He Mexican peso continues to resist the feared 20 units per US dollar at the beginning of today’s trading session, Thursday, August 29; in the morning it reaches 19.82 Mexican pesos.

However, the Today’s exchange rate Thursday, August 29 It occurs after the approval of the opinion of the reform to the Judicial Branch; but by August 27, the currency was placed at 20 pesos per dollar, higher level from December 2022.

The weight exceeded 20 pesos On Tuesday, August 27, when it was located in 20.14 units for sale at CitiBanamex branch offices, which represented an increase of 1.21% or 24 cents compared to the close of yesterday, Monday, August 26.

According to information from Bloomberg, the Mexican peso opened in international markets at 19.60 units per dollar, a fact that means a depreciation of 1.26% or 24 cents compared to Monday, August 26.

Peso resists the feared 20 units per dollar today, Thursday, August 29

For Thursday, August 29th, Mexican peso reaches 19.82 units against the US dollarwhile continuing resisting reach 20 pesos.

Peso dollar today Thursday August 29 (Especial)

A financial analysis report from Grupo Monex assures that the Mexican peso today, Thursday, August 29, extends the recoil and is positioned in the second place within the currencies of emerging countries what show greater losses against the dollar.

Today, the exchange rate resumes the upward trend after a slight pause of consolidation in the previous session, affected by the nervousness surrounding the judicial reform and its implications for the Mexican economy.

Peso continues to regain ground: this is how it closes today, Wednesday, August 28

At the close of trading today, Wednesday, August 28, as seen in the exchange rate of the Bank of Mexicohe The peso stood at 19.6417 units per dollar; or 19.68 according to Google Finance.

Although its publication in the Official Gazette of the Federation for Thursday, August 29 would be 19.66 pesos per dollar.

For its part, this is the Exchange rate at the close of trading today, Wednesday, August 28 approximate in different banks:

