2024-05-26 15:22:38

[토요기획] The world of international change sellers who’re combating for the primary time… International change vendor on the forefront of the international change market

Use casual language and abbreviations for second-level work… Meals are sometimes solved with delivered meals.

To commerce with cool-headed evaluation… Masking financial, social and political points

“You’re engaging even once you’re too busy to go to the toilet”… Gained-Greenback change charge anticipated to rise and fall

Expectations of a Federal Reserve rate of interest lower have an effect… “Preparations comparable to enlargement of international change reserves are crucial.”

《‘Struggle with out gunshots’ The world of international change sellers

International change sellers at business banks are waging a ‘warfare with out gunfire’ day-after-day. It’s stated that on days when change charge fluctuations are extreme, it’s a must to eat lunch within the dealing room and even can not go to the toilet correctly. We met these on the forefront of the international change market.

“10 offered at 2.8!” (Promoting $10 million at 1372.8 received)

“Completed!”

At 9 a.m. on the 2nd, calls started pouring in from all around the dealing room on the 4th ground of Hana Financial institution’s predominant department in Jung-gu, Seoul. This can be a name from firms seeking to commerce international change with the opening of the home international change market. International change sellers reply the telephone and instantly verify the change charges of nations world wide, together with the greenback, euro, and yen, utilizing eight screens positioned in entrance of them, and start dealing. As sellers shouted cipher-like change charge quotes one after one other, the dealing room immediately changed into a ‘battleground with out gunfire.’

● Do enterprise in easy and abbreviated type, and have lunch within the dealing room.

The day the reporting group visited the dealing room was proper after the U.S. Federal Reserve held a Federal Open Market Committee (FOMC) assembly and introduced a freeze on the benchmark rate of interest. Thankfully, there was no vital change within the won-dollar change charge on this present day, however sellers seemed nervous even earlier than the market began because the change charge might soar unexpectedly after the FOMC assembly.

Seol Jong-moon, supervisor of the FX platform division at Hana Financial institution, who has been a international change vendor for 15 years, stated, “I take a look at international information and financial experiences day-after-day, however when the market begins, the change charge typically fluctuates unexpectedly. The second proper earlier than the market begins is probably the most tense and solemn second.”

When the market opened, ranks disappeared from the dealing room. He stated that as a result of the change charge modifications by the second, it’s handy to talk briefly informally to get work achieved rapidly. When one vendor shouted, “50 offered at 9.8!” (50 million {dollars} offered at 1,379.8 received), one other vendor appeared to not have heard accurately and shouted, “Once more!” Solely after loudly shouting the change charge quote once more did a brief response, “Dun!” come again from the opposite facet.

International change sellers buy international change and derivatives used within the worldwide monetary market, such because the greenback and euro, when they’re low cost and promote them when they’re costly, making a revenue or finishing up international change transactions for firms which have a requirement for international change. do.

International change sellers use ‘abbreviations’ for environment friendly work. For instance, “offered” means promoting, and “purchased” means shopping for. Completed implies that the contract has been concluded, and the ‘1’ that sellers name out throughout international change transactions usually means $1 million.

International change sellers, who’re anxious for each second, solely name out the one’s digit and the primary decimal place for the change charge whereas buying and selling. It’s because there is no such thing as a time to recite the numbers one after the other. It could be troublesome for the common individual to know, however sellers can perceive it straight away as a result of they’re all trying on the similar change charge graph.

The international change sellers by no means took their eyes off the eight screens in entrance of them. On every display screen of the monitor, there was a graph of change charges that modified by the second, a transaction execution system, and international information websites comparable to Bloomberg. One vendor stated, “It could look hectic, however sellers have loads of statistics and knowledge to have a look at, so there are occasions once you want there have been extra screens.”

It was already lunch time, however a few third of the sellers didn’t stand up from their seats. With the intention to sustain with the ever-changing change charges, there is no such thing as a alternative however to depart a standby group within the dealing room. Those that stayed had lunch bins and salads delivered by an app, ate them rapidly, and went again to work. On days when change charge fluctuations are extreme, most individuals have to remain within the dealing room and eat a fast meal with delivered meals.

