Food chains (photo vecteezy, shutterstock)

When we talk recently about food retailing, we have to take into account a series of parameters that everyone does not do well with these companies. First and foremost we are talking about the cost of living in Israel. The public has become very sensitive to the issue in recent years and it doesn’t have too much to do with it, but it puts pressure on the food retailers and every time a survey shows that one retailer is cheaper than the other, it just moves there.

The second parameter is the ever-increasing competition in this industry, which at best is in very tough competition. In how long will Carrefour enter full operation (more or less) in Israel and at least according to the higher expectation level, it should increase the competition in the industry and perhaps even create a difficult competition in it.

More in-

Between these there is the issue of high interest rates and inflation and here we are talking about an expected decrease in the purchasing power of the public. At the moment we don’t see it, but if we adopt the updated economic research that talks about a transmission of a year (more or less) from the interest rate increase until it permeates the real economy, then we are very close (or at least approaching) to the point where the customer will have to reduce purchases of premium products that are characterized with higher profitability, and stick to the more basic products where profitability is limited.

Regarding the sector’s shares, we will introduce into this equation the less favorable atmosphere in the capital market at the moment and this means that the foreign investors are looking to reduce exposure to the local capital market and not increase it and this means that if in the past when the foreign investors wanted to be exposed to the local economy (and they did) they did it through, among other things, food retailing.

To all this goodness we need to include the fact that Shufersal, the largest chain in Israel, is in the process of stabilizing the ship after the management upheavals that befell it last year, which means that it is currently busy with itself and less with fighting back against Rami Levy, Victory and Yohannoff who dominate the discount world.

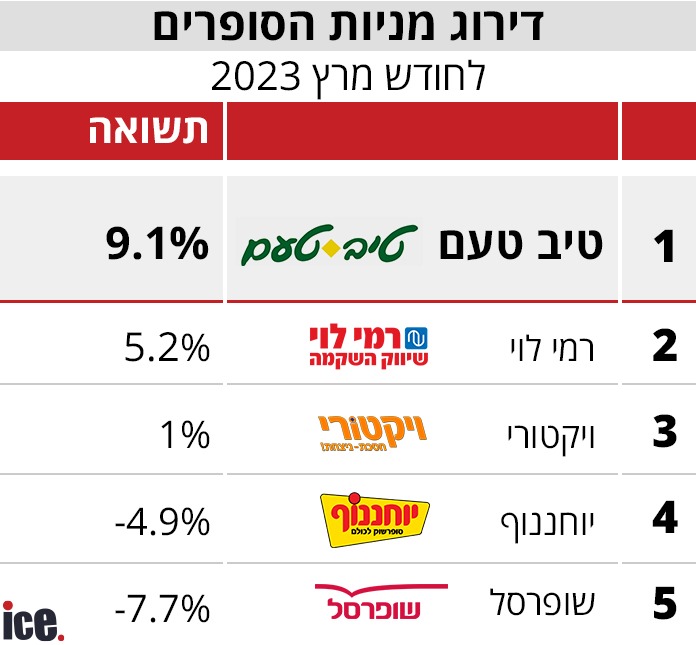

And above all, it should be remembered that the subject of the investigation by the Competition Authority into suspicion of price coordination has not yet ended and it also casts doubt on the industry. So, one way or another, we see a sector whose stocks are under pressure, and yet, there are stocks among them that produced decent returns in the last month, and that’s the full rating.

Comments to the article(0):

Your response has been received and will be published subject to system policy.

Thanks.

for a new comment

Your response was not sent due to a communication problem, please try again.

Return to comment