FTSE Russell to announce ‘Index Classification’ next month

For reasons such as market accessibility and loss of trust

‘Sol Sol’, the premise of maintaining an advanced market

Government responds by saying, “Ends in March next year”

There are concerns both inside and outside the government that the Financial Times Stock Exchange (FTSE) Russell, a global stock index provider, may designate Korea, which is currently classified as an advanced market, as a watchlist country. This means that since short selling has been completely banned in Korea since November of last year, there is a high possibility that it will receive a sort of ‘warning letter’ for reasons of market accessibility and loss of trust. If designated as a watchlist country, it may be removed from the advanced market in the future and classified as an emerging market.

● Entered advanced market in 2009, but concerns over being a ‘country under observation’

According to the government and financial circles on the 22nd, the government has been in direct contact with FTSE Russell several times in the UK, Australia, etc., to explain concerns about the accessibility of the Korean stock market. Ahead of FTSE Russell’s annual announcement of global index classifications on the 8th of next month (local time), the financial authorities are taking action in response to speculation that Korea may lose its advanced market status due to a blanket ban on short selling.

A financial authority official said, “FTSE Russell has not clearly stated its intention, but we are seeing the possibility of designating Korea as a country under observation on the premise of maintaining advanced market status,” adding, “We have sufficiently explained that the short-selling ban, which they are concerned about, will end at the end of March next year.”

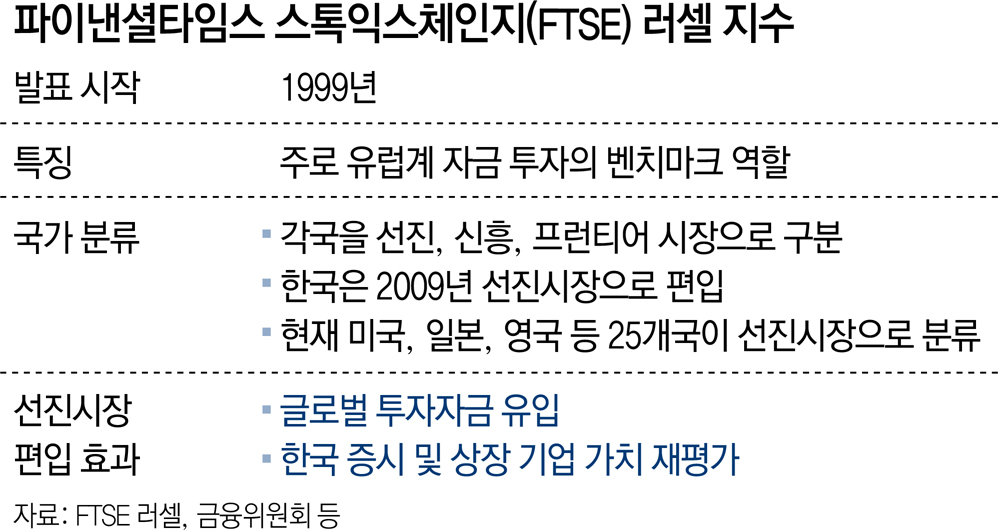

FTSE Russell, which is considered one of the two major global index providers along with Morgan Stanley Capital International (MSCI), mainly serves as an investment benchmark for European funds. Korea is still classified as an emerging market by MSCI, but it entered the developed market category by FTSE Russell in 2009. When FTSE Russell included Korea in the watchlist for inclusion in the developed market category in 2004, the government also worked to improve its status by expanding over-the-counter trading and easing regulations on short selling.

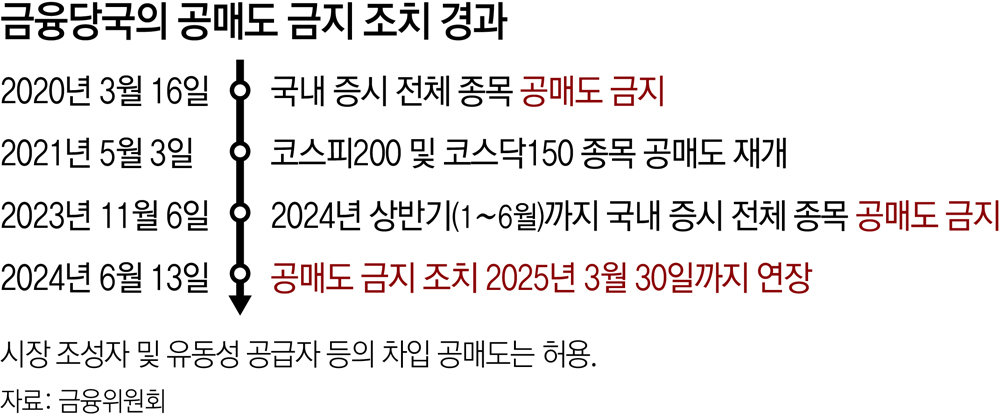

The problem is that domestic short-selling regulations, which were not out of line with global investors when the country was included in the advanced market, have recently been fluctuating according to the government’s will. When stock prices plummeted due to the COVID-19 pandemic, financial authorities banned short selling for all stocks in the domestic stock market in March 2020. After that, the financial authorities allowed short selling for KOSPI 200 and KOSDAQ 150 stocks in May 2021, saying that the improvement of the short-selling system was complete, but they banned short selling altogether again in November of last year. Bin Ki-beom, a professor of economics at Myongji University, pointed out that “so far, the Korean stock market has repeatedly banned and permitted short selling according to the government’s will,” and “from the perspective of global investors, this is an act that is bound to lose trust.”

● “Embracing risk by banning impromptu short selling”

The government’s position is that even if FTSE Russell designates Korea as a country under observation, it is unlikely that it will actually be excluded from advanced markets and that it will only be a temporary measure. Another financial authority official said, “Even if it is designated as a country under observation, if short selling resumes next year, it will only be a temporary measure for one year,” adding, “Since it is not being excluded from advanced markets, the market shock will not be significant.”

However, experts point out that the government, which has set the resolution of the “Korea Discount (undervalued Korean stock market)” as its main task, has taken on a risk by banning short selling, which has little practical benefit. Ahn Dong-hyun, a professor of economics at Seoul National University, said, “The problem is that the government’s ban on short selling was a political decision made in response to the claims of some investors,” and pointed out, “They have ignored the complex causes of the undervalued Korean stock market and have faced unnecessary risks with an impromptu policy.” Hwang Se-woon, a senior researcher at the Capital Market Research Institute, said, “Just by designating a country as a watchlist, there is a possibility that some foreign funds will flow out.”

Sejong = Reporter Kim Do-hyung [email protected]

Sejong = Reporter Lee Ho [email protected]

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-23 20:59:13