Starting next month, the limit will be reduced only in the metropolitan area.

A blow to ordinary people with an annual income of 40 to 60 million won… Newborn loan requirements eased from KRW 130 million to KRW 200 million

Low-interest loans ‘mismatched’ for high-income households… Point out that “it is less effective and there are concerns about reverse discrimination”

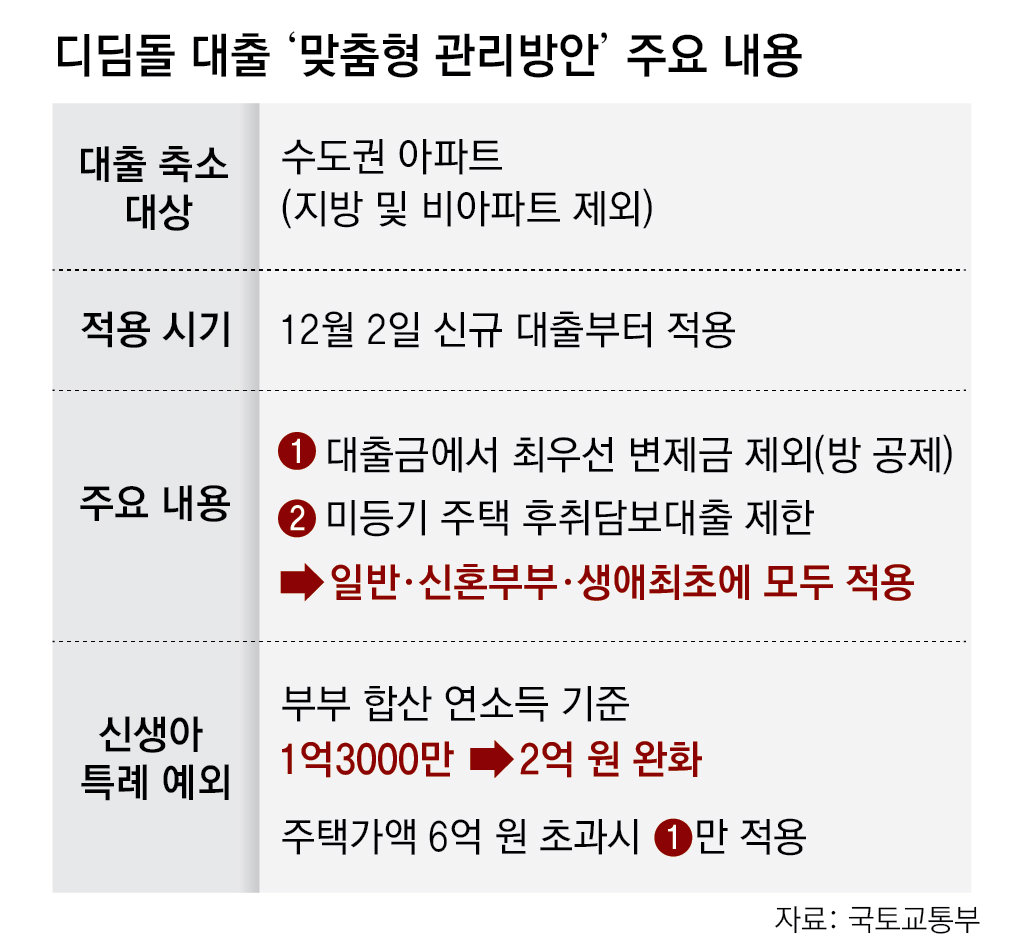

Starting next month, the stepping stone loan limit for apartments in the metropolitan area will be reduced by up to 55 million won. It is also prohibited to use stepping stone loans to cover the balance of loans for new apartments. However, among stepping stone loans, these regulations do not apply to households with newborns. Rather, the annual income requirement for applying for a loan is relaxed from 130 million won to 200 million won for a couple.

The Ministry of Land, Infrastructure and Transport announced the ‘Stepping Stone Loan Customized Management Plan’ containing these contents on the 6th. Last month, the Ministry of Land, Infrastructure and Transport suddenly reduced the stepping stone loan limit without warning. This is a low-income loan that a married couple with a combined annual income of less than 60 million won receives when buying a house worth less than 500 million won. After a period of confusion, such as postponing the reduction measure due to opposition from end-users and then announcing the reduction policy again, a loan reduction plan with a one-month grace period was announced on this day.

This measure is expected to hit the common people with a combined annual income of 40 to 60 million won. On the other hand, it is pointed out that it is an unbalanced policy because it opens up low-interest loan opportunities to high-income couples who have children.

