2024-06-25 22:06:04

The IS financial life Mexico has extra monetary stress What monetary well beingrevealed the primary Nationwide Monetary Well being Survey (ENSAFI) by which greater than 20 thousand Mexicans participated, in session with the Nationwide Institute of Geography and Statistics (Inegi) and the Nationwide Fee for the Safety and Safety of Customers of Monetary Providers (Condusef).

The primary survey, whose frequency has not but been outlined, defined that the common month-to-month revenue that the inhabitants aged 18 and over wanted to cowl their prices 16 thousand 421 pesosFor ladies it was 15 thousand pesos and for males it was 18 thousand pesos.

Final 12 months it was reported that 52 per cent of the inhabitants aged 18 and over stated that they had some type of financial savings. For ladies the proportion was 49.3 % and for males, 55.2 %.

Of the folks saved, the quantity was equal to 57.3 % as much as two weeks of what they earned or acquired and 10.3 % saved quantities higher than 3 months.

he 45.9 % of contributors stated that they had little or no cash from their month-to-month revenue on the finish of the month. resulting from inadequate revenue and 34.6 % stated they’ve little or no means to cope with sudden bills.

30.5 % indicated that over the past month he did not find the money for to cowl your bills with out going into debt. To handle the dearth of revenue, 68.3 % of respondents decreased their bills41.6 % borrowed from household or mates and 32 % used their financial savings.

In that context, the ENSAFi decided that the monetary curiosity of the Mexican inhabitants is 52.8 factors out of a potential 100 on the nationwide stage.

The cities with the very best Monetary Properly-being indicator have been: Quintana Roo with 56.3 %, Coahuila, 55.9 % and Mexico Metropolis with 55.8 %, whereas these with the bottom monetary well-being have been: Guerrero, 49 % first, Oaxaca, 49.8 %. cent and Zacatecas with the identical share.

However, 36.2 % of the inhabitants reported having some type of debt. The proportion of girls who had debt was 34.1 and 38.7 %, in males and solely 17.1 % thought of their stage of debt excessive or extremewho 48.9 % rated as reasonable.

On common, folks reported that the a most quantity they might decide to paying a debt month-to-monthwith out affecting his property, nor 2,777 pesos, in case feminine intercourse could be the utmost 2000 262 pesos and for males 3,382 pesos.

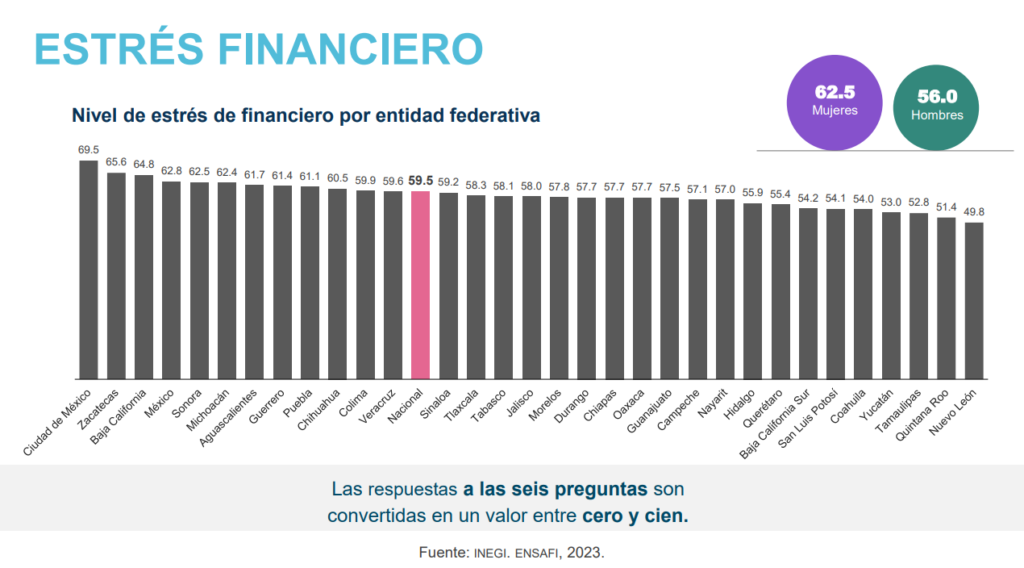

This resulted in a nationwide monetary stress of 59.5 % sudden bills, meals prices y instructional bills.

The residents of Mexico Metropolis are these with essentially the most monetary stress with 69.5 %, Zacatecas with 65.6 % and Zacatecas with 64.8 %, whereas the residents with the least monetary stress are Nuevo León with 49.8 %, Quintana Roo, 51.4 % and Tamaulipas with 52.8 %.

monetary stress complications, lack of sleep, gastritis/colitis, adjustments in blood stress, consuming issues and issues with household, mates and work.

Through the presentation of the outcomes, the Undersecretary of the Treasury, Gabriel Yorio González, emphasised the second flooring of the transformation ahead with public insurance policies to realize Monetary Properly-being and within the close to future there can be a platform with info on this regard. within the Condusef in order that Mexicans have the data and instruments that assist them handle cash higher.

The president of Condusef, Óscar Rosado Jiménez, identified that the The household is the primary circle by which cash administration ought to be mentionedwhich isn’t a the unique accountability of the State or the monetary system.

Submit navigation

#Monetary #stress #outweighs #welfare #ENSAFI #DNF