Traders are bracing for unusually rapid swings in stock prices as US semiconductor maker Nvidia announced its August-October (third quarter) financial results on the 20th.

Options suggest that Nvidia’s stock price could move about 8% in either direction on the day after the earnings release, according to data compiled by Bloomberg. This means that the market capitalization is expected to change by about $300 billion (about 46.7 trillion yen), and only 25 companies in the S&P 500 index have a market capitalization greater than this. Nvidia’s results pose more risk to the index than the next Federal Open Market Committee (FOMC) or the Consumer Price Index (CPI), Bank of America strategists said.

The financial results of Nvidia, which has grown to become the world’s largest company by market capitalization as a representative artificial intelligence (AI) stock, are the most watched financial year event in over a year. However, the company’s third-quarter financial results, scheduled to be released after the US market closes on the 20th, are more uncertain than usual about its business performance and future outlook.

That’s because Wall Street is divided on what to expect from the company’s latest product line, Blackwell, a next-generation chip for AI. NVIDIA says Blackwell will post billions of dollars in sales in the fourth quarter, and CEO Jensen Huang said there was ”insane” demand for the product.

But production has been delayed, making predicting supply even more difficult.

“There are significant unknowns regarding Blackwell’s production capacity,” said Dan Eye, chief investment officer of Fort Pitt Capital Group. “CEO Hwang has established a high level of credibility, but this time the hurdles are very high,” he said, adding that Nvidia is unlikely to be able to provide an overwhelming outlook for the fourth quarter that will surprise on the market. He said it was big.

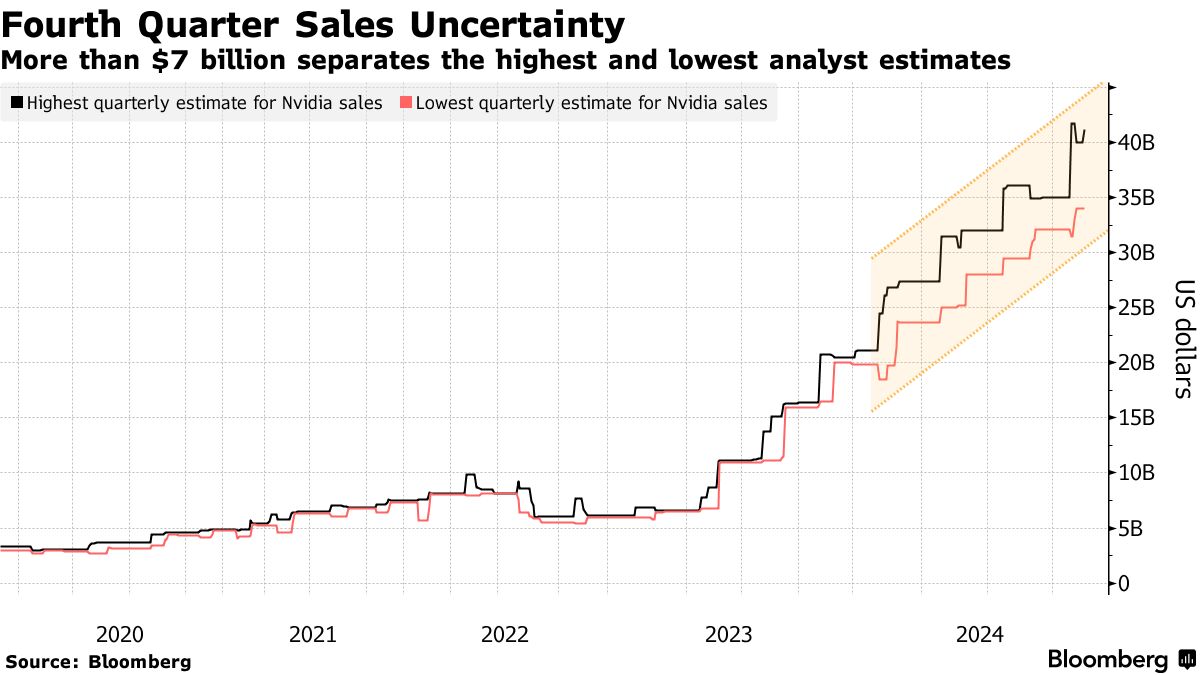

Given the uncertainty surrounding Blackwell, analysts have a wide range of expectations regarding the outlook for the fourth quarter. The revenue consensus is $37.1 billion, but the range between the highest and lowest estimates is more than $7 billion, according to a Bloomberg summary. NVIDIA usually announces its quarterly results at the same time as its earnings forecast for the following quarter.

