The rating agency S&P published at the end of the week a confirmation of Israel’s credit rating at the level of AA minus with a stable rating outlook. Overall, and certainly in relation to the global economic situation, S&P are optimistic about the Israeli economy, although they predict that next year’s growth will be only 2%.

However, in addition to referring to the usual data such as inflation, tax revenues and growth, the rating agency notes another aspect that occurs in the Israeli economy: the lack of transparency in the non-bank credit market, which is becoming problematic in light of the growth of the sector.

S&P notes that it is more complex to analyze the level of risk in the credit market in Israel, due to the growing share of non-bank credit institutions, which are not supervised by the Bank of Israel. “Although the various regulators cooperate, there are sometimes differences in approach, and we see potential for financial risks,” the rating agency notes.

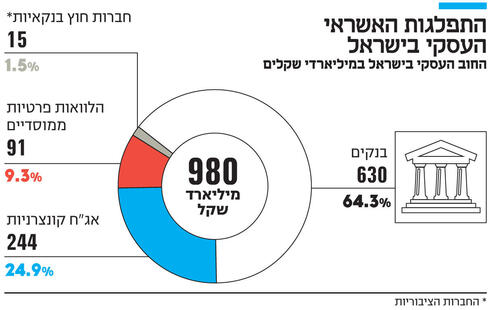

So what is the concern of the rating agency? In the past, the credit market in Israel was controlled by the banks almost completely. The supervision of the banks can be criticized for not being pro-consumer enough, but it cannot be said that it does not contain close supervision of the banks in regards to aspects of risk and stability. The banks are required to provide regular reports, and to publish Lots of data both publicly and directly to the supervisor, who knows exactly what the state of their credit portfolio is. There are also clear and tough rules when it comes to provisions for credit losses, and the Bank of Israel also sometimes imposes restrictions on granting credit if it thinks they have exaggerated their risk appetite, or if the economic situation has worsened , as it was at the beginning of the Corona crisis and as it was recently with credit to the real estate industry. Alongside this, the non-bank credit market has also developed in the last twenty years.

The change began about 16 years ago. One of the consequences of the Bacher reform was the development of a non-bank credit market in the business sector. The corporate bond market, which was negligible until then, gained momentum, and it is now a central part of business credit. This market is very transparent, since the bonds are traded on the stock exchange, so you can know what the risk level of the debt is, and there is also data on debt that runs into difficulties and settlements debt.

However, at the same time, another non-bank credit market has developed, which includes the private loans granted by the institutions (insurance companies and large investment houses) in the business sector. According to the data of the stability report of the Bank of Israel, the volume is NIS 91 billion as of the end of the first quarter of 2022.

At the same time, another non-banking channel has developed in recent years. These are many companies that were established, and provide credit mainly to small and medium-sized businesses. Many companies were established in recent years under the auspices of the zero interest rate, which generated demand for credit and the positive growth of the economy. Many of the companies were issued on the stock exchange, and according to Bank of Israel data, there are 18 public companies with a credit portfolio of approximately NIS 15 billion. Apart from them, there are also private companies that deal in the field.

We will also note that in recent years the non-bank credit companies have expanded into both consumer credit and mortgages. Sources in the banking system estimate that the market share of the non-bank market in the new mortgages reaches close to 10%.

However, while bank credit is strictly supervised and monitored, in the foreign banking market the situation is more complex: as mentioned, the corporate bonds are very transparent, but the data regarding the private loans of the institutions is much less transparent. They are indeed supervised by the Capital Market Authority, but the requirements regarding debt management, Its condition and secretions are much less visible, and are considered less tight.

For the other non-bank players, the situation is even less good. The Capital Market Authority does grant them a license, but the law mainly grants it powers in the field of consumer supervision. The public companies among them are indeed required to have proper disclosure and transparency from the Securities and Exchange Commission, but even here the supervision is much less strict, and as evidenced only in the last year we have seen two cases (in the Yonet and Backing companies) of problematic conduct, and high losses in non-bank credit companies.

As long as interest rates in the economy were zero and growth was high, then the gaps in supervision and the lack of information regarding the state of the non-bank credit market were less critical. But now the situation is different – the interest rate has already risen, and we will see the consequences later. Only next year will the slowdown begin to seep into the economy, and difficulties will begin to surface for the borrowers, who will be hurt both by the slowdown and by the increase in the cost of the loans they took. Will all the non-banking entities that face the scenario of a sharp increase in interest rates and a slowdown in the economy for the first time survive it?

Even if we are optimistic and get through this wave without many bankruptcies, and without collapses of non-bank entities, it is really time to think about whether it is right to leave the credit market in such distortions – when on the one hand a market with clear and strict rules, and on the other hand entities with flexibility in risk management and advertising minimal if any of their data.

It is worth noting that imposing capital limits and risk management on the non-bank credit market as on the banks is not the solution, and it may destroy it. There is room for differences between the bodies, but the gaps are currently too large, and even if they are worded politely, S&P is also bothered by this.