The inventory worth of Nvidia, the US semiconductor producer on the middle of the substitute intelligence (AI) growth, rose sharply on the twenty third. The day earlier than, the corporate introduced a extra bullish gross sales outlook that beat market expectations, suggesting AI computing funding stays robust.

The closing worth on the twenty third was $1,037.99, up 9.3%. The market capitalization has elevated by about 220 billion {dollars} (about 34.52 trillion yen) to greater than 2.5 trillion {dollars}. This improve is greater than the market capitalization of the semiconductor big Intel. Nvidia’s anticipated quarterly gross sales of $28 billion are greater than double Intel’s market expectations.

In line with the supplies launched on the twenty second, gross sales for Could-July (second quarter) are estimated to be round $28 billion. The typical analyst estimate compiled by Bloomberg was $26.8 billion. Enterprise outcomes for the February-April interval (first quarter) additionally exceeded expectations, pushed by progress within the information middle division.

With Nvidia’s inventory worth up 92% year-to-date as of the shut of normal buying and selling on the twenty second, a lot consideration was being paid as to if the most recent numbers introduced within the earnings announcement may justify the rise profound on the inventory.

Jensen Huang Chief Govt Officer

Photographer: David Paul Morris/Bloomberg

The monetary outcomes didn’t disappoint, and CEO Jensen Huang capped the joy by calling it the beginning of a brand new period. “That is the start of a brand new industrial revolution,” stated the CEO in an interview, “It is extremely thrilling.”

The robust gross sales outlook confirms Nvidia’s place as the largest beneficiary of AI investments. The corporate’s AI accelerator is a chip that helps information facilities develop cutting-edge instruments like chatbots. It has been a preferred product for the previous two years, and gross sales have elevated.

Gross sales for the February-April interval had been $26 billion, greater than triple the identical interval final 12 months. Earnings per share, excluding sure gadgets, had been $6.12. Analysts had anticipated gross sales of about $24.7 billion and earnings of $5.65 per share.

NVIDIA quarterly gross sales (hundreds of thousands of {dollars})

Supply: Bloomberg

Nvidia additionally introduced a 10-for-1 inventory break up and a 150% improve in its quarterly dividend to 10 cents per share.

Inventory costs of AI-related corporations additionally rose, together with Dell Applied sciences.