Original title:Nvidia Traders Brace for Potential $300 Billion Earnings Move(excerpt)

What impact could Nvidia’s upcoming earnings report have on the semiconductor industry as a whole?

Interview between Time.news Editor and Dr. Alice Johnson, Semiconductor Analyst

Time.news Editor: Welcome, Dr. Johnson! Thank you for joining us today. With Nvidia’s earnings report right around the corner, the markets seem to be on edge. Can you share why the anticipation surrounding these results is so intense?

Dr. Alice Johnson: Thank you for having me! Yes, Nvidia has become a cornerstone of not just the semiconductor industry, but also tech as a whole, especially with their leadership in artificial intelligence. The upcoming earnings report is significant as it could lead to substantial price swings—up to 8%—which is quite notable. This volatility underscores the market’s sensitivity to Nvidia’s performance, particularly as it relates to the AI boom.

Time.news Editor: That’s fascinating. With estimates suggesting a possible market capitalization shift of around $300 billion, how does Nvidia’s performance influence the broader S&P 500 index?

Dr. Alice Johnson: Absolutely. Nvidia’s size and market influence mean its stock movements have more impact on the S&P 500 than many economic indicators, like the upcoming Federal Open Market Committee meeting or the Consumer Price Index. If Nvidia posts disappointing results, it could lead to significant losses not just for them, but ripple throughout the index, affecting the larger market landscape.

Time.news Editor: Given that they’re releasing their third-quarter results amid uncertainty, how do you see the predictions regarding their new Blackwell chip impacting investor sentiment?

Dr. Alice Johnson: The enthusiasm for Blackwell has been palpable, driven largely by CEO Jensen Huang’s assertions of “insane” demand. However, the delays in production mean there are considerable unknowns. Investors often struggle with uncertainty, and if Nvidia can’t meet expectations—especially with such high stakes—then it could lead to a backlash. The mixed signals from Wall Street make this even trickier.

Time.news Editor: You mentioned that Wall Street is divided on the expectations for Blackwell. Can you elaborate on what factors might be contributing to this division?

Dr. Alice Johnson: Certainly. There are several elements at play. On one hand, the demand for AI technologies is soaring, which could translate into billions in sales for Nvidia. On the other hand, production delays make it difficult for analysts to project the actual delivery timelines and revenue. This discrepancy creates uncertainty. Factors such as supply chain issues, inventory levels, and competitive pressures from rivals also play into this mix.

Time.news Editor: How should traders and investors be positioning themselves in light of this anticipated volatility?

Dr. Alice Johnson: This is a critical moment for traders. Given the potential for significant price fluctuations, those with a high risk tolerance might consider options trading to hedge against possible movements. For more conservative investors, it may be wise to observe the earnings report and market reactions before making any large bets. The next few days should provide clearer insights into Nvidia’s trajectory.

Time.news Editor: As an expert, what are your long-term views on Nvidia beyond this earnings report? Do you see it maintaining its market leadership?

Dr. Alice Johnson: While the short-term volatility is concerning, Nvidia has positioned itself as a leader in AI and semiconductor technology. If they navigate these production challenges correctly, the long-term prospects remain strong. Their commitment to innovation, along with the growing demand for AI across various sectors, suggests they can sustain their market leadership—provided they address these supply chain issues effectively.

Time.news Editor: Thank you, Dr. Johnson, for your insights today. As we await Nvidia’s results, it’ll be interesting to see how the market responds.

Dr. Alice Johnson: Thank you for having me. It’s an exciting time in the tech industry!