On the 27th, the U.S. stock market saw a slight rise. The S&P 500 Index moved little near its all-time high. The market seeks clues about whether the enthusiasm for artificial intelligence (AI), which has driven the bullish market, will continue, looking towards Nvidia’s earnings report to be announced on the 28th.

| Stock | Closing Price | Change from Previous Day | Change Rate |

|---|---|---|---|

Goldman Sachs Group’s trading desk has referred to Nvidia as the “most important stock on Earth,” given its significant impact across broad indices. As a member of the “Magnificent Seven,” the company has accounted for more than a third of the Nasdaq 100’s gains this year.

The market anticipates that Nvidia’s stock price will fluctuate significantly after its earnings announcement. The options market has priced in a potential movement of about 10% in either direction following the earnings report. Nvidia’s stock price has surged approximately 160% year-to-date, and is up 1000% from the bear market low set in October 2022.

Nvidia’s Stock Price Trend

Source: Bloomberg

Anthony Saglin Bine of Ameriprise Financial mentioned, “We believe Nvidia’s earnings will have a more substantial impact on the overall market than last week’s speech by Federal Reserve Chair Powell at Jackson Hole.” He stated, “It’s time for Nvidia’s CEO Jensen Huang to move the market.”

Chris Senecal of Wolf Research anticipates that Nvidia’s earnings will set the market’s overall tone until the important employment statistics are released on September 6.

“We maintain a bullish stance, but short-term risks are tilted downwards. Seasonally, we are entering a weak period, which is further amplified this year as it is an election year,” he noted.

The Nasdaq 100 Index rose 0.3%. Nvidia’s stock increased by 1.5%. Salesforce, which is also set to announce its earnings on the 28th, declined by 0.4%. Super Micro Computer, which has been targeted by short-seller Hindenburg Research, fell by 2.6%. The Russell 2000 Index, composed of small-cap stocks, decreased by 0.7%.

Super Micro’s stock plummets as Hindenburg’s short-sell report targets it

Mark Haefele of UBS Global stated that although the tech sector might face increased short-term volatility, the AI growth story remains intact.

He added, “This week’s Nvidia earnings and Apple’s new iPhone launch will be significant catalysts to watch.” He maintained a positive outlook for quality AI beneficiaries in the semiconductor and software sectors.

U.S. Treasuries

U.S. Treasury markets were mixed. A strong demand in the two-year bond auction (amount issued: $69 billion) led to a drop of over three basis points (bp, 1 bp = 0.01%) in the two-year bond yield.

| Treasuries | Latest Value | Change from Previous Day (bp) | Change Rate |

|---|---|---|---|

In the two-year bond auction, the highest accepted yield was 3.874%, falling below the pre-auction trade closing level of 3.880%, marking the lowest level for a two-year bond auction since August 2022. There were concerns that a yield below 4% might deter investors, but this was reversed.

On the 28th, a five-year bond auction (amount issued: $70 billion) and on the 29th, a seven-year bond auction (amount issued: $44 billion) are both scheduled.

The Conference Board’s consumer confidence index for August was at its highest level in six months, but the market’s reaction to the economic indicators released that day was limited.

U.S. Consumer Confidence Index reaches six-month high – Views on the economy and prices improve (2)

