Military technology maker Rafael is looking for new growth engines. ToCalcalist It is learned that the state-owned company is in talks to buy up to 50% of the shares in Plassen Sasa. Plassen, which is fully owned by Kibbutz Sasa from the Galilee, is one of the world leaders in the field of vehicle protection.

Read more in Calcalist:

The deal that is being formed will be implemented in several stages. In the first phase, Rafael will acquire 15% of the shares in Plassen Sasa, and later will increase its holding in a few strokes until it reaches a 50% holding. There are gaps between the sides. The value of Plassen Sasa in the first phase is somewhat surprising and will be only NIS 500-400 million. In the next stages, however, the value will be significantly higher, in line with the expected improvement in the company’s results.

3 View the gallery

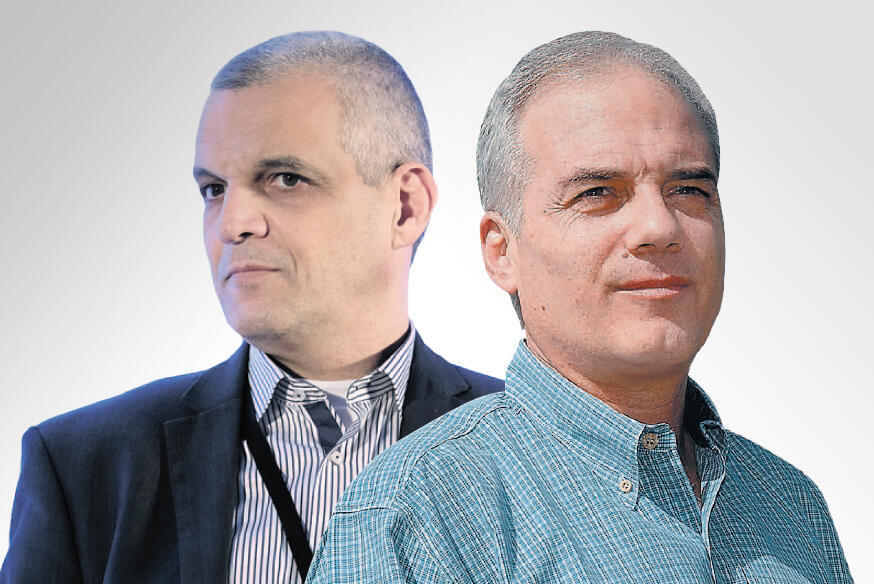

On the right, Plassen Sasa CEO Danny Ziv and Rafael CEO Yoav Har Even

(Photos: Gil Nehushtan, the company’s website)

This is a surprising current value because in the early 2000s and the first decade of these years, when Plassen Sasa was at its peak, had a sales turnover of $ 3-4 billion and earned hundreds of millions of shekels each year, it was valued at NIS 2-3 billion. Accordingly, the company distributed generous dividends and made Kibbutz Sasa one of the richest kibbutzim in the country.

Plassen Sasa manufactures protection for military vehicles, aircraft and vessels. Among other things, it produces protective additives that resemble scaly armor. Plassen Sasa also manufactures ceramic protective vests and ballistic vests based on the same materials from which the vehicle protection is manufactured. In addition, the company develops technologies for the production of protective parts that are made of carbon fiber and are intended for the civilian automotive industry. These components contribute to reducing the fuel consumption of the vehicles.

3 View the gallery

Plassen factory in Kibbutz Sasa

(Photo: Gil Nehushtan)

Plassen Sasa’s main product is a protected vehicle called the “Sand Cat” which is based on a Ford 550 chassis and weighs 8.5 tons. It can carry up to 11 people and is used for patrols and ongoing security missions. It can be equipped with missiles and launch facilities. This vehicle was sold to armies and bodyguards on four continents. One of the countries that purchased it is South Korea, which equipped it with Raphael’s systems. The Israeli Border Police uses it as well.

