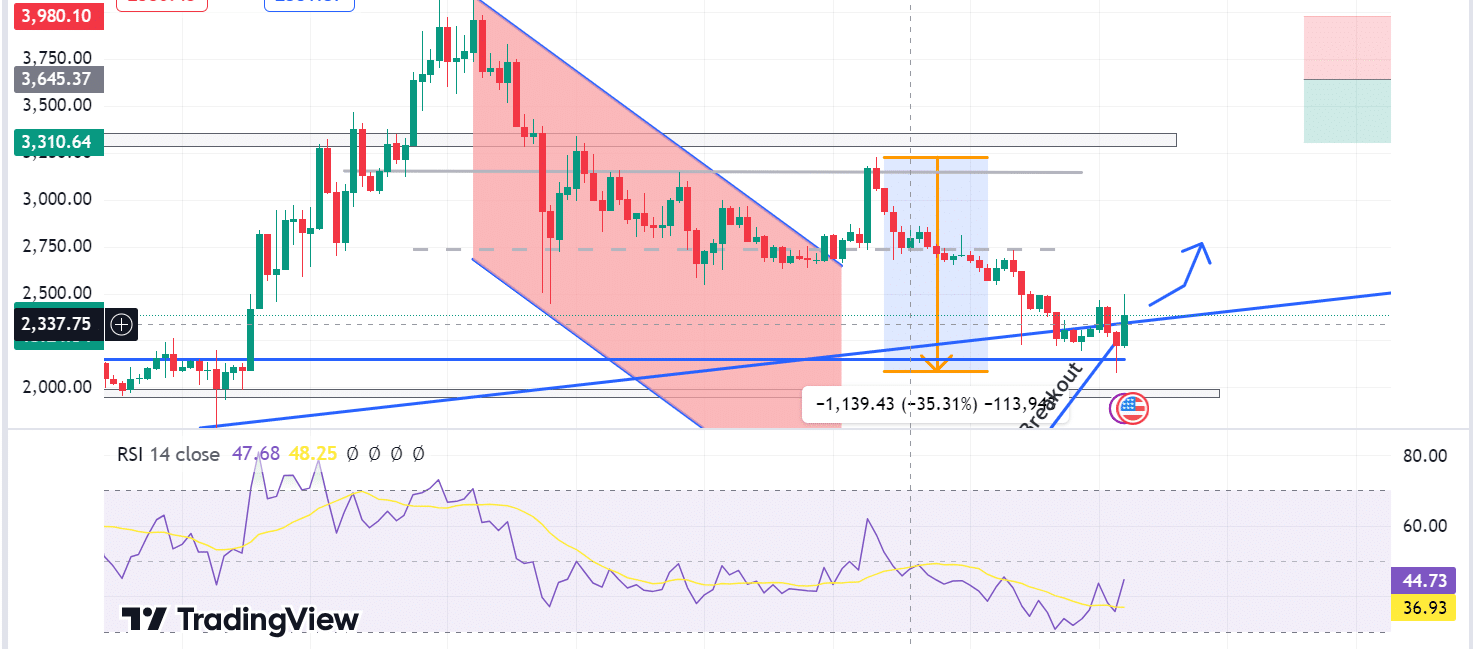

Supply: Tradingview

Moreover, the RSI reveals robust bullish momentum over the previous seven days. The RSI of 44.68 is above the RSI-based shifting common of 36.93.

When the RSI is above its shifting common, it signifies a bullish sign. Normally, present features are pushing losses, indicating bullish momentum.

Subsequently, with an RSI of 46, Maker signifies alternatives for a protracted place, anticipating additional worth features.