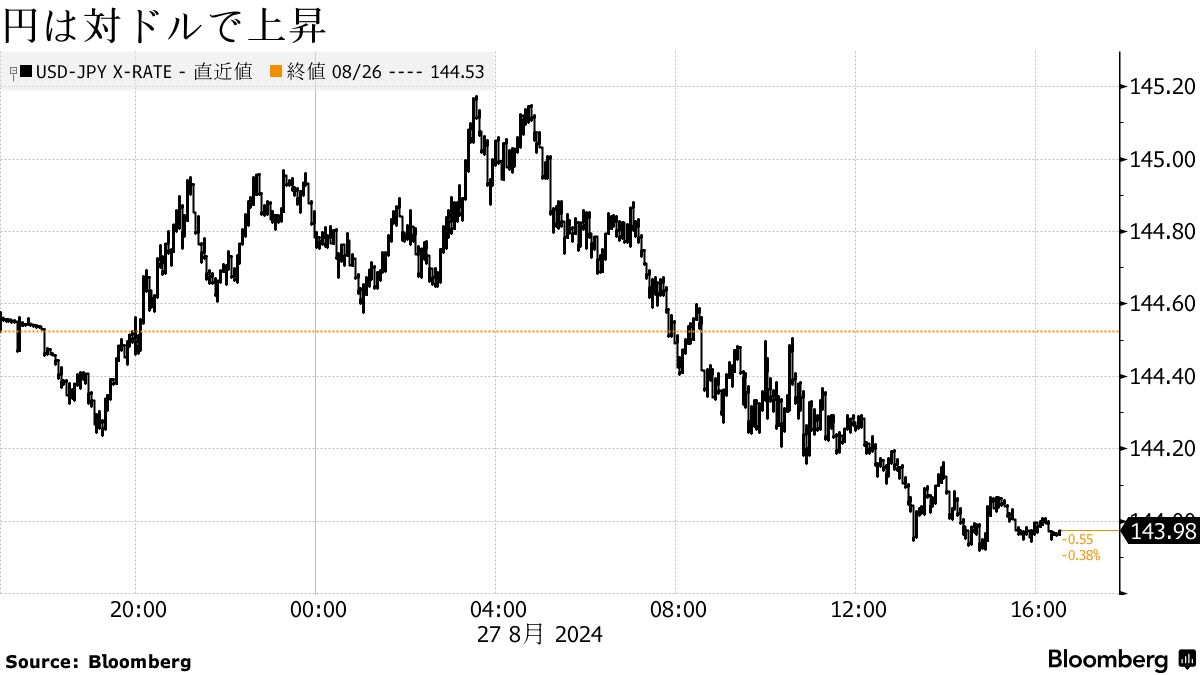

Foreign Exchange

In the New York foreign exchange market, the Bloomberg Dollar Spot Index was stable. Economists predict that the personal consumption expenditures (PCE) price index data to be released on the 30th will reinforce expectations for rate cuts by the U.S. Federal Reserve.

| Exchange Rate | Latest Value | Change from Previous Day | Change Rate |

|---|---|---|---|

The yen rose against the dollar, trading around ¥144 to $1. It was briefly bought up to ¥143.92.

A strategist from TD Securities noted in a report, “The dollar is weakening as carry trades unwind.” “The dollar continues to be influenced by interest rates, position adjustments, and momentum, and this trend may continue in the near term,” he stated.

On the other hand, he remarked, “Considering the persistent geopolitical uncertainties, softening global growth outlook, and the unclear future of the U.S. elections, the dollar is beginning to look structurally undervalued.”

European traders noted that month-end funding flows have started to be seen, with some bank models suggesting dollar buying.

Stephen Englender and Nicholas Chia, strategists at Standard Chartered Bank, said, “The dollar has moved quickly, so it may consolidate somewhat in the short term.” They commented, “Unless inflation stabilization around current levels or unexpected upside in economic activity occurs, the recovery phase for the dollar is viewed as an opportunity to sell.”

Furthermore, they continued, “We expect the dollar to weaken further next year as the interest rate differential narrows,” and added, “The risk to our base scenario is not a rapid rebound for the dollar, but rather a continuation of weakness in the short term.”

