2024-08-14 20:56:53

SAT denies millionaire tax fraud from a structure known as B410

The Supervision of Tax Administration (SAT) announced the identification of a Structure that could commit tax fraud for more than Q300 million, known as “B410”.

Perspective Writing

As shown in a press conference, after 32 audits, a fiscal impairment of more than Q300 million in taxes was determined, indicating possible tax fraud. However, they reiterated that other taxpayers of this same Structure are being analyzed and could represent more than an additional Q800 million.

The Superintendent of Tax Administration, Marco Livio Díaz, together with the mayors of Inspection, Taxpayer Services, Legal Affairs, Collection and Customs, explained that, derived from the use of the various inspection tools available to the Tax Administration and the use of the Module of relationships, it was possible to determine at least 410 companies that make up this Structure with some similarities: the same Guatemalan legal representative and partner, established in Belize. Furthermore, 75% of these companies were founded by the same notary.

🔎 #CasoB410 In a press conference, SAT authorities revealed details about the structure of Tax Fraud that has been identified.

Live broadcast ➡️ pic.twitter.com/o7OPA2xCIT

— Guatemala SAT (@SATTT) August 14, 2024

This information allowed us to establish the operational behavior of Structure B410, based on the registration of the same legal representative and accounting expert, tax addresses that are not located, mainly in red zones; In addition, they do not present evidence of infrastructure to develop their activities, with a change of documents for registration with SAT and sub-declarations.

Fountain. SAT

They added that during the processing of the data, it was discovered that between 2021 and 2023, the sales of this Structure according to FEL records amounted to Q5,730 million. Also, 9 B410 taxpayers have been identified who sell directly to the State of Guatemala, which according to awards in Guatecompras amount to more than Q81 million 761,000.

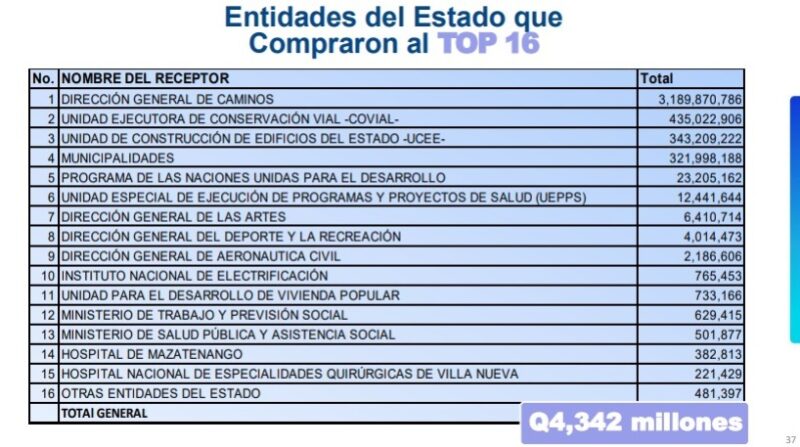

Similarly, it was confirmed that 16 taxpayers sold more than Q4,342 million to the State and received from this Structure more than Q375 million in goods or services (tires, freight, milling in projects, sub-leases of excavators, logistics with for distribution of materials, cleaning supplies, among others).

Fountain. SAT

Fountain. SAT

Finally, the SAT identified 2 taxpayers of this structure who sell goods or services to 5 construction companies supplied by the State. Within the investigation, it was determined that the links include the same account signatory, legal representatives, check movements between close relatives, among others determined by financial relations.

“SAT, as part of its commitment to transparency, as the guarantor and protector of State resources, presented the corresponding complaints to the competent legal entities, as well as providing copies of this complaint to the Public Ministry, the Comptroller and Auditor General and the High -Attorney. The Office of the General said, because this structure paid only Q26.9 million in taxes between VAT and ISR, out of the amount of more than Q5,700 million on invoice,” they said.

The Superintendent asked State institutions, the private sector, the civil society and the other productive sectors, not to be part of these or be a fool groups, since they promote tax fraud and unfair competition.

In addition, he said that the SAT will continue to establish mechanisms to detect these structures, respecting the rights of the taxpayer and guaranteeing the rights to collect so that the Guatemalan State can execute the actions aimed at ensuring for the sustainable development of the country.

WHAT DOES THE MP DO?

The Public Ministry (MP), the Economic Crimes Prosecutor’s Office, is investigating an incident of possible tax fraud, after the Tax Administration Supervision, in accordance with the provisions of the Tax Code, submitted the complaint to the Criminal Court of First Instance. in Tax and Customs matters.

In that sense, the aforementioned institution sent a copy of it to the Public Ministry, which was sent to the Economic Crimes Prosecutor’s Office for investigation.

The post SAT denies millionaire tax fraud from a structure called B410 appeared first on PERSPECTIVA.

#SAT #denies #millionaire #tax #fraud #structure #B410