In the civil field, Plassen Sasa, which is managed by Danny Ziv, operates through subsidiaries such as Plassen Carbon Composite, which manufactures products from composite materials for civilian vehicles. Customers of this company include Chrysler and General Motors, which use the company’s products in the luxury Corvette and Wiper models.

At the beginning of the first decade of the millennium, Plassen Sasa’s products were used by American forces in Iraq and Afghanistan. The extensive campaign contributed to the launch of the company’s results. In 2010, it also won the Outstanding Exporter Award from the Ministry of Economy and Industry, as it was selected as a shield for US military vehicles in tenders totaling billions of dollars. Accordingly, in 2009-2010 it posted record sales of $ 3-4 billion per year.

But with the withdrawal of American forces from Iraq and Afghanistan, the U.S. military’s need for Plassen Sasa’s products diminished. As part of which it cut its workforce in half and dropped from a workforce of 1,000 to a workforce of only 400-500. Sales to the IDF have also begun to decline, and this trend continues to this day. The deal with Raphael may be to some extent a solution to this problem.

The IDF and the U.S. military were not the only problems for Plassen Sasa. In the last decade, there has been a decrease in the volume of military confrontations in the world in general, and those involving battles and armor in particular, since the war has largely moved to the ballistics and cyber fields. Due to the distress the company went into, Plassen Sasa decided to change its face. It began to develop, alongside military products, products suitable for the civilian industry.

Entering the civilian sector led to a renewed increase in its revenues, and the number of workers again crossed the thousand mark. Today, 60% of the workers are employed in the United States and France. At the same time, Plassen Sasa began looking for a partner with a strong presence in the security field. This search led her to Rafael’s arms, which have significant strengths in marketing.

3 View the gallery

Armored vehicle made by Plassen

(Photo: Company website)

Raphael, which is run by Yoav Har Even, for its part, is looking for new growth engines. In 2020, the year of the corona, it showed an 18% decrease in new orders totaling $ 2.3 billion, a decrease of 0.8% in total aggregate, which amounted to $ 7.1 billion and a 15% decrease in net profit, which amounted to $ 94 million. This is at a time when its counterparts in Israel, IAI and Elbit, actually showed record results. This was due to the fact that Raphael’s exports failed to cover the weakness of sales in the country.

Last April, Rafael raised NIS 805 million in bonds from institutional entities in Israel. More than a quarter of the amount was intended to finance an extensive process of upgrading the company’s working conditions, in order to better compete with manpower, especially engineers, who are in demand among large technology companies. The balance of the amount, apparently, is intended for investment in growth, for example through the purchase of Plassen Sasa.

And if so, why would Rafael purchase only 50% of the deal? Due to government regulation. Maintaining above this rate will turn Plassen Sasa into a government company and impose a variety of regulations and restrictions on it. This will limit Rafael’s ability to steer the company’s business in a way that will significantly contribute to its growth.

This was also the case in 2018, when Rafael decided to acquire the UAV manufacturer Aeronautics, which was traded on the Tel Aviv Stock Exchange at the time. In order not to hold more than 50% of Aeronautics and make it governmental, Rafael acquired only 50% and added a partner to the deal – Avichai Stolro – who acquired 50%, and together they made the company private. The two paid NIS 850 million for the full share of Aeronautics, while providing businessman Aaron Frenkel with a nice round. Frenkel joined Aeronautics at the end of 2018 and purchased shares for about NIS 90 million. About a month later, the deal with Rafael Vestolero came to the table. Frenkel received NIS 170 million, so he achieved a return of almost 100%.

These days Frenkel may find himself making a bigger round operation. Frenkel owns 37% of the shares of the Gav Yam-producing real estate company. Properties and Building, which owns 44.5% of the shares, is preparing to purchase Frenkel’s shares for at least NIS 3 billion, while Frenkel has invested a total of NIS 2 billion in the purchase of the shares.

.