AI Bubble Theory – Overlapping with Business Slump Report

As semiconductor-related stocks continue to decline,

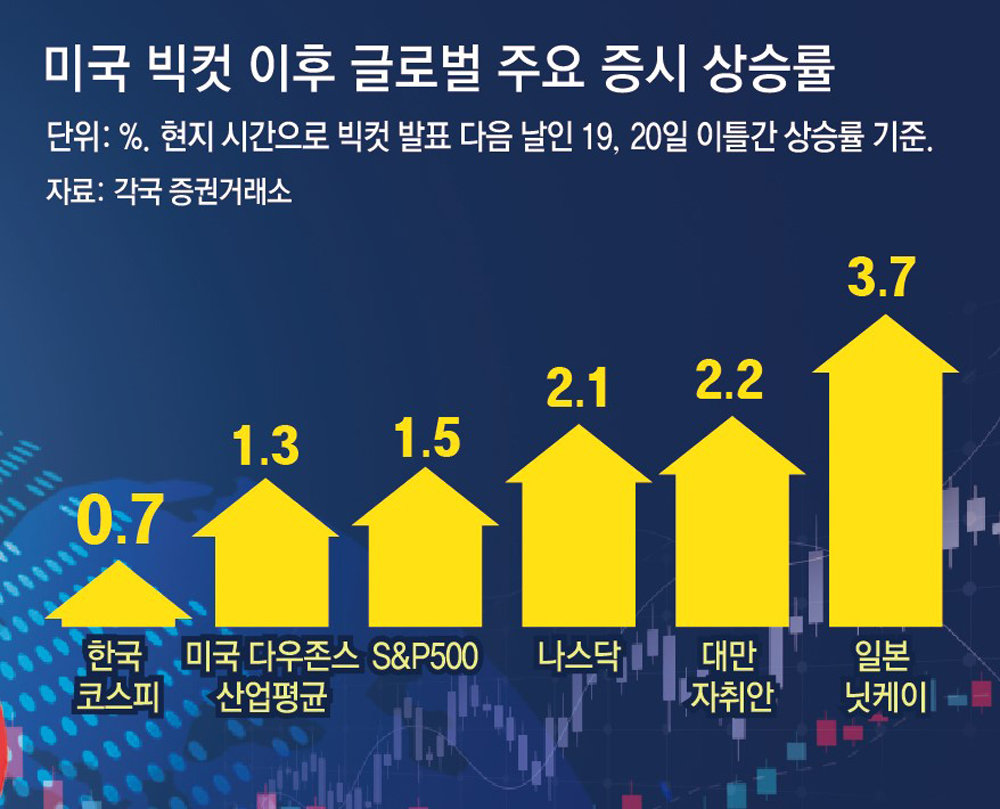

KOSPI also fails to properly enjoy the big cut effect

Two-day increase rate 0.7%… Japan ↑3.7%

Despite the US-led ‘big cut’ (0.5% point cut in the base rate), domestic semiconductor-related stocks are actually showing a downward trend. The negative factors of the global semiconductor outlook and ‘selling reports’ from foreign securities firms have overlapped. Leading domestic semiconductor stocks, Samsung Electronics and SK Hynix, have shown a slump in the past month, with their market capitalizations evaporating by more than 100 trillion won.

According to the Korea Exchange on the 22nd, Samsung Electronics’ market cap, which was 467.4339 trillion won on the 21st of last month, decreased by 91.3376 trillion won in one month to 376.963 trillion won as of the 20th of this month. During the same period, SK Hynix’s market cap also decreased by 25.8441 trillion won from 140.2132 trillion won to 114.3691 trillion won. The decrease in the market cap of the two stocks was 117.1817 trillion won, which is equivalent to 5% of the entire KOSPI market cap, evaporated in one month.

The slump in Samsung Electronics and SK Hynix was largely due to concerns about a global semiconductor slump caused by prolonged high interest rates. Investor sentiment toward semiconductor-related stocks froze as DRAM prices, which had been rising for a year, began to decline due to sluggish demand for IT equipment such as smartphones and PCs. The spread of artificial intelligence (AI) bubble theory, especially on Wall Street, also had a negative impact.

The foreign securities firm Morgan Stanley released a report on the 15th, during the Chuseok holiday, predicting a slump in the semiconductor industry, which also contributed to the stock price decline. Morgan Stanley forecasted that the global semiconductor industry would decline starting in January next year, and lowered the target stock price for SK Hynix from 260,000 won to 120,000 won, which is lower than the current stock price. It also lowered the target stock price for Samsung Electronics from 105,000 won to 76,000 won.

As domestic semiconductor-related stocks continue to slump, the domestic stock market is also not able to properly enjoy the Big Cut effect.

After the U.S. Federal Reserve announced on the 18th (local time) that it would cut the base interest rate by 0.5 percentage points, the KOSPI rose by only 0.70% over the two days. This is less than half the growth rates of the Nikkei Stock Average (3.69%) in neighboring Japan and the Taiwan Stock Exchange Index (2.22%).

The accelerated exodus of foreign investors is also darkening the outlook for the domestic stock market. Foreign investors, who had been net buyers until July of this year, sold 2.868 trillion won worth of KOSPI in August alone, and have sold over 6 trillion won this month. As of the 20th, the foreign investment ratio in KOSPI also fell to 33.29%, the lowest level in 7 months since February 21st (33.28%).

Experts have mixed opinions on the domestic stock market. Kim Young-ik, a professor of economics at Sogang University, said, “Concerns about the domestic stock market, including semiconductors, are excessive,” and “Foreign investors have recently taken profits, but they are likely to return soon.” On the other hand, Ha Jun-kyung, a professor of economics at Hanyang University, said, “The global economy next year will be worse than this year,” and “The domestic economy may face more difficulties due to sluggish semiconductor exports and a slowdown in domestic demand.”

Reporter Lee Dong-hoon [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-24 07:39:23