[조영광의 빅데이터 부동산] Looking into Seoul’s commercial districts… ‘Golden real estate’ requires high-quality jobs, K-lifestyle, and traditional markets

The sales trends of the distribution industry in the first half of this year have been announced. Not only the three department stores and three large marts, but also the offline sales performance of the domestic distribution industry, including convenience stores and semi-large stores, was not bad. According to the Ministry of Trade, Industry and Energy, the sales growth rate of the domestic offline distribution industry in the first half of this year was 3.4%, which is a larger increase than the same period last year (2.1%). In particular, February showed a high sales growth rate of 11% compared to the previous month. Not only online, but also offline commercial districts are stirring.

Offline distribution sales and foreign tourists both increase

The recovery of offline commercial districts can also be found in the increase in the floating population. The floating population in commercial areas nationwide, which had fallen to an average of 2.45 million people per day during the COVID-19 pandemic, increased by nearly 1 million to an average of 3.45 million people per day in the first half of this year. In addition, foreign tourists, a strong supporter of major commercial districts in Seoul, increased 11-fold from 970,000 in 2021 to 11.03 million last year. The number of foreign tourists in the first half of this year recovered to 91% compared to 2019. The COVID-19 pandemic has created a ‘new normal’ phenomenon in various fields. In particular, the new normal phenomenon had a strong effect on commercial real estate, which underwent qualitative changes due to the COVID-19 pandemic. The recovery of offline sales and floating population is evidence that data has been accumulated to determine what new normal trends will lead commercial districts after the COVID-19 pandemic.

In a typical real estate recovery cycle, core products and locations react first, and then recovery begins in order of grade. In the case of apartments, which are core domestic real estate products, recovery began in Gangnam, Seoul, and continued in Mayongseong (Mapo, Yongsan, and Seongdong-gu) and Nodogang (Nowon, Dobong, and Gangbuk-gu). The recovery of the apartment market will spread to commercial real estate, which is the second-highest real estate category. Interest in commercial real estate is expected to be stimulated as the regular deposit interest rate is losing its appeal in the early 3% range and the loan interest rate is also lowered to the mid-4% range.

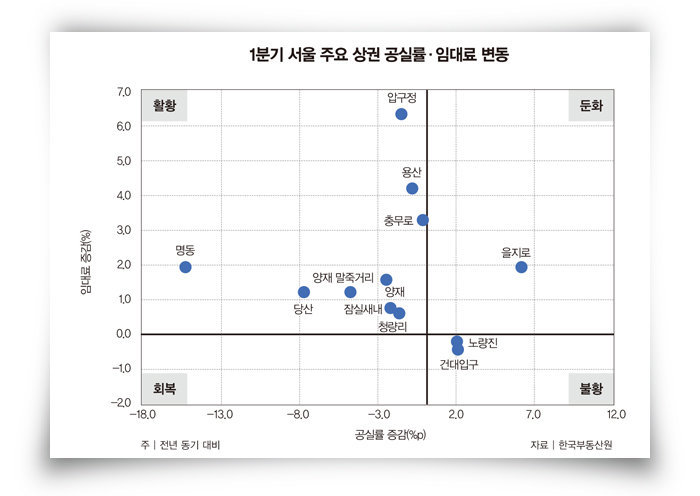

The commercial area data accumulated from distribution sales and floating population is trying to answer what the new normal trend is. At the same time, the high interest rate situation that is calming down is telling us that the time has come for commercial real estate. There is no reason not to pay attention to commercial area big data in the second half of this year. To read and predict commercial area trends with big data, you only need to remember two pieces of data: how much rent has increased (or decreased) compared to the same period last year, and how much the vacancy rate has increased (or decreased) (see graph). Based on this, you can capture four phases: recession → recovery → boom → slowdown. For example, a commercial area where rent is increasing and vacancy is decreasing can be said to be a booming commercial area.

Seoul downtown commercial area

Myeongdong and Chungmuro are booming, Euljiro is slowing down

In downtown Seoul, Myeong-dong and Chungmuro are the commercial districts that are sending out signals of prosperity. The Myeong-dong commercial district is booming due to the return of foreign tourists. In particular, a different form of tourism than in the past is leading the commercial district trend. As Chinese group tourists, ‘youke (游客)’, are replaced by Chinese individual tourists, ‘sanke (散客)’, commercial districts where you can experience the ‘real life’ style of Koreans are booming. Olive Young and Daiso, which were remodeled into foreigner-specialized stores at the end of last year, are considered the leading players leading the Myeong-dong commercial district. Sales have grown rapidly as foreigners flock to experience K-beauty and K-food with good cost-effectiveness and a variety of products.

K-beauty shopping trend in both Gangnam and Buk

Namsan is what led the boom of the Chungmuro commercial district. Chinese and Japanese people in their 20s and 30s are flocking to Namsangol Hanok Village and Namsan N Seoul Tower, which are connected to the Chungmuro commercial district. Likewise, it has been confirmed that K-lifestyle tourism is revitalizing the commercial district. According to a joint survey by Airbnb and the Korea Tourism Organization, one of the main reasons for Chinese tourists visiting Korea is the night view. The ‘Top 100 Night View Restaurants’ announced by the Ministry of Culture, Sports and Tourism last year included representative commercial districts in downtown Seoul, such as Namsan N Seoul Tower, Gwanghwamun, Deoksugung Palace, and Naksan Section of Hanyangdoseong. Seoul’s night view is also emerging as a vital element of the commercial district by foreign MZ generation tourists who want to experience the hidden charms of Korea.