● Seoul loan limit reduced by 55 million won

The plan announced on this day is to exclude the highest priority repayment to be paid to small tenants from the loan amount when calculating the loan limit for apartments in the metropolitan area starting from the 2nd of next month (applying ‘room deduction’) and post-secured loans for unregistered houses (the balance). The key is to limit lending. Local houses and non-metropolitan apartments are excluded from the application of regulations. An official from the Ministry of Land, Infrastructure and Transport said, “To manage household debt, we are also reviewing whether to apply the Debt Service Ratio (DSR) to policy loans.”

With the room deduction applied, the loan limit is reduced by 55 million won in Seoul and 48 million won in the Gyeonggi

When a couple with two children buys a 500 million won apartment in Seoul, the loan limit is reduced from 350 million won to 295 million won. If you sign a sales contract and apply for a loan two days before the next month, an exception will be made if there is a tenant in the house you want to buy and the balance must be paid in the first half of next year (January to June).

Loans for the balance of new apartments are also restricted. However, to reduce confusion, a tenant recruitment announcement will be made two days before next month, and loans will be accepted for complexes moving in in the first half of next year.

● Requirements for special loans for newborns are relaxed

On the other hand, the requirements for special loans for newborns were relaxed. This is a loan that a homeless person who has given birth to a child within two years can receive at an annual interest rate of 1-3% when purchasing a house worth less than 900 million won. The government will expand the annual income standard from 130 million won to 200 million won next month. It will be further relaxed to 250 million won from next year to 2027. Considering the median sale price of houses in Seoul in September (884 million won), this opens up an opportunity for high-income households with children to purchase houses in Seoul at low prices. An official from the Ministry of Land, Infrastructure and Transport stated the purpose, saying, “Responding to population decline and low birth rates is a matter of national survival.”

It has been decided that there will be no loan restrictions for households with an annual income of less than 40 million won when purchasing a low-priced house worth less than 300 million won. Accordingly, actual consumers who have an annual income of 40 to 60 million won and want to purchase a house worth 300 to 500 million won (600 million won for newlyweds) are expected to be directly affected.

Although the government introduced the ’tweezers regulation’ to prevent the rise of housing prices in Seoul and the metropolitan area, experts diagnosed that the actual effect would not be significant and could lead to controversy over reverse discrimination. Song In-ho, director of the Economic Information Center at the Korea Development Institute (KDI), said, “It is good to increase predictability and minimize change when it comes to policy loans.” He added, “Is the loan received by the common people subject to this regulation sufficient to be a priority for household debt management? “I doubt it,” he said. Kwon Dae-jung, a professor of real estate at Sogang University Graduate School, said, “Household debt needs to be managed, but if policy loans are reduced or restricted, ordinary people who lack financial resources will be greatly affected.” He added, “Households that cannot receive special loans for newborns may protest, saying it is reverse discrimination.” “There is,” he said.

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

- I recommend it

- dog

Hot news now

The recent changes to the Stepping Stone Loan program announced by the Ministry of Land, Infrastructure and Transport in South Korea have sparked significant discussion regarding their implications for various households.

Key Highlights of the Announcement:

- Loan Limit Adjustments: The maximum loan limit for the Stepping Stone Loan has been reduced by 55 million won in Seoul. For a married couple buying a 500 million won apartment, the loan limit drops from 350 million to 295 million won.

- Targeting Low-Income Households: This program originally aimed to aid low-income households (combined income under 60 million won) in purchasing homes valued under 500 million won. However, the recent adjustments are expected to negatively impact those with a combined income of 40 to 60 million won.

- Special Provisions for Households with Newborns: Households with newborns will have a relaxation of conditions for loan eligibility. The annual income threshold for applying will increase from 130 million won to 200 million won, and will further expand to 250 million won by 2027.

- Call for Change in Lending Policies: While the government aims to regulate household debt through these changes, experts question whether these adjustments adequately address the needs of the lower-middle class, who might struggle the most with securing housing under this new framework.

- Balance of Fairness: There are concerns over fairness, especially since families with children seemingly receive preferential treatment in accessing low-interest loans, which may contribute to reverse discrimination against other struggling households.

- Responses from Experts: Economic analysts have expressed skepticism about the tangible effects of these changes on housing prices in the metropolitan area, emphasizing that access to loans for the common population may not be sufficiently prioritized within household debt management discussions.

while the government’s aim is to address population concerns and manage household debt, the program’s limitations and the introduction of new restrictions present challenges for many prospective homebuyers, especially those without newborns or those falling into the income brackets that are now deemed ineligible for favorable loan terms.