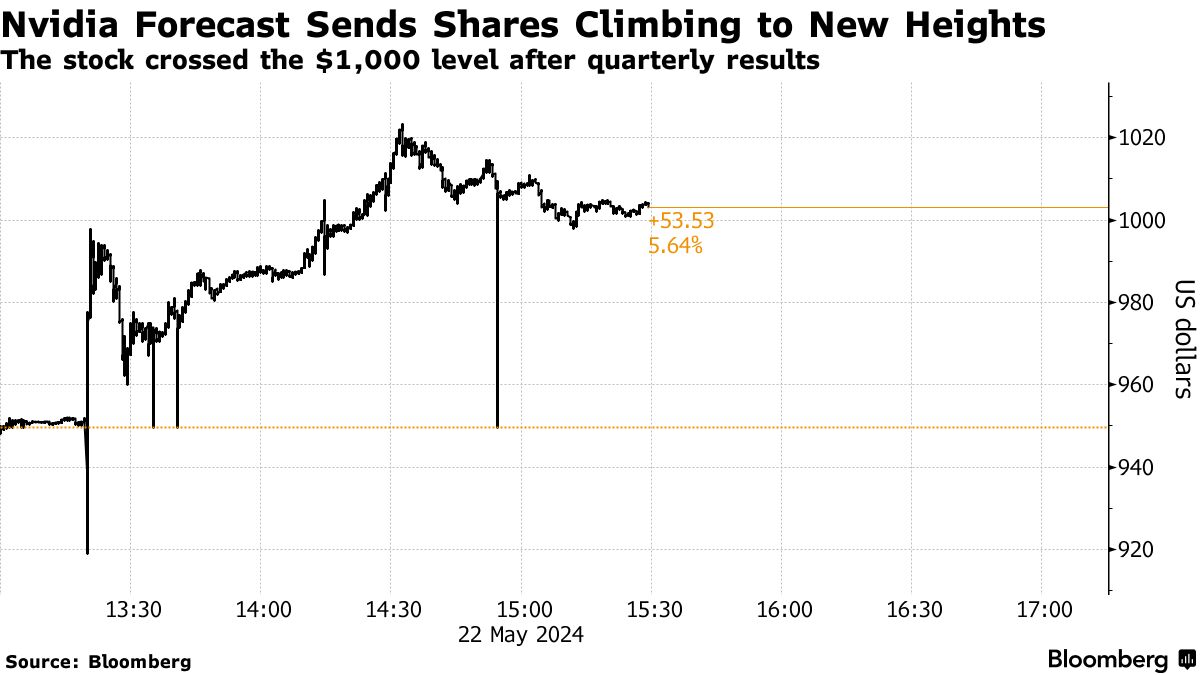

Nvidia inventory worth

Supply: Bloomberg

Gross sales by division for the February-April interval had been $22.6 billion for the mainframe information middle division. Gaming chips had been price $2.6 billion. Analysts had anticipated gross sales of $21 billion for the info middle division and $2.6 billion for the gaming division.

The corporate emphasised that it desires to increase its expertise gross sales channels past main cloud computing suppliers. Huang stated AI is changing into extra prevalent amongst shopper web corporations, automakers, biotechnology and healthcare clients.

As well as, there’s a development referred to as dominant AI, by which nations develop their very own methods, and these alternatives are creating a number of billion-dollar markets past cloud service suppliers, he stated.

CEO Huang additionally defined that the corporate’s next-generation chip platform, Blackwell, is presently in full manufacturing. “We’re prepared for the subsequent wave of progress,” he stated, laying the groundwork for an AI technology that may deal with trillions of parameters.

Authentic title:Nvidia Inventory Rises as Gross sales Forecast Delivers on AI Hopes (3)、Nvidia Rallies Anew After Rosy Forecast Reveals Strongest AI Growth(excerpt)

(Replace the inventory worth with the final worth on the twenty third)

Nvidia, a leading semiconductor manufacturer central to the AI boom, saw a significant increase in its stock value on the 23rd, following a favorable sales outlook that surpassed market expectations. The closing price on that day reached $1,037.99, climbing 9.3%, with the company’s market capitalization surging by approximately $220 billion to over $2.5 trillion. This milestone exceeded Intel’s market cap, and Nvidia’s projected quarterly sales of $28 billion more than doubled Intel’s forecasts.

According to figures released on the 22nd, sales for the second quarter (May-July) are projected at around $28 billion, surpassing the average analyst estimate of $26.8 billion compiled by Bloomberg. Nvidia’s performance in the first quarter (February-April) also exceeded expectations, particularly in its data center division.

As of the closing of regular trading on the 22nd, Nvidia’s stock had risen 92% year-to-date, leading to speculation about whether the earnings numbers reported could validate this dramatic increase. The financial results were promising, with CEO Jensen Huang proclaiming this moment as the beginning of a new industrial revolution, highlighting an exciting future ahead.

Nvidia has established itself as the major beneficiary of investments in AI, with its AI accelerator chip, vital for advancing technologies like chatbots, being in high demand over the past two years. The company’s sales for the February-April period reached $26 billion—more than triple the amount from the same period last year—while their earnings per share (excluding certain items) stood at $6.12, exceeding analysts’ expectations of $5.65 per share.

Additionally, Nvidia announced a 10-for-1 stock split and a 150% increase in its quarterly dividend to 10 cents per share. Other AI-related companies, including Dell Technologies, also experienced a rise in stock prices following Nvidia’s encouraging outlook. In the breakdown of sales by division for February-April, the data center segment generated $22.6 billion, while the gaming chips division accounted for $2.6 billion, both figures exceeding analyst projections.