- Banca Afirme: 18.70 pesos for purchase | 20.20 pesos for sale

- Banco Azteca: 18.40 pesos | 20 pesos

- Banorte: 18.40 pesos | 20 pesos

- BBVA Mexico: 18.79 | 19.93 pesos

- Cibanco: 18.60 | 20.09 pesos

- Citibanamex: 19.07 | 20.15 pesos

- Inbursa: 18.80 | 19.80 pesos

- Scotiabank: 17 pesos | 20.60 pesos

Dollar drops to 19.78 Mexican pesos today, Wednesday, August 28

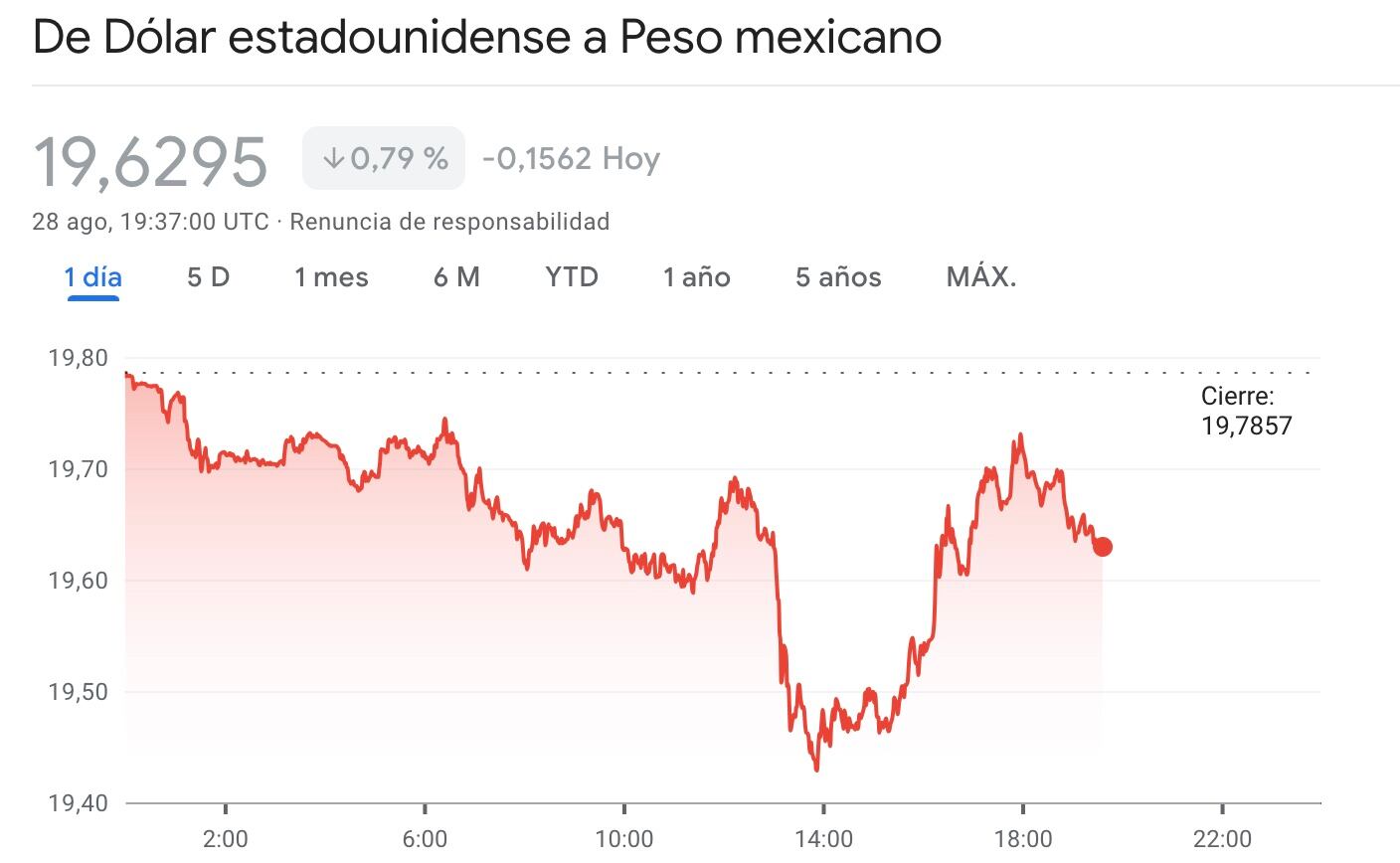

Today Wednesday August 28th The US dollar reached 19.7857 pesoswhich means an appreciation of the national currency by 36 cents.

However, by 19:37 UTC time, the exchange rate reached 19.6295 Mexican pesos per dollar.

At the opening of the foreign exchange market session, the Mexican peso regained ground and positioned itself in first place among the currencies of emerging countries.

On August 28, the exchange rate reversed part of the decline from the previous session, in light of the latest comments from the president-elect Claudia Sheinbaumwhich suggests the Caution in the approval process for judicial reform.

Mexican peso against the dollar on August 28 (Screenshot)

Dollar close to 20 Mexican pesos after approval of the ruling on the reform of the Judicial Branch

He The price of the dollar approached 20 Mexican pesos Today, Tuesday, August 27, this follows the approval of the opinion of the reform to the Judicial Branch in the Chamber of Deputies, a fact that generated uncertainty in the exchange market in Mexico.

According to economic analysts at Monex and Base, the depreciation of the peso is due to the Investors’ uncertainty about the reform of the judiciary and the disappearance of autonomous institutions, since they claim that the initiative puts at risk the commercial relationship of North America with the United States and Canada.

In this sense, analysts consider that this initiative, which President Andrés Manuel López Obrador (AMLO) and President-elect Claudia Sheinbaum seek to promote, could slow down new investments y stop reinvestment of profits as well as the recruitment of staff in companies located in Mexico.

In other words, according to analysts, the reform of the Judicial Branch could lead the Mexican economy into a recession.

Dollar close to 20 Mexican pesos: AMLO attributes exchange rate to external factors

Around the The price of the dollar almost climbed to 20 Mexican pesos, President Andres Manuel Lopez Obrador (AMLO) made a statement today, Tuesday, August 27, in response to questions from the press about the exchange rate.

In this regard, the president said that “there is nothing to fear” and attributed the depreciation of the Mexican currency to external factors:

“There is nothing to fear, and if there are changes in the exchange rate, like yesterday, for example, it has to do with external factors, like what is happening with Japan, the United States, nothing to do with the Judiciary, as the columnists, experts, spokesmen of the conservative and corrupt block lie. Nothing, it is very good (the economy in Mexico), we have no problem with that.”

AMLO

It should be remembered that US financial corporations, such as The Bank Of America o Morgan Stanleywarned about the alleged risks which would bring reform to the Judiciary.

In this context, López Obrador explained that in the past the Financial rating agencies “were the ones that dominated the countries, they imposed the agendas”a fact through which “they were dedicated to transferring the assets of the nation, of the people of Mexico, to private individuals through privatization. We do not want the assets of the people of the nation to continue being handed over.”

“We understand that you are upset by the policy we are pursuing, but you cannot even claim that it is an inefficient, failed policy, because the results are there. In what country have there been better economic results than in Mexico in recent years? In the United States, in Germany, France, where?”

AMLO

2024-08-30 00:49:38