Among the commercial districts in downtown Seoul, there is one that has entered a slowdown phase due to the burden of rising rents and high vacancy rates. It is the Euljiro commercial district that has earned the reputation of being a “hip-hop district” and has properly targeted the tastes of the MZ generation. In this area, the revival of the office market has led to the influx of large corporations and the development pressure from the downtown redevelopment project, which has led to rising rents. As a result, the “gentrification” phenomenon is appearing.

Seoul Gangnam commercial district

Apgujeong and Yangjae are booming

The major commercial districts of Gangnam, which have the largest floating population in Seoul, are generally booming. According to the Korea Tourism Data Lab, the number of domestic beauty and medical consumption by Chinese, Japanese, and Taiwanese tourists in their 20s and 30s in the first quarter of this year increased by nearly 100% compared to the same period last year. Gangnam was chosen as their cosmetics shopping mecca after Myeongdong, and Apgujeong was chosen as their beauty salon mecca after Hongdae. It seems that the boom in Gangnam is also led by foreign tourists. In K-medical shopping, the use of plastic surgery and dermatology clinics has particularly increased, and Japanese female tourists are leading this. This explains why rents in the Apgujeong commercial district soared by about 6% in the first quarter of this year.

The Yangjae and Maljukgeori commercial districts have recorded a noticeable decrease in vacancy rates despite rising rents. The driving force behind the boom in these commercial districts is artificial intelligence (AI) industry jobs. Earlier this year, Seoul designated Gaepo 4-dong as an ‘ICT Special Development Promotion Zone’. The ICT Special Development Promotion Zone and AI Regional Special Development Special Zone development projects are already underway, centered around nearby Yangjae 2-dong. In the future, the large-scale living area from Gaepo-dong to Yangjae-dong is expected to become an AI job paradise. The Yangjae commercial district, where research labs of major corporations such as Samsung, LG, and KT are concentrated, will secure a more solid job demand with the AI roadmap as its backbone.

Other Seoul commercial districts

Yongsan, Dangsan, Cheongnyangni, and Jamsil Saenae are booming

Other booming commercial districts in Seoul are Yongsan and Dangsan. Both areas have many promising jobs and are supported by solid demand. With the development of the Yongsan International Business District and the Yongsan Electronics Market, Yongsan is expected to continue to be filled with high-quality jobs.

Yeouido, which is leading the revival of the office market, has many high-income workers, but the rent is high, making it a difficult location for small and medium-sized businesses. In that sense, the Dangsan commercial district has both competitive rent and a geographical advantage that can absorb the demand of Yeouido workers. It is highly likely that it will transform into a unique commercial district centered on small and medium-sized businesses in the future. You can also see the skyscrapers of Yeouido from Dangsan, and it will match the new normal commercial district trend of ‘night view charm’, which will increase the value of the commercial district.

Noryangjin commercial district loses vitality as public offering heat dies down

The Cheongnyangni commercial district is being revitalized by the return of residents following the completion of redevelopment and the influx of permanent residents due to the high floor area ratio. In addition, the revival of the nearby Gyeongdong Market is creating a synergy effect with the newly built complex shopping center, making it a promising commercial district.

The Jamsil Saenae commercial district, known as the ‘baseball game after-party commercial district’, is booming thanks to the popularity of professional baseball. LG Twins and Doosan Bears, who use Jamsil Stadium as their home, are both performing well, and Korean professional baseball is breaking the record for the highest attendance ever. With the development of Jamsil Stadium, the two teams will use Jamsil Main Stadium as their temporary home stadium for several years. We can expect the Jamsil Saenae commercial district to continue to boom for the time being.

In Seoul, there are also depressed business districts where not only rents are falling but vacancies are increasing. These are the Noryangjin and Konkuk University entrance business districts. The Noryangjin business district is losing its vitality due to the decline in the school-age population and the decline in the civil service exam fever. Instead of test takers, office workers who used to fill Noryangjin’s residential spaces are being absorbed into the nearby Yeouido business district, making recovery seem distant. The Konkuk University entrance business district is losing demand to the nearby Apgujeong and Cheongdam business districts and Seongsu-dong business districts, and is not finding any signs of recovery.

Even if a commercial district enjoyed its heyday in the past, it is difficult to expect a revival if it deviates from the new normal trends of commercial districts such as ▲skilled jobs ▲K-lifestyle ▲traditional market with individuality. If you think about it the other way around, you can see that the golden real estate that will bring you more wealth than expected in the new normal era will come from commercial districts that satisfy the S, K, and T triad. Now that the interest rate cut trigger has been pulled, you need to check if the commercial real estate you are interested in is in the S, K, and T commercial districts.

*If you search for ‘Magazine Donga’ and ‘Twovengers’ on YouTube and portals respectively and follow them, you can find a variety of investment information, including videos in addition to articles.

〈This article Weekly Donga 〉Published in issue 1453

Youngkwang Jo, Housenomist

2024-08-17 08:32:57