2024-06-16 12:41:00

Tesla in 2020-2021 and NVIDIA in 2023-2024. Each time a inventory that data an astonishing surge in its inventory worth seems within the U.S. inventory market, there’s a firm that’s summoned by Wall Road pessimists. American community gear producer CISCOThat is proper.

How did Cisco, which was and nonetheless is taken into account the world’s greatest telecommunications gear firm, grow to be an emblem of a bubble? What are the teachings of the inventory market taught by Cisco, and the way does this relate to Nvidia? As we speak’s subject is Cisco and Nvidiano see.

*This text is a web-based model of the Deep Dive publication printed on the 14th. Subscribe to Deep Dive’s publication, ‘Financial information you may fall in love with as you learn it.’

Shovel Vendor within the Dot-Com Period

The late Nineteen Nineties, when the entire world was excited concerning the Web revolution. In the course of the sizzling ‘dot-com gold rush’ period, there was an organization that bought pickaxes and shovels. Cisco, which provides community gear comparable to switches and routers, was the principle character. Within the August 1999 annual report, Cisco CEO John Chambers proudly said: “When Cisco predicted 4 years in the past that the Web would change our lives, it appeared like a daring assertion. However now few folks doubt this. we’re The quickest rising and most worthwhile firm within the trade“It’s acknowledged as such.”

Cisco’s gross sales, which had been $2.2 billion in 1995, elevated to $18.9 billion in 2000. The typical gross sales progress price throughout that interval reached 55% per yr. Cisco’s progress appeared like it could proceed without end. Cisco’s inventory worth, which was lower than $2 in early 1995, rose vertically and hit $80 on March 27, 2000. In comparison with early 1998 ($9.68), the inventory worth improve price is a whopping 727%.. Cisco beats Microsoft (MS) No. 1 in international market capitalization (USD 570 billion)It went as much as . With this momentum, there have been rosy predictions that Cisco would obtain a market capitalization of $1 trillion for the primary time in historical past.

At its peak, Cisco’s price-to-earnings ratio (PER) was huge. The inventory worth is 205 occasions the earnings per share ($0.39 in 2000)As a result of it has reached. It was really a ‘loopy valuation.’ However Wall Road did not have a lot doubts. We had been busy elevating the goal inventory worth consistent with the rise within the inventory worth. An analyst at Chase Hambrecht & Quist on the time justified it this fashion: “Cisco has a really spectacular progress document, so the monetary neighborhood thinks about earnings three to 4 years down the street, not simply multiples of this yr’s earnings.”

After which all the things falls aside. After reaching its peak, Cisco inventory worth started to plummet. In only one yr, 85% of the market capitalization was misplaced, and in October 2002, the inventory worth fell to $8.06. It was lower into 1/10 items.

Gross sales tripled, inventory worth halved

The dot-com bubble normally refers to a surge in know-how inventory costs as a consequence of obscure expectations with out substance. however Cisco wasn’t a dot-com bubble. This can be a firm that sells precise merchandise comparable to switches and routers, not banner ads. So Cisco’s progress on the time appeared to mirror precise demand out there.

However when the bubble bursts, it seems that wasn’t the case. The overflowing liquidity as a consequence of low rates of interest and the ensuing extreme and redundant investments had been the driving pressure behind 55% annual gross sales progress.It was. The expansion that justified the 205x PER was a mirage created by the bubble. Stock piled up, and in March 2001 we needed to perform our first main layoffs. Internet revenue turned to deficit in 2001, and gross sales decreased for the primary time in 2002.

Now, 20 years later, how a lot is Cisco’s inventory worth? As of the closing worth on the twelfth, it’s $45. It’s 44% decrease than the very best worth in March 2000. Throughout that point, the inventory worth by no means went close to $80.

Are you saying our efficiency is inferior to it was 24 years in the past? no. In 2023, Cisco recorded gross sales of $57 billion, its highest ever. Earnings per share (EPS) elevated to $3.07. In comparison with 2000 (gross sales of $18.9 billion, EPS of $0.39), it has grow to be a strong firm that makes way more cash. It nonetheless ranks first in market share.