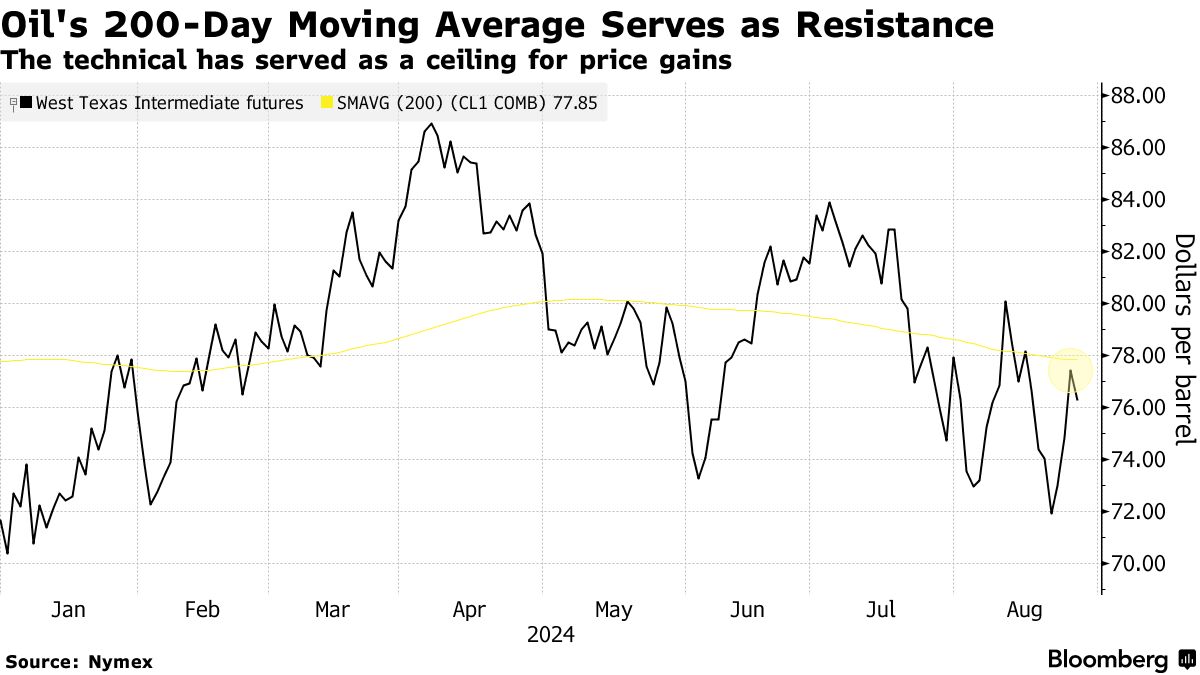

Oil & Gold

New York crude oil futures fell after four trading days of increases. Technical indicators suggested that the surge in prices due to supply disruptions in Libya was excessive.

West Texas Intermediate (WTI) futures had increased by over 7% over the previous three trading days but fell by 2.6% on this day.

Alex Kuptsikevich, a senior market analyst at FxPro, noted, “Short-term technical factors are at play. WTI has surpassed $77 per barrel, so the momentum of the past three days has faded.” He added that the 200-day moving average has functioned as a support line for much of this year but could also serve as a resistance line.

On the New York Mercantile Exchange (NYMEX), the WTI futures for October ended at $75.53 per barrel, down $1.89 (2.4%) from the previous day. London ICE’s Brent for October fell 2.3% to $79.55.

Spot gold prices were stable. The market is focused on inflation statistics which could provide clues regarding the trajectory of U.S. rate cuts.

The core price index for U.S. personal consumption expenditures (PCE) for July, to be released on the 30th, is expected to show a deceleration with a three-month moving average rising at an annual rate of 2.1%. If this occurs, it would be slightly above the Federal Reserve’s target of 2%.

Gold prices have risen by over 20% this year, supported by expectations of rate cuts and aggressive purchases by central banks, amidst ongoing conflicts in the Middle East and Ukraine, which have driven safe-haven demand.

Gold futures for December on the New York Commodity Exchange (COMEX) settled at $2552.90 per ounce, down $2.3 (less than 0.1%) from the previous day. As of 1:50 p.m. New York time, spot gold prices are up $1.5 (less than 0.1%) at $2519.54. Earlier in the day, they had dropped by 0.6%.

Original Title: Stocks Churn as Nvidia’s 1,000% Rally to Face Test: Markets Wrap (Excerpt)

Treasuries End Mixed With Curve Steeper After Two-Year Auction

Dollar Pauses as Market Awaits Month-End Flows: Inside G-10

Oil Falls in Technical Correction From Rally on Libya Disruption

Gold Edges Lower as Traders Seek Clues on Fed Path for Rate Cuts