Banks (photo by Magma Images)

The month of October was a good month in the financial markets, the reason for this is mainly the bull trap that the big players led to, but the official reason was much more prosaic. “The central banks will do everything so that the economies do not slide into recession” said the main players in the markets and perhaps in a kind of wishful thinking they sold themselves this story and they were also the buyers of their own goods.

This story brought the stock market to an excellent month. A month of sharp increases as if we were at the end of the crisis and not at the beginning, but let’s not let reality confuse anyone and stick to the celebration that no one wants to destroy.

So if everyone is talking about curbing the monetary tightening of the central banks, then the obvious conclusion is that the market has fallen too much since the beginning of the year and now all that is left for it is to correct upwards.

So if this is the face of things, then the conclusion that was requested is that the banking system will not be forced sometime next year to start setting aside considerable amounts for secured debts and the real estate market will not come to a standstill and they will not tighten the underwriting in the mortgage sector and that’s all good.

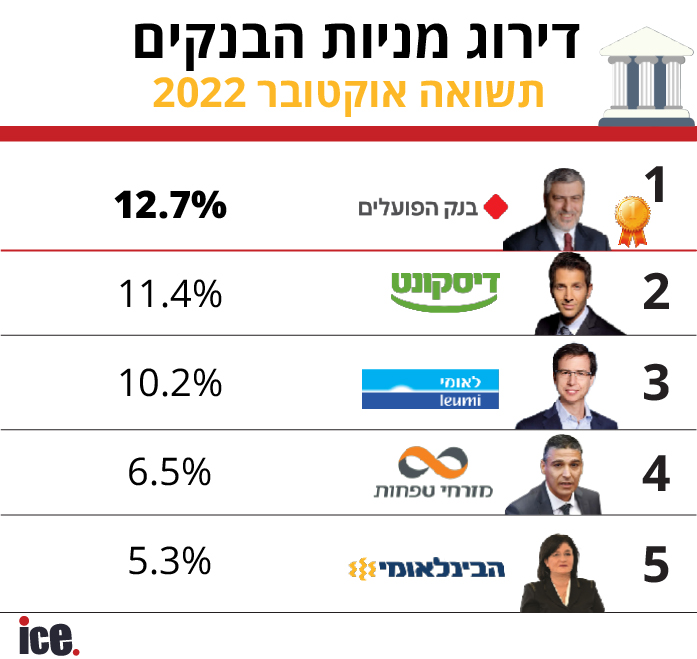

So after we described the picture that the big investors told themselves last month, it is requested to check what the shares of the big banks did and here the story is quite normal. Bank Hapoalim was the biggest beneficiary of this process because at the end of the day, Hapoalim’s credit portfolio has undergone a significant improvement in recent years, so it will be able not to write off too much money.

Discount was the second bank after him and it is for a similar but different reason. Discount stormed the markets in the last year and a half and significantly increased its credit and hence theoretically at least, the risks it took were higher and hence more profitable, if everything goes as it should.

The third bank was Leumi, which in the last year and a half has been very aggressive in providing credit. He enters into adventures that, if they go well, will bring him handsome profits, but if not? Houston, we’re going to have a problem.

Mizrahi and International are considered very conservative banks in the areas of credit. Mizrahi is deep in the mortgage sector and International does not enter into adventures, therefore the shares of these two banks produced the lowest yield last month. But make no mistake, this low return is not a bad return at all when selling dreams.

Comments to the article(0):

Your response has been received and will be published subject to the system policy.

Thanks.

for a new comment

Your response was not sent due to a communication problem, please try again.

Return to comment