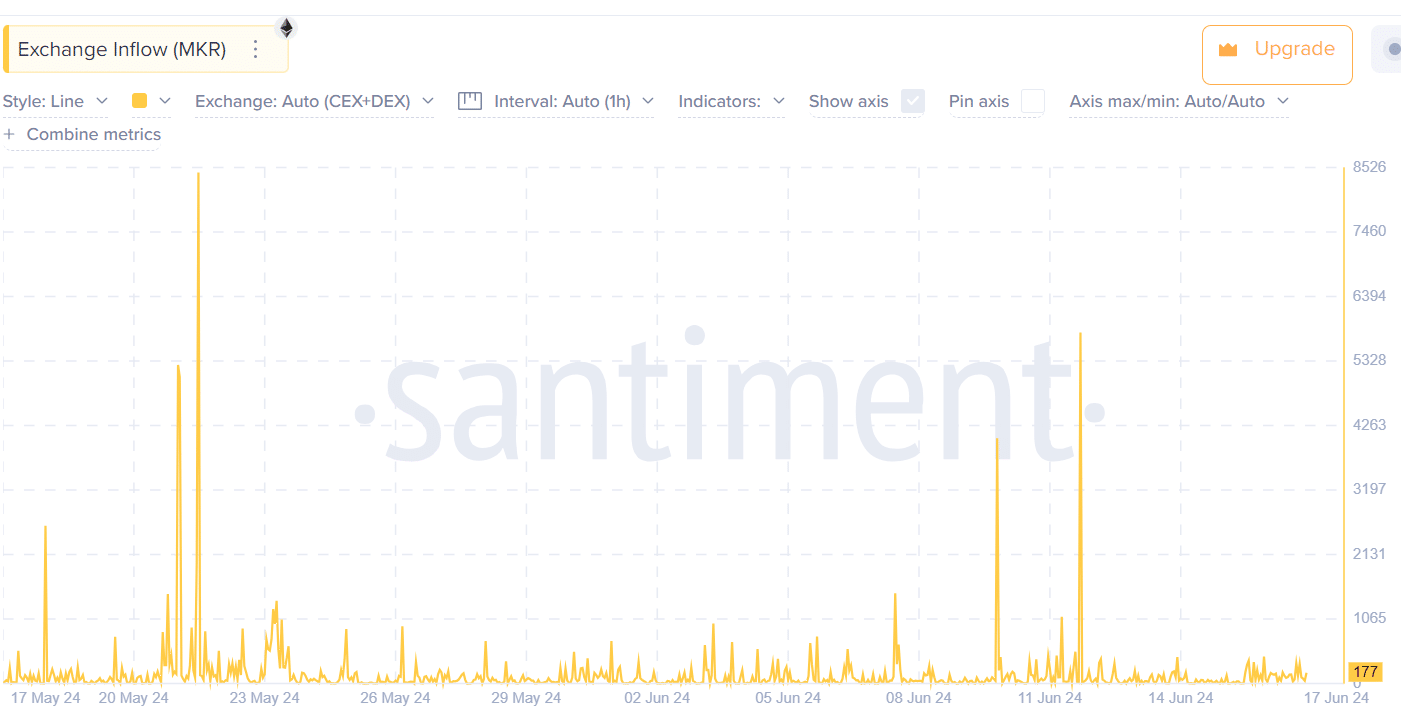

Moreover, in response to Santiment, MKR overseas change inflows have decreased over the previous week. International foreign money inflows declined from a excessive of 5,799 on 12 June to a low of 177 on the seventeenth.

Supply: Santiment

Usually, increased foreign money inflows imply that customers are making ready to commerce their belongings, leading to larger promoting strain. Extra gross sales strain drives costs.

Subsequently, the decrease overseas change inflows reported by MKR point out that there are few accessible belongings, decreasing promoting strain and driving costs increased.

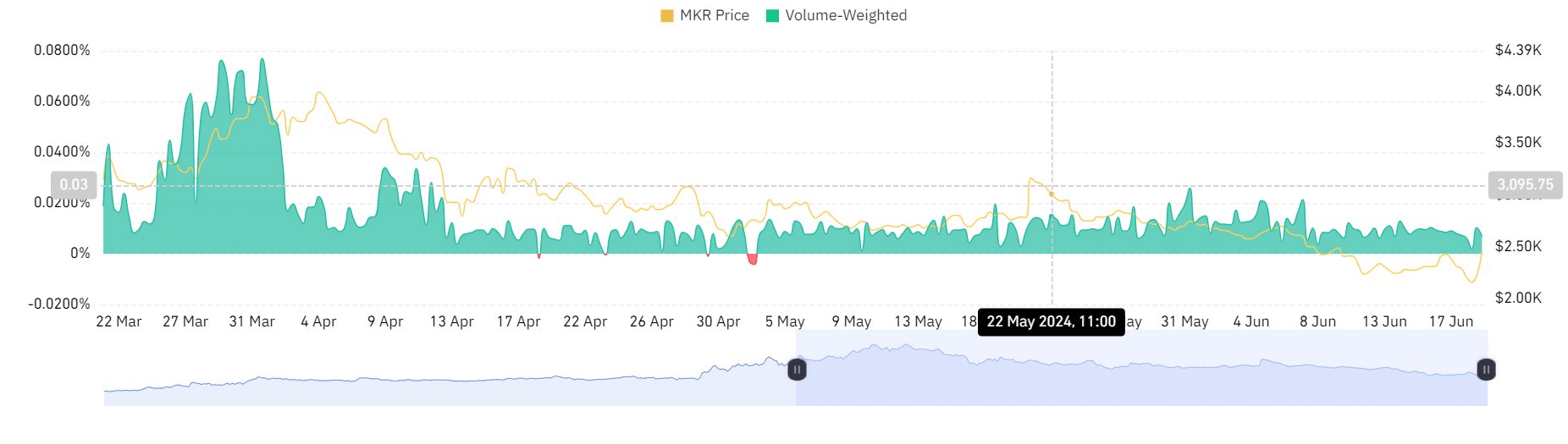

Apparently, in response to Coinglass, MKR has reported a volume-weighted balanced funding fee.

Supply: Coinglass

The funding fee is impartial and constructive. This implies that the lengthy and quick positions are balanced and that the market has stability with out bearish or bullish dominance.

Realistically, that is it MKR market capitalization when it comes to BTC

Will MKR’s latest increase proceed?

Over the previous seven days, MKR has seen vital features. Key indicators level to bullish momentum following the $2,150 assist that was held.

Because the recession fades, MKR goals to problem the resistance stage round $2,729 as nicely, the market outlook is bullish, with RSI rising and foreign exchange inflows declining.

That is an computerized translation of our English model.

#MKR #Targets #Technical #Indicators #Reveal..