Following a loss of $279 billion (approximately 40.5 trillion yen) in market capitalization on the 3rd, there is increasing caution in the market regarding how much further the share price of semiconductor giant Nvidia may drop.

Chief Global Strategist at Freedom Capital Markets, Jay Woods, points out that a significant level to watch is $100, which is around the August low on a closing basis.

Woods stated, “If Nvidia’s stock falls below the August low, it would suggest a shift in momentum at least from a technical standpoint,” adding that “buying is likely to occur around $100, and it will likely trade sideways for a while from there.”

The recent drop (14% over three trading days) was triggered by the revenue forecast announced earlier, which did not meet investors’ high expectations. On the 3rd, two survey reports were released that expressed caution regarding corporate spending on artificial intelligence (AI), further unsettling investors. Bad news continued after the close, with Bloomberg reporting that the U.S. Department of Justice has issued a document subpoena to the company as part of its antitrust investigation.

Portfolio Manager at Evercore Wealth Management, Michael Kirkbride, explains that the problem for Nvidia shares is the lack of imminent positive catalysts.

He noted, “We are currently in a bit of a vacuum period. While we have passed earnings season, September is packed with many economic indicators coming out,” adding, “During such a vacuum, the market tends to become very short-term and reckless.”

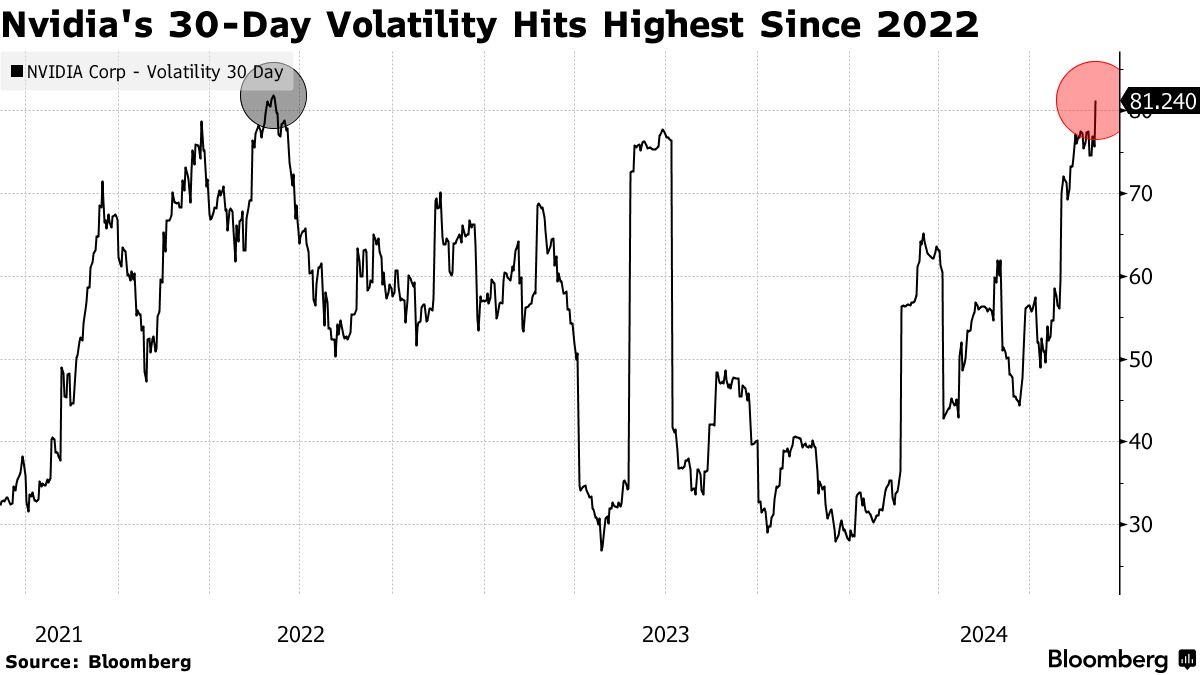

The plunge on the 3rd marked the seventh time in the past two months that Nvidia’s stock experienced a movement exceeding 6% in a single day. According to data compiled by Bloomberg, Nvidia’s 30-day volatility is at its highest level since mid-2022.

However, both Woods from Freedom Capital and Kirkbride from Evercore remain optimistic about Nvidia shares in the long term.

Woods suggests that there is no need to panic over the recent sharp drop. Kirkbride sees no fundamental issues with Nvidia itself or its earnings. He stated, “We are still long-term holders, and we have heard nothing that would change the narrative regarding Nvidia or its customers and their spending plans.”

Original title: Nvidia Rout Has Traders Watching $100-Share Level Amid ‘Vacuum’ (excerpt)