Even within the afternoon, the mouths and palms of international change sellers had been busy. It’s because lots of of international change transactions have to be concluded a day whereas on the similar time checking international information retailers comparable to Bloomberg to rigorously verify for any components which will trigger change charges to alter.

● “Even when you find yourself afraid of sudden change charge volatility”

Because the won-dollar change charge rose considerably this 12 months, home banks’ international change administration efficiency changed into a deficit in comparison with the identical interval final 12 months. In response to the monetary sector on the twenty third, the international change transaction losses of the 4 main business banks (KB Kookmin, Shinhan, Hana, and Woori Financial institution) within the first quarter of this 12 months (January to March) totaled 301.6 billion received. In comparison with the 97.5 billion received surplus within the first quarter of final 12 months, transaction revenue decreased by almost 400 billion received in comparison with the earlier 12 months.

The rationale why international change transaction losses at main business banks elevated considerably is as a result of the change charge jumped to 1,400 received in the course of the day final month, resulting in elevated volatility and elevated international change losses. International change sellers stated that they all the time really feel concern of sudden modifications available in the market as a result of they conduct transactions based mostly on change charges that fluctuate each second. Specifically, buying and selling a big amount of cash in a brief time frame by understanding the change charge pattern could cause loads of psychological burden and trauma when a big loss is incurred.

Supervisor Seol stated, “I used to be confused by the sudden rise within the yen early this morning, however the vendor I used to be working with responded stably.” He added, “Even when the market flows unexpectedly, comparable to when the change charge immediately soars, the vendor’s job is to conduct transactions in response to the scenario with out panicking. “Function,” he defined.

With the intention to survive within the quickly altering change charges, international change sellers should intently monitor the financial, political, and diplomatic conditions of nations world wide. There are greater than only one or two international statistics and knowledge that you might want to verify each time. It’s essential to rigorously monitor traits in base rates of interest world wide, in addition to financial development charge, client value index, employment charge, and varied social and political points.

Director Lee, head of the S&T Middle at Shinhan Financial institution, stated, “To foretell market traits, we all the time search for knowledge or articles that would have an effect on the change charge.” He added, “When change charge fluctuations are extreme, I keep up all evening monitoring change charge traits even after work.” “I do it,” he stated.

As a result of the change charge modifications each second, it isn’t simple to go to the toilet throughout work hours. Choi Eun-ji, an assistant supervisor at KB Kookmin Financial institution’s market operations division who has been a international change vendor for 4 years, stated, “Once I’m actually busy, there are occasions once I overlook that I even needed to go to the toilet and go to work.”

One of many difficulties sellers face is that they can’t make or obtain any private calls or messages inside the dealing room. It’s because the usage of cell phones is prohibited for safety causes as transaction info, and many others. could also be leaked. Due to this case, members of the family typically name the dealing room workplace straight when one thing pressing occurs at house.

Regardless of this busy each day life and high-intensity work, the recognition of international change sellers inside banks is sort of excessive. Assistant Supervisor Choi stated, “(Sellers) are extremely popular inside the financial institution as a result of the work is advanced, you’ll be able to study rather a lot about something, and you’ll construct your individual experience,” including, “It is without doubt one of the departments that younger bankers particularly wish to come to.” stated.

● ‘Excessive and low’ change charge anticipated to be round 1,200 received within the second half of the 12 months

The won-dollar change charge, which closed at 1,288 received on the finish of final 12 months, confirmed instability, exceeding 1,400 received at one level throughout final month’s buying and selling as expectations for a U.S. base charge lower receded and the Center East battle intensified.

All three international change sellers who had been interviewed by the reporting group predicted that the won-dollar change charge this 12 months will present an upward and downward pattern, and that the won-dollar change charge on the finish of this 12 months will likely be between 1,270 and 1,290 received. Because the timing of the Fed’s base charge lower was pushed again additional than market expectations, the primary half of the 12 months (January to June) noticed a excessive change charge pattern, however within the second half of the 12 months (July to December), expectations for a full-fledged U.S. base charge lower had been rising and the won-dollar change charge fell. Their widespread evaluation is that there will likely be a downward pattern.

