2024-08-01 12:16:22

Total sales in the second quarter: 74 trillion won, operating profit: 10.4 trillion won

“HBM Expansion” Nvidia, etc. Delivery Imminent

Samsung Electronics has surpassed Taiwanese semiconductor company TSMC in semiconductor sales for the first time in two years. Analysis is emerging that the 8-layer and 12-layer 5th generation high bandwidth memory (HBM) ‘HBM3E’ products, which have attracted the attention of the global industry, are about to be supplied to major artificial intelligence (AI) semiconductor companies, including Nvidia and AMD.

Samsung Electronics announced on the 31st that it recorded consolidated sales of 74.7 trillion won and operating profit of 10.44 trillion won in the second quarter (April to June). Compared to the same period last year, sales increased by 23% and operating profit increased by nearly 16 times.

Samsung Electronics’ earnings surprise was largely due to the semiconductor boom led by AI. The semiconductor (DS) division’s sales in the second quarter soared 94% year-on-year to KRW 28.56 trillion. This surpassed the previously announced sales of Taiwanese foundry (semiconductor contract manufacturing) company TSMC in the second quarter of NT$673.51 billion (KRW 28.3 trillion). Samsung Electronics’ DS division sales, which had been lagging behind TSMC since the second quarter of 2022, succeeded in reversing this quarter. The DS division’s operating profit also jumped by KRW 10 trillion year-on-year to KRW 6.45 trillion.

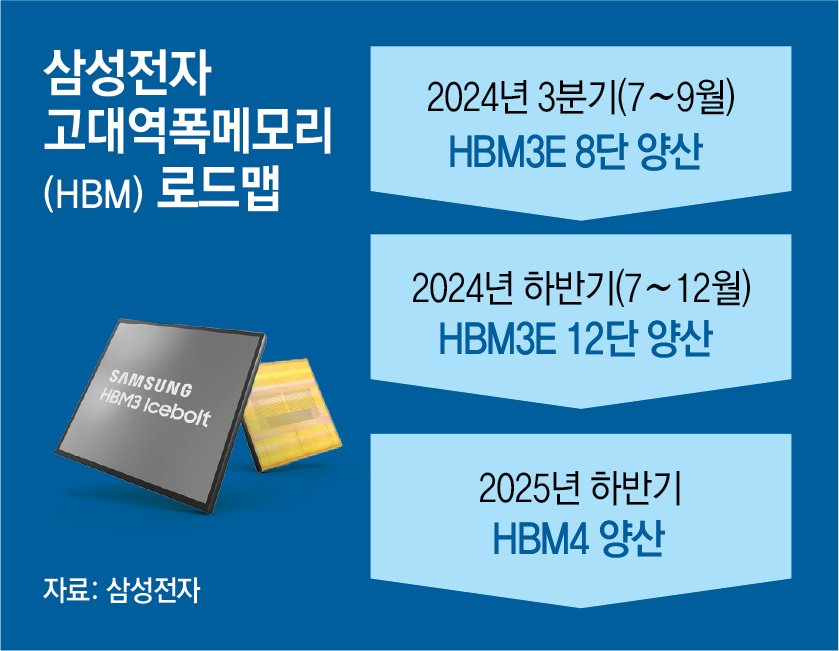

Samsung Electronics also released a roadmap for its HBM business. In a conference call announcing its earnings, Kim Jae-joon, Executive Vice President of Samsung Electronics’ Memory Business Division, said about HBM3E, which Nvidia and others are currently conducting quality tests for, “We plan to begin supplying 8-layer products in earnest during the third quarter (July to September) and 12-layer products in the second half (July to December).” This suggests that Nvidia’s supply in the second half has become visible. He also said, “As of recently, the amount for which customer (supply) agreements have been completed this year is nearly four times that of last year,” and “We plan to expand the supply next year by more than double that of this year.”