In some methods, buyers’ predictions from 24 years in the past that Cisco could be the winner within the trade had been appropriate. Nevertheless, the issue was the inventory worth. Even when there are not any issues on the firm and you make good cash, If the inventory worth is ridiculously excessive, the inventory can not proceed to run.

Similarities and variations from NVIDIA

Nvidia is the rationale why Cisco’s previous historical past was revealed intimately. Nowadays, evaluation evaluating the 2 firms, Cisco and NVIDIA, retains popping out.

It’s because NVIDIA’s inventory worth surge is so dramatic. The inventory worth has jumped 757% in only one and a half years since 2023. Nvidia has grow to be the third largest firm in market capitalization ($3.19 trillion), following Apple and Microsoft. Should you take a look at the inventory worth graph, it’s true that it seems much like Cisco in 1999.

There’s additionally one thing else in frequent. NVIDIA too A pickaxe vendor in a modern-day gold rush.That is the purpose. AI firms all over the world are lining as much as purchase NVIDIA’s high-performance GPUs for know-how improvement. As a result of demand is so excessive, NVIDIA can promote at excessive costs. Simply as there was no Web with out Cisco gear, there isn’t any AI with out NVIDIA GPUs.

Due to these similarities, the sturdy reminiscence of Cisco’s inventory worth plunge is usually cited as a foundation for Nvidia pessimism. This was additionally the outlook for Nvidia that Ark Funding CEO Cathy Wooden expressed in an investor letter final March. That is what it says.

“If (AI) software program revenues don’t explode sufficient to justify over-deployment of (GPU) capability, cloud clients particularly could pause spending and modify extra stock. In the long run, competitors (with Nvidia) will intensify as a result of, not like Cisco within the dot-com period, AMD, cloud service firms, and Tesla are additionally designing AI chips.”

Axios additionally identified this in a latest article, displaying Cisco and Nvidia inventory worth graphs aspect by aspect. “If AI firms fail to resolve a number of issues with the know-how, the demand for these particular chips (GPUs) could weaken or disappear, and the AI craze will cease. One thing comparable occurred 25 years in the past. They used to promote routers that each enterprise wanted to get on-line. Cisco was the Nvidia of the 90s Web increase.”

Nevertheless, this nonetheless seems to be a minority opinion. It’s because, numerically, the present Nvidia is a lot better than Cisco proper earlier than the bubble burst.

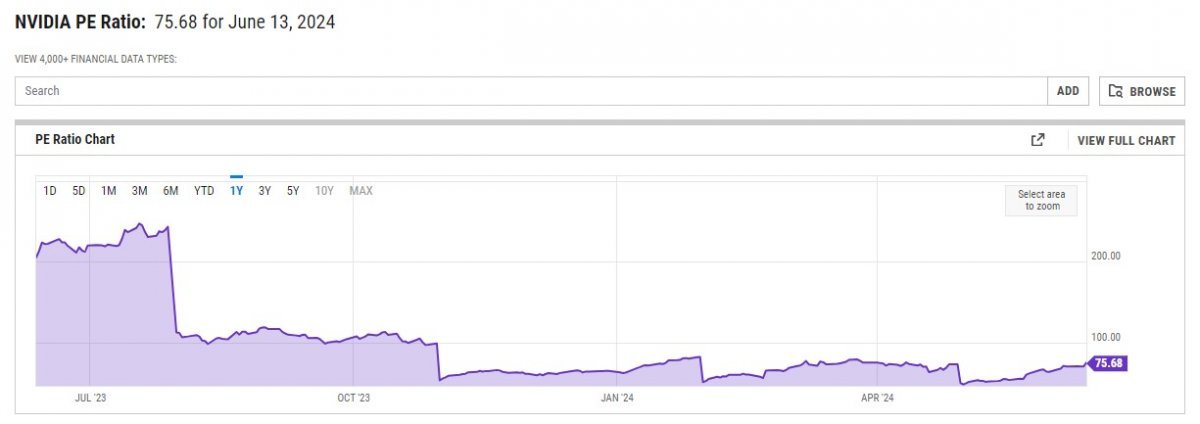

1. NVIDIA’s price-to-earnings ratio (PER) is presently round 75x. Though this can be a pretty excessive determine, it’s nothing in comparison with Cisco at its peak (205 occasions). There was a time when NVIDIA’s PER was over 200, however the PER was introduced down as earnings soared each time the quarterly outcomes had been launched.