The Korea Institute for Worldwide Financial Coverage (KIEP), a government-run analysis institute, additionally predicted in its ‘2024 World Financial Outlook’ report on the twenty first that the greenback will likely be underneath stress to weaken attributable to expectations of a U.S. base rate of interest lower within the second half of this 12 months.

Nonetheless, there are additionally vital variables. There are a lot of main points such because the timing of the Federal Reserve’s rate of interest lower, geopolitical dangers triggered by the warfare within the Center East, and the US presidential election scheduled for November this 12 months, so won-dollar volatility might improve relying on the scenario.

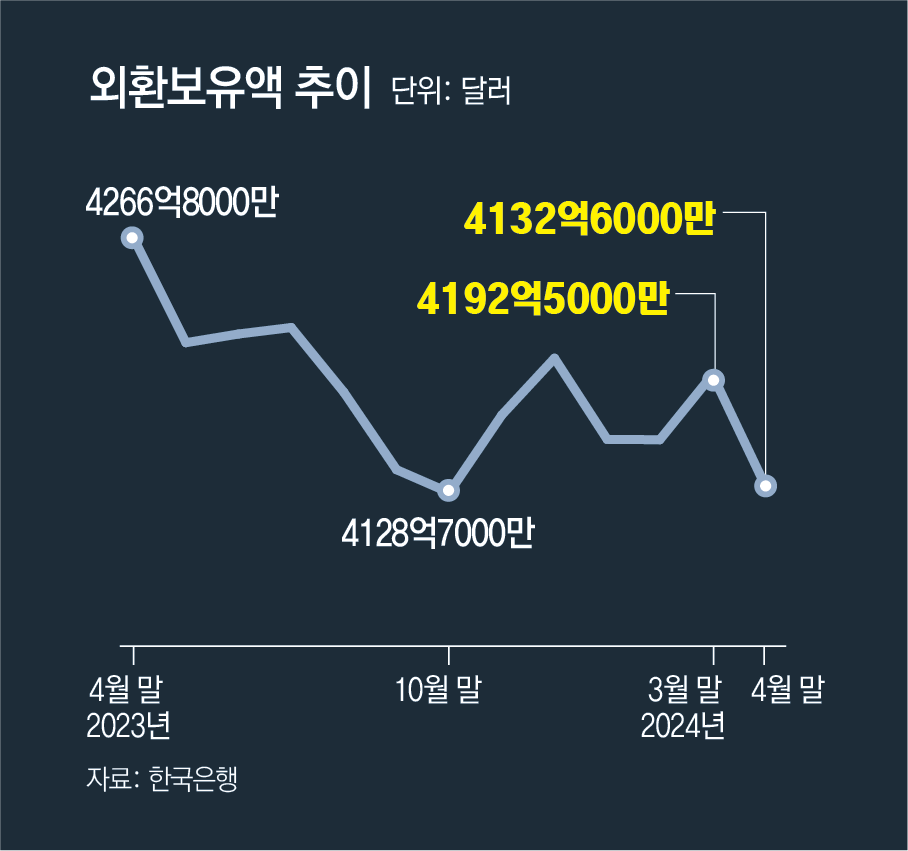

Because the won-dollar change charge might fluctuate considerably once more relying on the difficulty, consultants level out that preemptive responses, comparable to increasing international change reserves, are crucial. In response to the Financial institution of Korea, international change reserves as of the tip of April had been $413.26 billion, down $5.99 billion from the tip of March ($419.25 billion). It’s analyzed that international change reserves have decreased as a result of international change authorities’ efforts to defend the change charge so as to forestall a speedy rise within the won-dollar change charge and the lower in international foreign money deposits of monetary establishments.

Lee Jeong-hee, professor of economics at Chung-Ang College, stated, “Because the change charge might fluctuate once more relying on international points within the second half of the 12 months, the federal government should take preemptive measures comparable to stabilizing the change charge by growing international change reserves way more than now.”

Reporter Soh Seok-hee [email protected]

2024-05-26 15:22:38