Samsung, 5th generation HBM supply imminent… “Second half sales to increase 3.5 times that of first half”

Semiconductor sales surpass TSMC by 28.5 trillion

When the 5th generation HBM enters full-scale mass production

Significant performance improvement along with rising DRAM prices

“Expecting benefits from NVIDIA’s supply chain diversification”

Samsung Electronics announced that it will significantly increase its supply and sales in the high-bandwidth memory (HBM) market, which is attracting attention due to the expansion of global artificial intelligence (AI) demand in the second half of this year (July-December). It said that supply will increase fourfold compared to the same period last year, and sales will increase more than 3.5 times compared to the first half.

Although Samsung did not directly mention Nvidia, it hinted that it is about to supply its 5th generation HBM to major AI semiconductor companies including Nvidia. The stock price also soared 3.6% on the 31st on expectations that Samsung will launch a full-scale HBM strategy.

● 6 trillion won in operating profit from semiconductors, HBM performance visible

According to Samsung Electronics on the 31st, out of the 28.56 trillion won in semiconductor sales, the memory division recorded 21.74 trillion won. It announced the arrival of the ‘spring of memory’ with a 142% growth compared to the same period last year in terms of sales.

Regarding the strong memory performance, Samsung Electronics explained, “As demand for both generative AI servers and corporate servers increased, demand for high value-added products such as DDR5, high-capacity SSDs (solid-state drives), and HBM continued to expand, supporting performance.” In addition, the System LSI Business Unit, which is in charge of fabless (semiconductor design), announced that it achieved its highest sales ever in the first half of the year (January to June) as supply for new products from major customers increased.

Samsung Electronics hinted that its performance in the HBM market is starting to pay off in earnest along with its earnings announcement that day. Kim Jae-joon, Executive Vice President of Samsung Electronics’ Memory Business Division, said in a conference call, “For HBM3, we are expanding supply to all major graphic processing unit (GPU) customers, and in the second quarter, sales grew nearly threefold compared to the previous quarter.” The company also announced that the 5th generation ‘HBM3E’ product, which has garnered much attention in the market, will begin mass production of 8-layer products in the third quarter of this year (July-September) and 12-layer products in the second half of the year. Regarding the 6th generation product ‘HBM4,’ it was stated that “development is progressing normally with the goal of shipment in the second half of next year.”

If Samsung Electronics confirms the supply of HBM3E to major customers such as NVIDIA and AMD, the growth in performance in the second half of the year is expected to accelerate even further. Samsung Electronics forecasted that the proportion of HBM3E in total HBM product sales will increase to 10% in the third quarter and 60% in the fourth quarter (October to December).

Kim Dong-won, a researcher at KB Securities, predicted in a report that day, “Samsung Electronics is expected to benefit the most from Nvidia’s diversification of its HBM supply chain,” adding, “A significant improvement in performance is expected in the second half of the year due to the rise in DRAM prices and full-scale mass production of HBM3E.”

● Investment in research and development is at its highest in a quarter

The Mobile Experience (MX) and Networks division, which handles smartphones and communication equipment, saw its operating profit for the second quarter decrease by KRW 810 billion year-on-year due to the off-season caused by rising prices of key raw materials and the absence of new products. The company announced that the ‘Galaxy S24’ series, which was released in the first quarter (January to March), achieved double-digit growth in both shipments and sales in the first half of the year compared to the previous year. Daniel Araujo, managing director of the MX division, said in a conference call that day, “In the second half of the smartphone market, demand for premium products will drive market growth year-on-year, driven by increased demand for AI and the release of new products.”

In addition, Samsung Display and Harman contributed to the second quarter performance with a slight increase in operating profit compared to the same period last year.

Research and development (R&D) expenses in the second quarter amounted to KRW 8.5 trillion, exceeding KRW 8 trillion for the first time ever and recording the highest quarterly figure. Samsung Electronics stated, “We are breaking the record for the highest R&D investment for four consecutive quarters,” and “We will continue to make active R&D investments for future growth engines.” Facility investment in the second quarter amounted to KRW 12.1 trillion, up KRW 800 billion from the previous quarter. KRW 9.9 trillion was invested in the semiconductor sector and KRW 1.8 trillion in displays.

Reporter Kwak Do-young [email protected]

2024-08-01 12:16:22