2. Nvidia is rising a lot quicker than Cisco. First quarter gross sales elevated 262% in comparison with the earlier yr. Cisco grew solely 55% in 2000.

3. There’s additionally a distinction when it comes to profitability. NVIDIA’s gross revenue ratio continues to rise, reaching 78.3% within the first quarter.was recorded. Because of this quite a bit was left over by promoting it at a better worth in comparison with its value. Cisco’s gross revenue margin in 2000 was round 64%.

There’s additionally a distinction in qualitative phrases. Nvidia has a reasonably sturdy moat. Nvidia’s Software program platform CUDAThat is it. Since 2006, NVIDIA has supplied the programming software program CUDA totally free, and has already constructed an enormous ecosystem utilized by greater than 4.7 million builders all over the world. I/O Fund analyst Beth Kindig focuses on this level. “The CUDA platform is what software program engineers and AI engineers study to program GPUs. This helps tie them to NVIDIA. This mix is an impenetrable moat.”

Are you working out of knowledge?

Up to now, there are not any indicators that Nvidia’s progress will decelerate any time quickly. After all, that does not imply we will proceed the present phenomenal progress price without end. What is going to in the end hinder Nvidia’s progress? As talked about earlier There’s a risk that the client’s ardour for AI funding could quiet down or rivals could emerge.That is typically talked about. I want to introduce one extra attention-grabbing declare. Analysis exhibits that the enlargement of AI will quickly attain its limits.

As you already know, GPU is a chip used for AI coaching, and coaching AI requires an enormous quantity of knowledge. AI analysis institute Epoch mentioned in a lately up to date report (‘Will there be a scarcity of knowledge? Limits of increasing LLM based mostly on human-generated knowledge’). Excessive-quality knowledge for AI coaching will run out inside 2 to eight years.I assumed it could work. It’s because AI mannequin coaching is occurring a lot quicker than the velocity at which people create new knowledge. The present knowledge stock is about 300 trillion tokens, which signifies that this can run out inside a couple of years. The researchers say: “There’s a critical bottleneck. “Should you grow to be restricted by the quantity of knowledge, you’ll now not be capable of scale your mannequin effectively.”

So, knowledge just isn’t infinite, however is a way more finite useful resource than we predict. This can be a considerably shocking discovery. Irrespective of what number of pickaxes and shovels you make, for those who run out of meals to feed your employees, will not you finally be unable to mine gold? By. Deep Dive

Nvidia’s inventory worth chart is at all times shocking. I ponder how far the inventory worth, which has already damaged by means of the ceiling, will soar. To summarize the principle contents:

-If there was Nvidia within the AI period, there was Cisco within the dot-com period. Cisco, which provides switches and routers, recorded a inventory worth improve of greater than 700% in two years and ranked first in international market capitalization.

-However when the dot-com bubble burst, inventory costs plummeted. Cisco continues to be primary within the trade, however its inventory worth is half what it was 24 years in the past. The issue was not the corporate, however the ‘loopy valuation’ of greater than 200 occasions.

-As Nvidia’s inventory worth soars, pessimism is rising that it’s going to find yourself like Cisco. After all, it’s nonetheless a lot better than Cisco in 2000 when it comes to gross sales progress price and worth/earnings ratio.

-What are the danger elements that might halt Nvidia’s unbelievable progress? Just like the Web, the AI period will proceed, however remember that inventory costs could fall as quickly as the expansion price slows.

*This text is a web-based model of the Deep Dive publication printed on the 14th. Subscribe to Deep Dive’s publication, ‘Financial information you may fall in love with as you learn it.’

Reporter Han Ae-ran [email protected]

2024-06-16 12:41:00